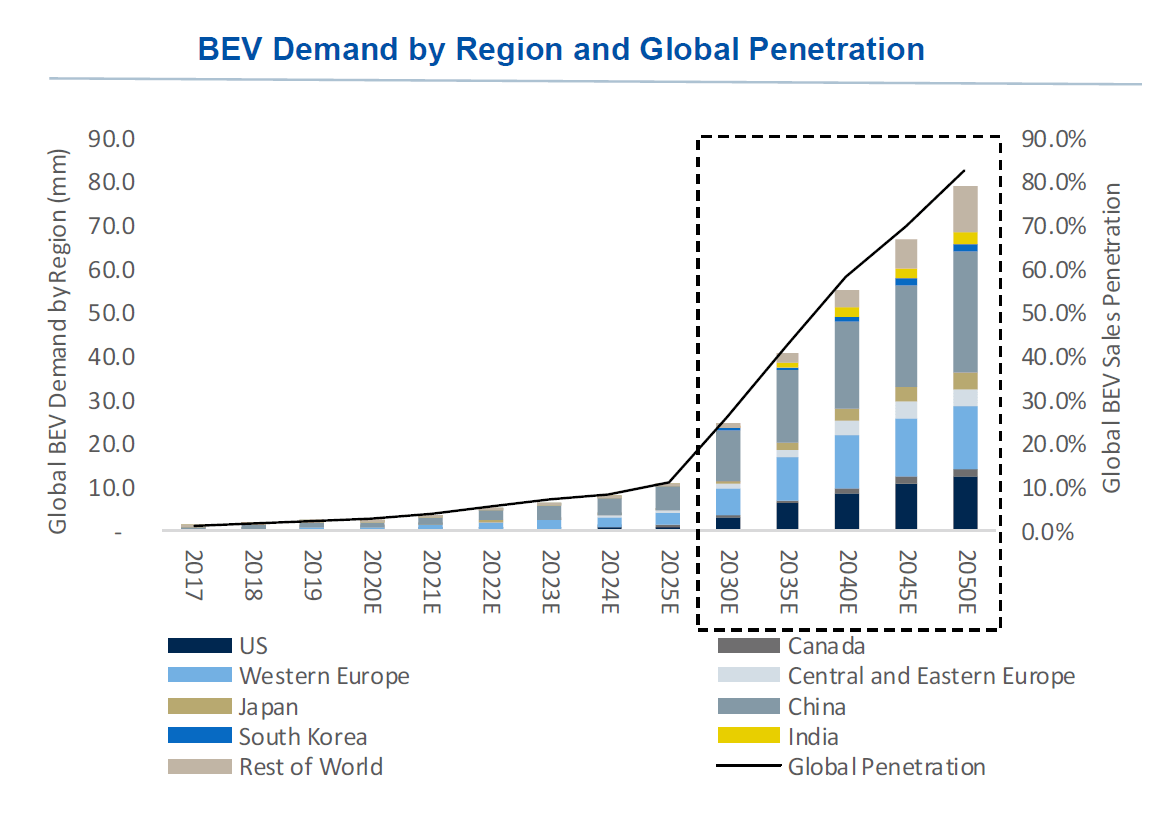

Over the past couple of years, governments across the world have been accelerating the transition from petrol and diesel to electric vehicles through the announcement of multiple regulations and incentives. Despite these efforts and all the publicity surrounding electric cars, we estimate adoption worldwide at the end of 2020 represented 3% for battery electric vehicles (BEVs) and 1.3% for plug-in hybrid-electric vehicles (PHEVs).

Factors influencing an increase in electric vehicle adoption

Growth over this decade will continue to be regulatory driven as tougher carbon emissions laws and penalties are put in place and as governments incentivize electric vehicles. Moreover, many local and national governments have proposed banning Internal Combustion Engine (ICE) vehicles. We expect greater proliferation of BEV models on the market, as more automakers get into the electrification act, the cost of electric vehicles and batteries declines and infrastructure is built out. This means there will be more BEVs across many vehicle segments and price points, meeting a broader set of consumer needs. As such, we believe consumers’ adoption of electric vehicles is set to rise.

“We envision BEV penetration in Western Europe increasing to 20% by 2025, while China will reach 17.5% and the US 7%. By 2050, penetration could reach 95% in Western Europe and China and 80% in the US.”- Joseph Spak, CFA RBC Capital Markets, LLC and Tom Narayan, RBC Europe Limited.

Based on this, we envision BEV penetration in Western Europe increasing to 20% by 2025, while China will reach 17.5% and the US 7%. By 2050, penetration could reach 95% in Western Europe and China and 80% in the US. When it comes to PHEVs, we believe they will be considered a transition technology reaching a sales peak in 2035 with sales starting to decline at that point.

Source: RBC Capital Markets estimates, IHS Automotive, Wards, Autodata, ACEA, CAAM, JAMA, OICA

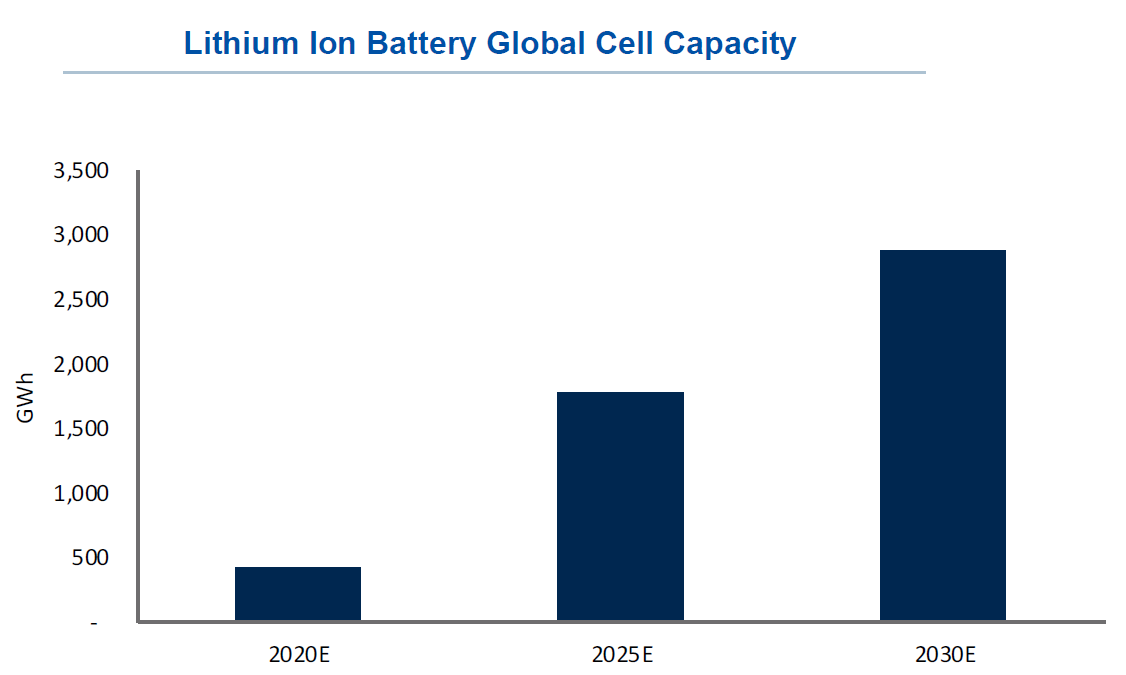

Battery availability and charging infrastructure

A key challenge to the success for a large scale adoption of BEVs will be the availability of batteries. We estimate that lithium ion battery cell capacity could increase >7x over by 2030 to 2.9TRw bearing in mind there is other demand for cells (such as commercial vehicles). We also estimate that for light vehicles alone, nearly 6TRw capacity is needed to electrify all new light vehicles. This could require an investment in the trillions of US dollars.

Source: Reuters, Business Korea, Yahoo Finance, TI Insight, company reports, RBC Capital Markets estimates

Another question raised by the public over the past few years has been the lack of charging infrastructure. While this still remains low, we believe home charging will be an alternative solution while the network expands. Based on current plans for network deployment by 2025, countries such as the UK, France and Germany will appear to have enough charging density to support the increasing demand.

The cumulative impact of new light vehicle BEV sales can have many implications for infrastructure and other industries. We forecast given current demand and scrappage trends, ICE vehicles in operation (VIO) will grow at a +1% CAGR over the period 2020E-2025E but then will decline at a -2% CAGR over the period 2025E-2050E. Meanwhile, we expect the BEV VIO to grow reaching 15% of total VIO in 2035 and 46% by 2050. However, if ICE scrappage incentive schemes or banning of existing ICE vehicles in certain areas accelerates, this could meaningfully accelerate the ICE decline and increase the BEV mix.

The impact of the electrification transition on automakers is costly with traditional automakers still in the earlier stages of a heavy investment and capex cycle. Further, many new entrants may try to compete in the electric vehicle space. However, this is a clear growth area within automotive and the investment by traditional automakers is likely necessary to ensure their participation in the future.

Joseph Spak and Tom Narayan authored “RBC ESG Stratify: Electric Vehicle Forecast to 2050” published on December 17, 2020. For more information about the full report, please contact your RBC representative.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.