This month, our experts discuss the EM Central Bank flows and the vulnerability of EM FX to investor flows.

Overview of the EM Asia reserves model and results.

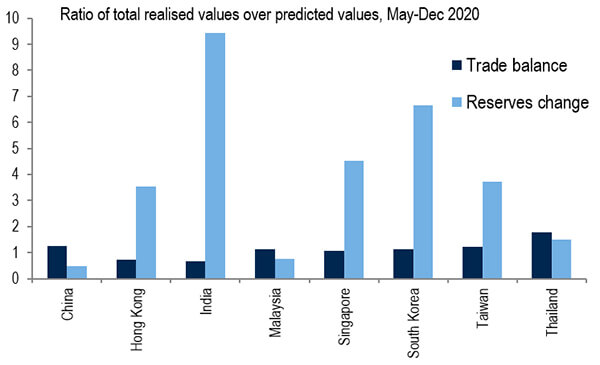

- The aim was to estimate if Asian reserve accumulation in recent months was more than expected, given shifts in the trade balance, and also how this might differ from country to country.

- The model estimated how much reserve accumulation had been driven by “fundamental” drivers such as changes in the trade balance, USD valuation and the value of likely reserve investments in US Treasury bonds.

- Generally trade balances did not differ much from the realized values, with the ratio between the total actual trade balance and the total predicted trade balance mostly close to 1 for the countries in the sample.

- The ratio of the total actual reserves accumulation between May and December 2020 and the total predicted total reserves accumulation were much higher than 1 for most countries in the sample. The model did a poor job predicting the reserves accumulation. This suggested that a significant amount of the increase in reserves over the May through December period was driven by non-fundamental factors, especially in India, South Korea, Singapore and Taiwan.

- The sizeable implied intervention activity should temper the still generally positive FX outlook for these currencies, as they indicate determined official resistance against currency appreciation.

Given the sizeable implied intervention activity, is the phenomenon of USD recycling back as a factor in FX markets?

- The pace of annualised absolute Asian reserves growth between May 2020 through February 2021 reached almost US$600bn, a rate that is almost comparable to the previous period of high reserves growth in 2009 through mid-2014, when it reached an annualised pace of $615 billion.

- The oil exporters are not yet a factor in the reserve accumulation story, only the Asian central banks.

- Overall reserve accumulation globally is still lagging the pace that was seen a decade ago.

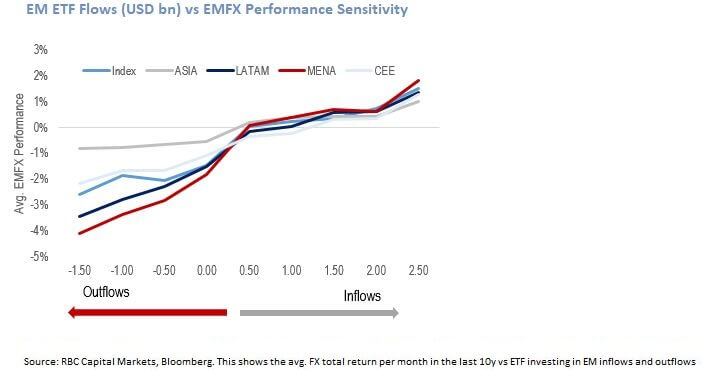

In contrast, large US ETFs have been investing in Emerging Markets debt and equity at a total of ~10bn US dollars as of February YTD. However, EMFX was down on average 2.5% YTD as of February on a total return basis.

- The 2021 consensus view was for a weak dollar and a large rebound in EMFX, we have actually experienced the contrary.

- Central Banks have been accumulating reserves, effectively adding a limit to where some of these currencies can move. One example is Chile where the central bank announced a reserves accumulation program once the currency rallied below the 700 level.

- In the last 10y, EM ETF flows have accounted for billions of dollars into Emerging Markets local currency debt and equity. With the rise of China as an asset class and a low share of foreign holdings of Chinese assets we have seen an uneven distribution of flows, with investors going overweight Asia vs underweight Latam.

The recent increase in US yields has challenged the weak dollar consensus view. Recent price action suggests that sudden changes to the FED’s communication or any of their programs could trigger a large taper tantrum. How will flows play out in this scenario?

- Inflows in EM markets are important in creating a wealth effect in EM economies as local financial assets appreciate.

- Intuition suggests that inflows should result in EMFX appreciation but history shows that EMFX appreciated only 50% of the time during periods of net inflows, while depreciated 70% of the time during outflows.

- The reaction function is quite asymmetric given the market structure of EMFX and when investors want to leave, the door is much smaller. On average a large outflow could have 4x larger impact than inflows of the same magnitude.

- EM Asia is much less sensitive to these changes than Latam and South Africa, resulting in an uneven distribution of flows to EM Asia and an underweight position in Latam.