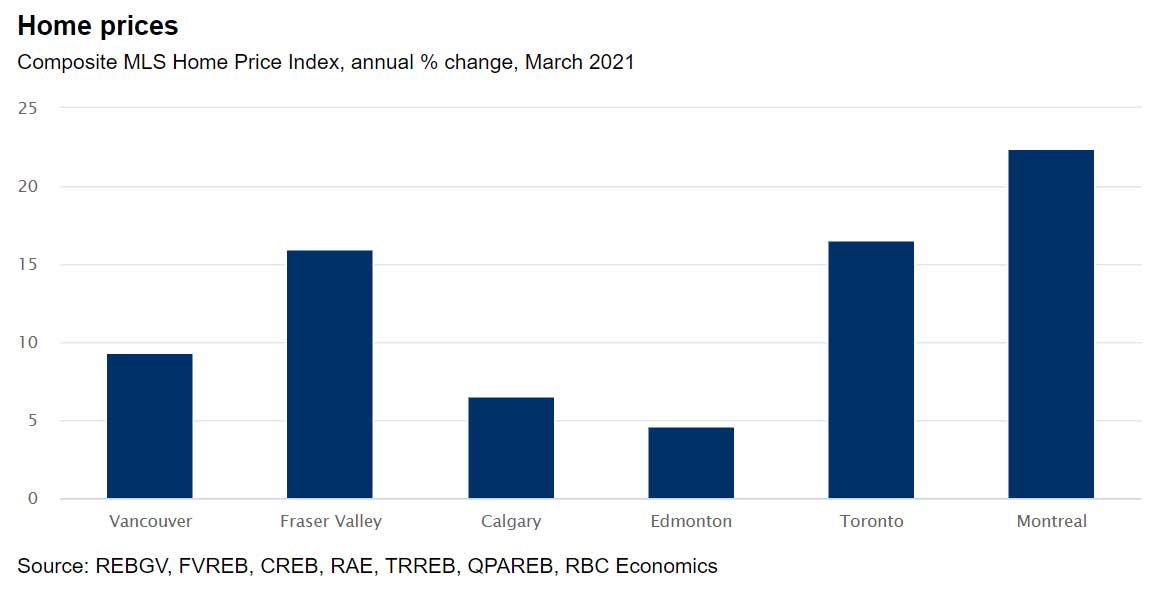

The buying frenzy has cranked up the heat on home prices several more degrees in March. All early-reporting local real estate boards showed accelerating increases in the composite MLS Home Price Index, led by Montreal (up 22.4% y/y), Toronto (up 16.5%) and the Fraser Valley (up 16.0%). Gains were far stronger for single-family homes, where inventories are especially tight and buyers willing to pay a rapidly-growing premium. Exceptionally low interest rates, changing housing needs and high household savings clearly continue to stoke demand for homes offering more living space. However, prices in some markets are increasingly difficult to justify based on fundamentals—and are poised to spiral further upward in the near term. The sharp deterioration in single-family home affordability is driving more buyers toward condos. Condo sales have picked up in recent months in several large markets, including Vancouver, Calgary, Toronto, Ottawa and Montreal. This was again the case in March. Inventories, while still ample in some markets, are gradually coming down, providing modest support for prices. The stage looks set for some firming of condo prices in most major markets in the period ahead.

Major market highlights: March 2021

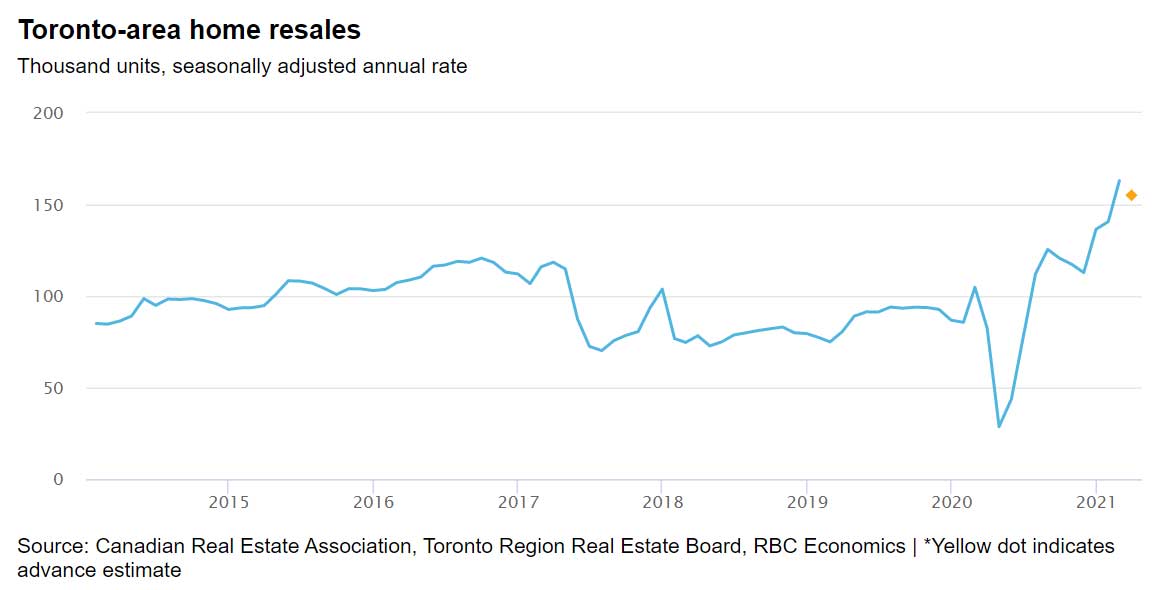

Toronto-area—Prices continued to soar

Residential properties got a lot more expensive across the-area last month. The aggregate MLS HPI benchmark blasted through the $1 million mark for the first time, surging 16.5% from a year ago. Single-family home prices (up 23.6% y/y) accounted for most of the increase though condo prices (up 2.1% y/y) have turned a corner and are now trending higher. Some of the fiercest bidding wars took place in suburban markets where demand remained red hot. Prices in Durham Region (up 32.8% y/y) and Halton Region (up 22.1%) continued to spike. The rate of increase was comparatively more moderate in the City of Toronto (up 7.5% y/y) but that’s largely because of earlier softness in the downtown condo segment—single-family home prices were up a strong 17.8% y/y. The surge in property values attracted more sellers in the GTA in March. Many more will be needed to temper the market. Despite easing slightly, demand-supply conditions remain extremely tight. Bidding wars and escalating prices are likely to continue in the near term.

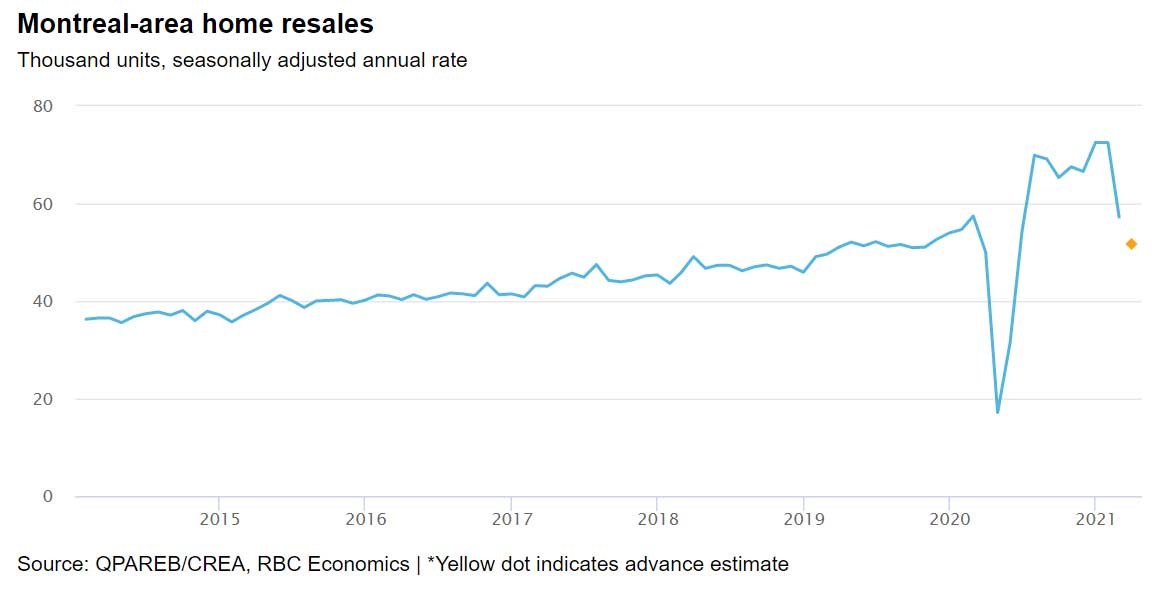

Montreal-area—Low single-detached home inventories keep sellers in command

More sellers came to market in March but their numbers still fell well short of supercharged demand. Single-family home segments remained exceptionally undersupplied despite the increase, especially in suburban locations. This kept home prices on a steep upward trajectory. Median single-family prices surged 33% y/y on the North Shore and got closer to the 30% mark in Laval and the South Shore. Many buyers instead turned their attention to condo apartments on the Island of Montreal, of which there were still plenty to choose from. More subdued price gains—the median condo price rose just 5% y/y in March—no doubt also attracted some buyers. Condo resales jumped 45% y/y on the Island last month. The recent influx of sellers across the entire-area, if sustained, could go a long way toward de-escalating bidding contests and tempering price increases. For now, though, tight demand-supply conditions for single-family homes will continue to apply intense upward pressure on property values. Montreal’s composite MLS HPI surged 22.4% y/y in March, the strongest gain ever recorded in the-area.

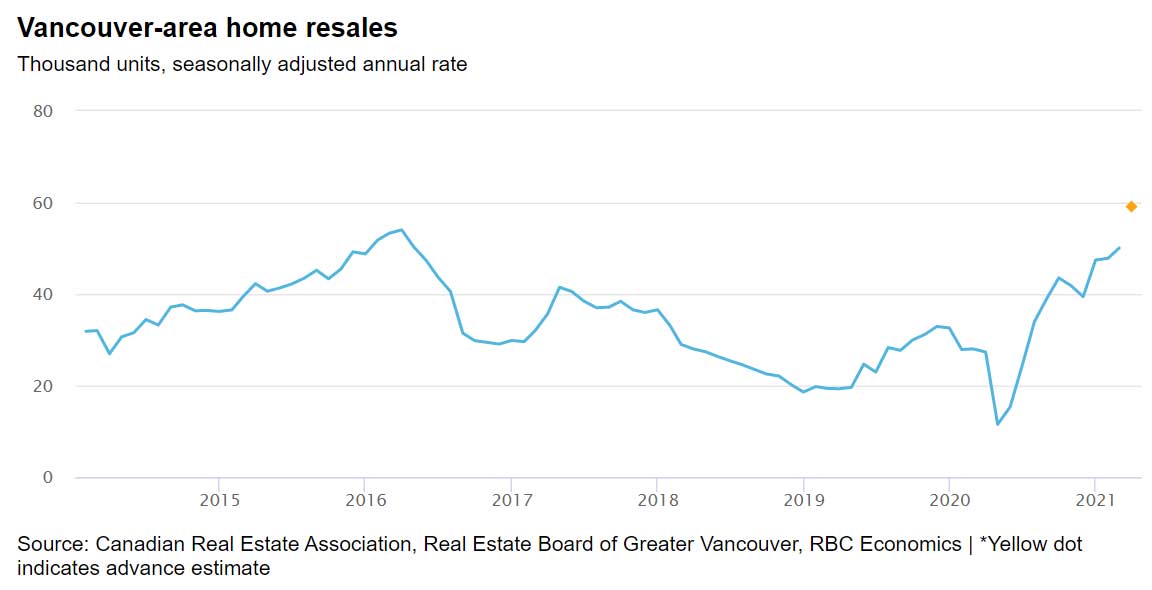

Vancouver-area—March was one for the record books

A bunch of new listings got the market going at a record clip in March. Home resales surged 126% y/y, blowing by the 10-year average for the month by 72%. Clearly, demand remains exceptionally hot at this stage. Despite an 87% y/y jump in new listings, demand-supply conditions continue to heavily favour sellers. This mostly applies to single-detached homes where bidding wars boosted the value of a typical unit to $1.7 million in March, up 17.9% y/y. Activity in the condo apartment market has also heated up. Condo resales sky-rocketed 129% y/y last month. Yet relatively high inventories continued to temper the rate of price appreciation (3.7% y/y). This may not be the case much longer, however. We expect inventories to shrink as condos’ growing affordability advantage over other categories fuels buyer interest. All-round tight demand-supply conditions would set the stage for even stronger advances in Vancouver’s composite MLS HPI than the 9.4% y/y rise recorded in March.

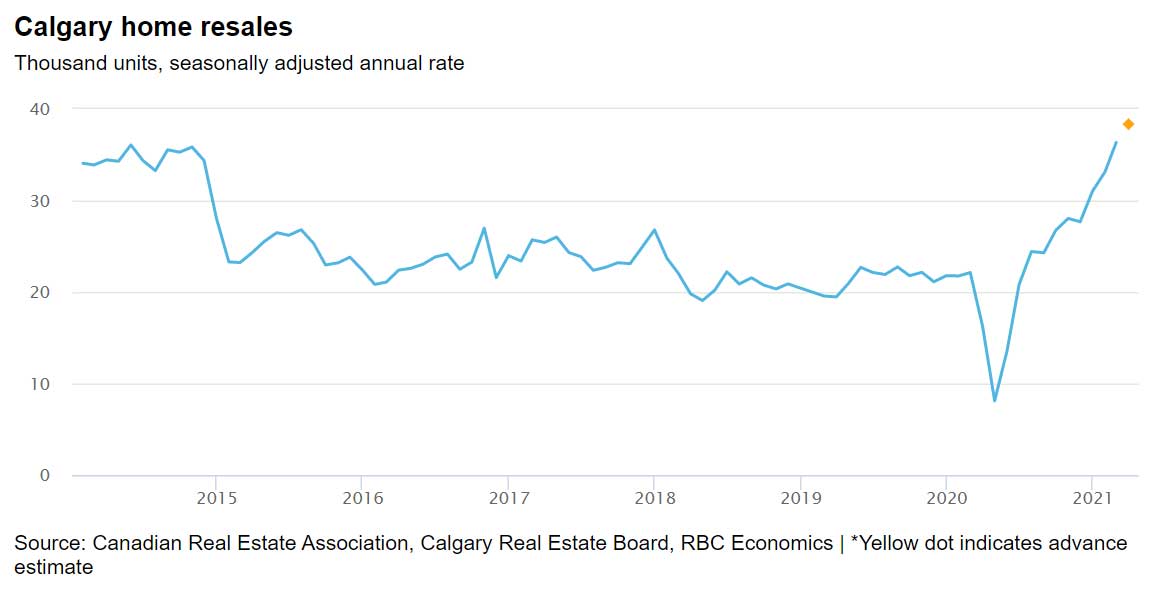

Calgary—Market rally keeps going strong

While the pre-pandemic starting point was relatively soft, Calgary’s market has quickly caught up with other red-hot Canadian markets. March resales were the strongest in 10 years—and potentially could have been even stronger were it not for low single-family home inventories. Demand-supply conditions have tightened considerably over the past seven months, significantly intensifying competition between buyers. Prices are now rising at their fastest rate (6.5%, based on the composite MLS HPI) in six years. We expect further gains in the near term. Yet these gains are unlikely to threaten Calgary’s affordability status. Price levels have still a long way to go before surpassing their late-2014 peak.

Edmonton

Activity was extremely hectic in March with resales soaring 110% y/y. Demand-supply conditions clearly favour sellers, and prices are generally going up. Edmonton’s composite MLS HPI accelerated to a rise of 4.6% y/y, reflecting strength in single-family home categories. Condo prices are still below year-ago levels, however.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.