Macroeconomic Outlook - June 2021

The outlook for the global economy improved over the past three months. Governments increased policy support, and rising vaccination rates allowed some countries to reduce restrictions on activity. In the US, declining COVID cases and an ambitious vaccine rollout resulted in an earlier and more broad-based reopening than in other advanced countries. The recovery picked up speed with real GDP accelerating in both the first and second quarters of 2021. Increasing fiscal support, an improving labour market and the large cache of savings on household balance sheets will keep the US economy growing at a solid clip in the second half of the year. Concern has shifted from whether the economic recovery will be strong enough to whether it will be too strong, re-igniting long-dormant inflation pressures. The Biden administration’s aggressive spending won’t only bump up US growth prospects but opens the door for a firming in demand that will help Canada and other trading partners emerge from the pandemic stronger.

Global policymakers keep support in place

Central bankers and governments remain committed to keeping support measures in place until economies have returned to pre-pandemic trends. Interest-rate increases are off the table in 2021 with small tweaks to non-traditional programs more likely if central banks make any changes at all. The Bank of Canada has led the pack in scaling down its quantitative easing program, though we expect the US Federal Reserve will follow suit late this year. Both are expected to raise the policy rate by 50bps in 2022. No rate moves by the BOE or ECB are expected until 2023. Central banks will move at a measured pace to avoid derailing confidence or destabilizing financial markets.

Government support measures to help economies make it through the crisis are continuing aimed at sustaining growth and facilitating a full recovery in labour markets. Following a $900 billion package announced in December 2020, the US government approved another $1.9 trillion in direct relief to US households and small businesses at the end of the first quarter. The Biden administration is also looking to pass a large American Jobs Plan to finance infrastructure investment. Canada’s federal government, in its April budget, extended some pandemic-related support programs for workers and businesses and announced more than $100 billion in new spending over three years. In the near term, these measures will support a rebound in consumer spending with investment activity likely to follow as demand ramps up.

More confidence that a post-pandemic recovery is underway

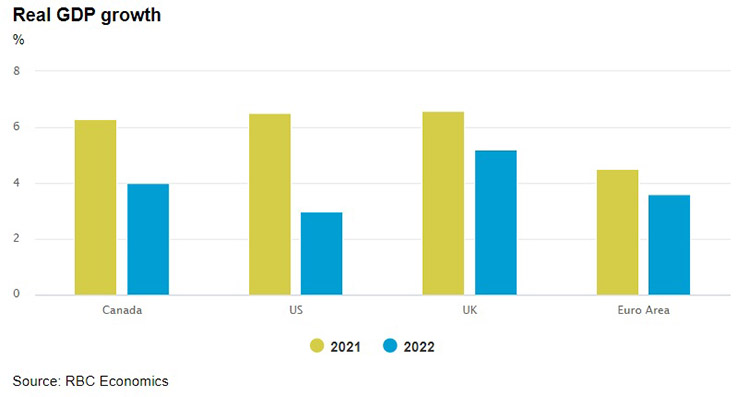

The combination of low interest rates, waves of government support and the acceleration of vaccinations that allow the reopening of hard-hit sectors will fuel robust growth in many advanced economies. Our forecasts are for Canada, the US and UK to grow at a greater than 6% pace in 2021 with solid gains ranging from 3% to 5% expected in 2022. The euro area economy is projected to build momentum after a soft start to the year and slower reopening with GDP increasing by 4.5% in 2021 and 3.6% in 2022.

There will be bumps along the way

Even with policy support, the pandemic’s scars won’t fade quickly. Supply-chain interruptions, rising shipping costs and materials shortages may constrain activity in the industrial sector and put upward pressure on prices. Additional inflation pressure may come from consumers, who have amassed large pools of savings and will be in the market for services they couldn’t access during the pandemic.

April’s inflation rate in many advanced countries was much higher than a year earlier largely because prices fell in the early days of the pandemic. This so-called base effect is expected to prove temporary as the exaggerated downward moves early in the pandemic fall out of the annual calculation. That said, underlying inflation measures also moved higher and market-based inflation expectations are above pre-pandemic levels. Coupled with companies saying they intend to increase prices to recover pandemic-related losses and higher input costs, it looks increasingly likely that even when the temporary base-effect impact is gone, inflation will remain higher than before the pandemic.

Canada – better days ahead

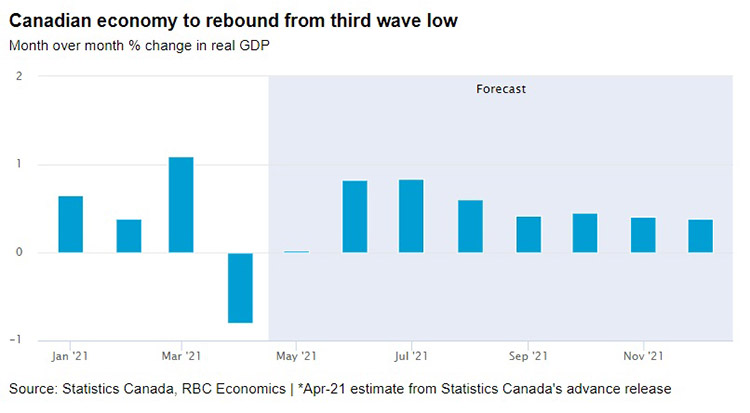

The latest surge in COVID cases and greater lockdown measures weighed heavily on the economy in April and May. After posting a solid 5.6% annualized increase in the first quarter, economic output fell in April, marking the first decline in a year.

Even with weakness declines in April and May, Canada’s economy will largely recover its COVID-related losses in the third quarter. Our forecast looks for the economy to run very hot in the second half of the year. Job losses in April and May will proved short-lived with additional hiring expected as hard-hit industries are able to reopen. The recovery in the labour market, elevated savings balances and persistent government support for the unemployed will be a driving force. Spending on services which stood almost 12% below pre-pandemic levels in early 2021, is forecast to increase at double-digit rates in the second half of the year.

Fired up housing market

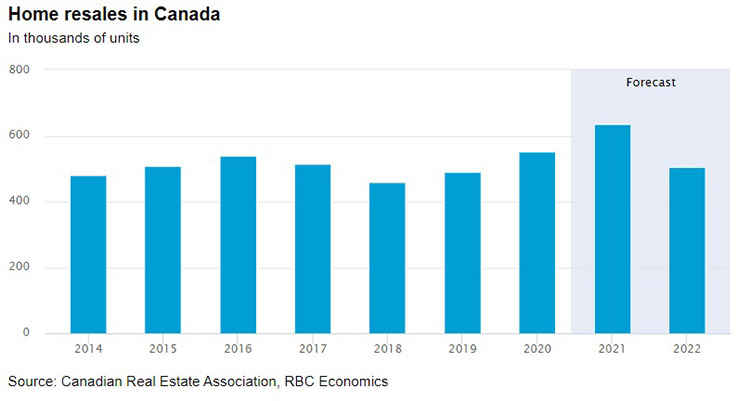

Canada’s housing market blasted into 2021, with sales hitting successive record highs in January through March. The market softened somewhat in April and May though remained at a historically elevated level. We expect a gradual rise in longer-term interest rates, deteriorating affordability, mortgage stress test tightening and the resumption of office work to cool activity as 2021 progresses. Soaring prices could also attract more sellers, helping to ease the extreme imbalance that has characterized the market for months.

The strong start to the year set the stage for home resales to rise 16% in 2021 with the monthly pace expected to moderate over the remainder of this year and into 2022, producing a noticeable 21% annual drop in activity next year. Prices are forecast to increase 13% in 2021 and a more modest 3.3% in 2022.

Businesses – light at the end of the tunnel

Business investment in non-residential buildings, engineering projects and capital goods remained well below pre-pandemic levels in early 2021. Investment in technology and communications equipment has fully recovered but spending on transportation equipment dropped. Forty percent of Canadian businesses indicated they expect to increase investment over the course of the year with some of this activity likely to materialize once firms are confident that a sustainable reopening is in place.

The sharp rise in demand for commodities benefited Canadian exporters with the volume of energy and food products approaching pre-pandemic levels and revenues boosted by higher prices. This helped to narrow the gap of goods exports relative to late 2019 while services exports remain substantially lower. The more rapid reopening of the US economy and elevated demand for commodities augurs well for Canadian goods exports to ramp up further while services exports will start to catch up as international borders open. Imports have also partially recovered from their pandemic lows as strength in the manufacturing sector drove up purchases of equipment like computers and electronics. With companies running up against capacity constraints and heightened demand to automate processes, demand for imports is projected to accelerate.

Jabs and Jobs

Not only do businesses expect to increase spending on machinery and equipment but a growing number intend to hire. Canada’s labour market recovery has been uneven, with close-contact industries running with significantly fewer workers while other industries have ramped up their labour force. Professional services, finance, education and healthcare have all added jobs relative to pre-pandemic levels while hospitality, recreation and retail are running with substantial losses. The more aggressive pace of vaccinations was accompanied by a jump in job postings that stood 20% above mid-December’s level in late May as companies teed up for a more durable reopening. This augurs well for workers who have joined the ranks of the long-term unemployed, although some may not have the skills currently in demand. Businesses report that the inability to find workers is one of the biggest challenges they face.

Inflation surge – will it prove temporary?

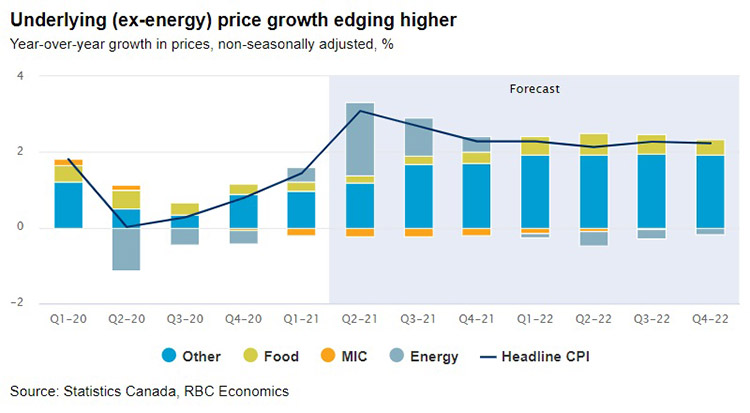

One of the key questions for financial markets and businesses is whether the sharp increase in inflation will fade once the base effects (pandemic related drop in prices a year ago) subside. April’s headline inflation rate hit 3.4% in Canada, the fastest pace in almost a decade. Underlying inflation pressures also firmed with 54% of goods and services within the CPI basket posting increases of more than 2%. The inflation rate will ease as some of the transitory distortions recede. However, supply-chain constraints, sharply higher input costs and the expected surge in household demand once virus containment measures ease will limit the decline. Historically, when market-based and surveys of inflation expectations increase, actual prices and wage demands follow suit. While we don’t think the recent increase in expectations will run significantly above the Bank of Canada’s 2% target, we’ve upgraded our forecasts and look for the headline rate to average 2.6% in the fourth quarter with the core measure that excludes food and energy prices expected to reach that level a year later.

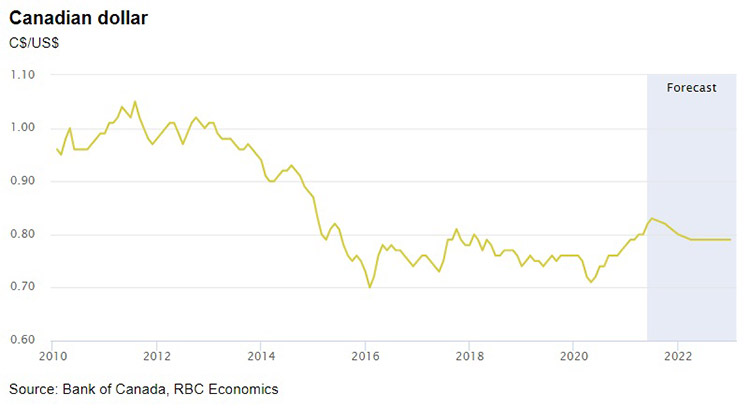

Currency’s rise weighs on prices of imported goods

The jump in demand for commodities and widening in Canada/US short-term interest rate spread supported a strengthening in the Canadian dollar against its US counterpart. In mid-April, Canada’s dollar crossed 80 US cents for the first time since early 2018, and touched 83 US cents in late May. The currency’s appreciation has reduced consumer goods import prices by 7% compared to a year ago which will provide some near-term price relief.

We expect commodity prices will maintain their recent gains although the pace of increase is likely to peter out. Markets expect the Bank of Canada to raise the policy rate ahead of the Fed which will likely keep Canada’s currency well supported in the near term. Any shift in the timing of rate-hike expectations by the Fed will be positive for the US dollar with Canada’s currency forecast to slide back toward 80 US cents by year-end and close to 79 US cents at the end of 2022.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.