Provincial Outlook - June 2021

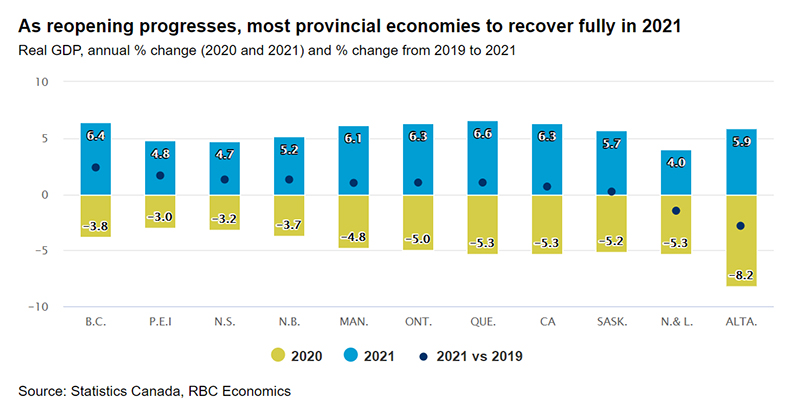

All Canadian provinces made great strides delivering first doses of vaccines against COVID-19 this spring. These efforts, along with renewed restrictions imposed during the second and third waves, brought down daily viral cases significantly and lightened the load on the health care system in almost every region. The other side of the valley is in plain sight! And provincial authorities can now proceed with reopening plans. We expect relatively rapid progress on that front will at least partially restore activity in industries bearing the brunt of restrictions. This will broaden the economic recovery, adding to the thrust record government spending, booming global commodity markets, surging US economy and a super-strong demand for housing are generating. We expect growth to return in a big way in every province this year, supporting a half-century-high growth rate of 6.3% nationwide. This would represent a welcome turnaround from last year’s abysmal 5.3% contraction.

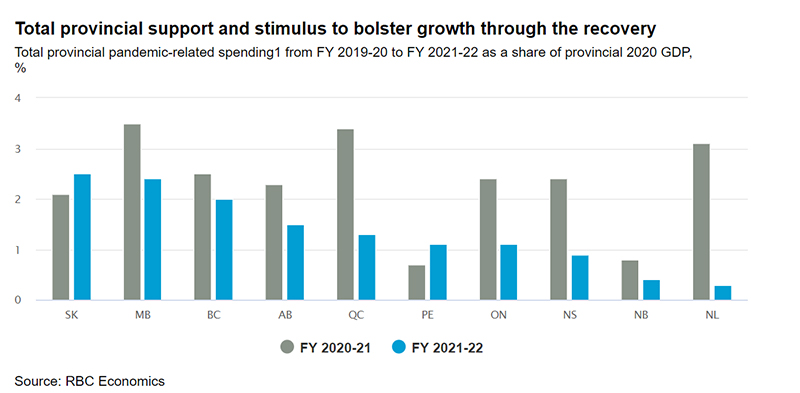

Governments provided tremendous support to limit the economic shock in 2020, and will contribute materially to the recovery in 2021 and 2022. Collectively, provinces have committed nearly $72 billion to pandemic response and recovery over two years, in addition to a $15-billion boost to capital investment. These actions amount to a significant 3.9% of national output. The majority (71%) of provincial spending is funded from their own sources, with the remainder (29%) from federal transfers. Provincial government action plans are proportionately larger in Western provinces and Quebec. Saskatchewan and Manitoba plan to spend the most relative to the size of their economies this year—though part of this reflects the greater needs to combat the third wave, especially in Manitoba where the health situation has been particularly severe. Plans tend to be smaller in Maritime provinces as the economic damage has been generally less severe in the region.

We expect all but two provincial economies to fully recover in 2021. It will be a longer journey for Alberta, and Newfoundland and Labrador. Both were hit particularly hard last year by the double-whammy of the pandemic and oil price crash, creating substantial lost ground to recover. We project Quebec (6.6%), British Columbia (6.4%), Ontario (6.3%) and Manitoba (6.1%) to grow the fastest this year. This will place British Columbia the furthest along on its recovery path, surpassing pre-pandemic output levels by 2.4%. The province will significantly benefit from booming commodity markets and the ramping up of capital investment projects. While projected to grow at relatively more subdued rates, the Maritimes provinces are also poised to surpass 2019 economic levels by greater-than-average margins.

The reopening phase bodes well for provincial labour markets from coast-to-coast. We expect widespread job gains over the remainder of this year, as hard-hit sectors such as accommodation and food services, and arts and entertainment get back on their feet. These industries account for the bulk of the unemployed in all provinces. The eventual lifting of travel restrictions within Canada (and potentially across our international border) will significantly boost the prospects of tourism-dependent regions, including on the East and West Coasts. A broader, fuller recovery is ahead in every part of the country. The other side of the valley looks promising.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.