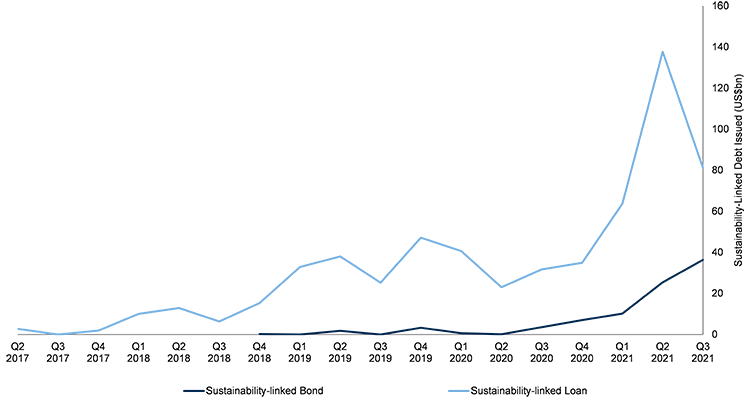

- Sustainability-linked debt is the fastest-growing product segment within the capital markets and sustainability-linked bond issuance is demonstrating particularly rapid growth

- The key performance indicators (KPIs) and sustainability performance targets (SPTs) underpinning these instruments will continue to face increasing scrutiny from investors and lenders for relevance, materiality, and level of ambition

- RBC Capital Markets works in partnership with our clients to help them establish robust sustainability strategies, ESG disclosures aligned with best practice standards and frameworks, and ambitious and material ESG targets

The Momentum of the Sustainability-Linked Debt Market

Sustainability-linked debt is the fastest-growing product segment within the capital markets today and includes loans and bonds with interest rates tied to the achievement of sustainability performance targets. This edition of Sustainability Matters focuses on the foundational role that corporate sustainability strategy and ESG disclosure play in the sustainability-linked debt market, particularly for credibility and market acceptance.

Unlike use-of-proceeds instruments, such as green bonds, sustainability-linked debt can be used for general corporate purposes, providing a flexible alternative for many borrowers to access the sustainable finance market. In the first nine months of 2021, sustainability-linked debt issuance reached US$355 billion, a 150% increase from the entirety of 2020. Sustainability-linked bonds are a rapidly-growing subset, with issuance rising by over 500% from 2020 to reach US$72bn as of September 30, 2021.

Rapid Growth in the Sustainability-Linked Debt Market

Source: Bloomberg Intelligence as of September 30, 2021

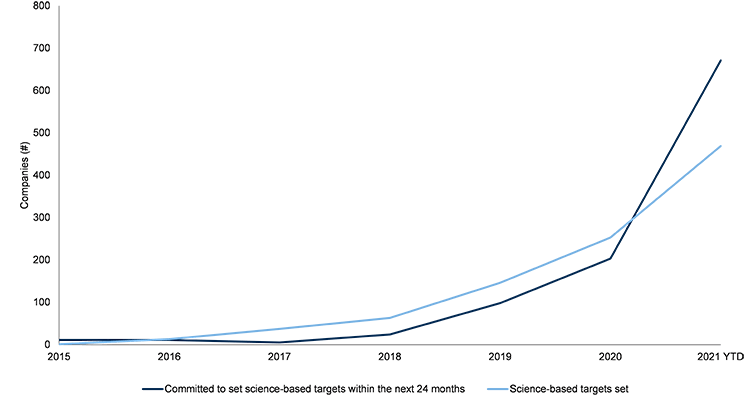

Momentum in the sustainability-linked debt market is driven by a number of key factors, including the transition toward a net-zero economy, rapid growth in corporate target-setting related to greenhouse gas (GHG) emissions reductions and other ESG factors, and record-low interest rates which have led to an increase in refinancing activity. Voluntary process guidelines on sustainability-linked debt issuance published by the Loan Market Associations in Europe, the U.S. and Asia, and the International Capital Market Association (ICMA) have also served to bolster the confidence of financial market participants.

As the sustainability-linked debt market matures, the key performance indicators (KPIs) and sustainability performance targets (SPTs) underpinning these instruments will increasingly be scrutinized by lenders and investors for relevance, materiality, and level of ambition. To mitigate the risk of greenwashing, it is essential that borrowers have a robust sustainability strategy in place as well as a history of ESG performance reporting.

The Strategic Rationale for Issuing Sustainability-Linked Debt

The sustainability-linked debt market is positioned to benefit from a post-pandemic environment focused on building an inclusive, resilient, and sustainable economy. With an uptick in ESG-related disclosures, commitments, and target-setting across all industries, corporates are increasingly grasping the important role that sustainability-linked debt can play in the alignment of financing and corporate strategies with sustainability objectives.

Increasing Corporate Commitment to Science-Based Emissions Reduction Targets

Source: The Science-based Targets initiative (SBTi) as of October 25, 2021

Establishing a robust sustainability strategy, supported by ESG disclosure aligned with best practice standards and frameworks, and material and ambitious environmental, social, and governance targets, is an important first step ahead of embarking on the structuring of a sustainability-linked debt instrument. A clearly articulated sustainability strategy, combined with a history of ESG performance reporting, provides lenders and investors with concrete evidence of the borrower’s readiness and credibility, as well as important historical context to gauge the level of ambition of the sustainability performance targets.

The LMA/LSTA/APLMA’s Sustainability-Linked Loan Principles (SLLP) and ICMA’s Sustainability-Linked Bond Principles (SLBP) outline best practices and promote integrity in the sustainability-linked debt market by providing guidance related to structuring, disclosure, and verification. Both sets of Principles are organized around five core elements:

- Selection of Key Performance Indicators (KPIs)

- Calibration of sustainability performance targets (SPTs)

- Loan or bond characteristics

- Reporting

- Verification

The first two core elements – selection of KPIs and calibration of SPTs – provide the foundation on which the strength and credibility of a sustainability-linked instrument rests. Borrowers are encouraged to communicate the rationale for, and process through which, the KPIs were selected and ensure that the indicators are material to their overall sustainability strategy and address relevant environmental, social, and/or governance issues.1

Equally, the sustainability performance targets (SPTs) should be calibrated in a way that is ambitious, consistent with the borrower’s overall sustainability strategy, and, where possible, reference the strategic pathways and actions through which the borrower intends to reach its targets.2 Given these considerations, having a robust sustainability strategy, disclosure and targets in place beforehand is an important first step to ensure appropriate alignment and materiality of KPIs and ambition of SPTs. Furthermore, borrowers are required to obtain independent, external verification of their performance levels against sustainability performance targets at least once a year.

Poised for Expansion in the Year Ahead

The sustainability-linked debt market has demonstrated tremendous growth since its inception and appears poised for new momentum in the year ahead as borrowers seek to integrate sustainability considerations throughout their operations and communicate their commitments to the market. As these innovative financial instruments continue to mature, we anticipate increased scrutiny of the underlying structural elements of sustainability-linked loans and bonds. RBC Capital Markets works in partnership with our clients to help them establish robust sustainability strategies, ESG disclosures aligned with best practice standards and frameworks, and ambitious and material ESG targets to support the continued advancement of this growing market.

1 APLMA, LMA, and LSTA. “Sustainability Linked Loan Principles.” Updated July 19, 2021. https://www.lsta.org/content/sustainability-linked-loan-principles-sllp/

2 Ibid.

For all our ESG insights, click here.