- Integrating ESG considerations into the IPO process is an accelerating trend: the proportion of SEC Form S-1 filings referencing “ESG” has grown ninefold over the past 18 months

- We see three key drivers behind this trend: growing awareness of the financial materiality of ESG, higher investor engagement on sustainability issues, and increased global regulatory focus on ESG reporting

- RBC Capital Markets partners with our clients to help them integrate sustainability considerations throughout the IPO process

3 Drivers of ESG Integration in the IPO Process

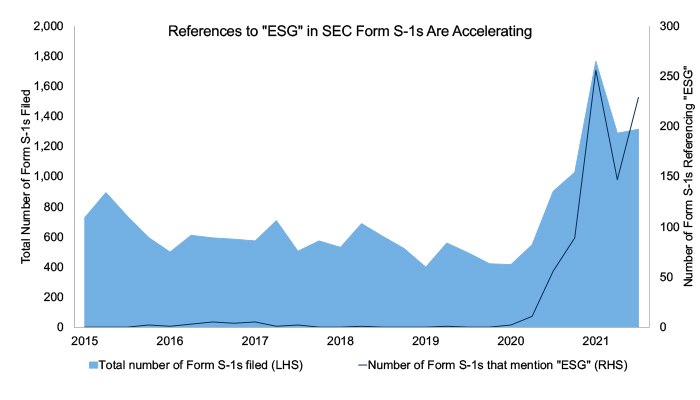

An authentic and compelling corporate sustainability strategy is quickly becoming an integral part of every company’s equity story. For private companies looking to enter the public market, embedding ESG considerations throughout Initial Public Offering (IPO) materials is becoming increasingly commonplace. This trend is reflected in the data: references to the term “ESG” in Form S-1s, which are SEC registration documents required for companies that want to list on a U.S. public exchange, have accelerated rapidly over the past year. In Q3 2021, 17% of all Form S-1s filed during the quarter referenced ESG, representing a ninefold increase in 18 months.

Source: Securities and Exchange Commission. Note: The area portion of the chart indicates the total number of SEC Form S-1s filed each quarter since 2015. The line portion of the chart shows the SEC Form S-1s filed since 2015 that reference the term “ESG”. In some cases, companies file an amended Form S-1, known as an S-1/A, after the original S-1. S-1/As are also included in this dataset.

We see three main drivers behind the growing integration of ESG considerations in the IPO process. First, given the financial materiality of ESG, companies looking to enter the public market have a clear financial incentive to communicate a statement of corporate purpose and sustainability strategy to the market. Second, robust ESG credentials can drive incremental demand from sustainability-focused investors and open up access to new pools of capital. Third, global momentum toward mandatory climate-related disclosure requirements presents an opportunity to proactively address sustainability disclosures ahead of potential regulatory changes that may emerge in the future.

Financial Materiality of ESG

ESG performance is financially material and can contribute to higher valuations, stock outperformance, and a lower cost of capital. According to RBC CM research, S&P 500 and S&P Europe 350 companies with better ESG risk profiles (as indicated by Sustainalytics) have outperformed those with higher ESG risk over time on a sector-neutral basis.1 In addition, companies with the best ESG risk profiles tend to have lower total return volatility, higher ROEs, and higher P/E valuations.2 Other studies have shown that companies with high ESG ratings have less systematic risk exposure, lowering investors’ required rate of return and the company’s cost of capital.3

In the not-too-distant past, a well-articulated corporate sustainability strategy may have been viewed as a nice-to-have, but non-essential, element to include in a company’s prospectus and investor marketing materials. Now, however, private companies looking to enter the public market are increasingly recognizing that the depth and quality of sustainability disclosures can have a meaningful financial impact and are adapting their IPO communications accordingly.

Investor Expectations

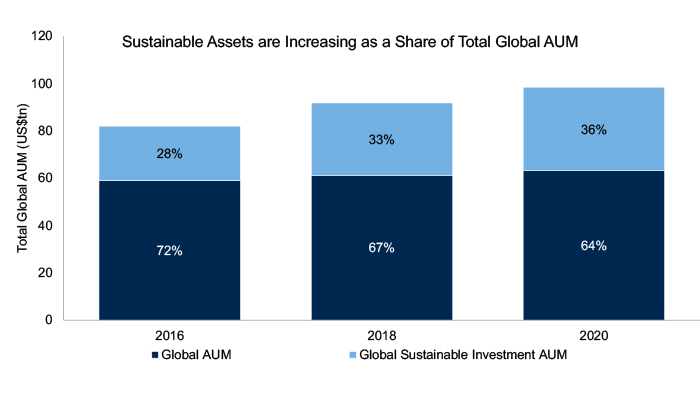

Sustainable investing is now firmly in the mainstream: in 2020, sustainable investment, which encompasses a range of strategies that consider ESG factors in portfolio selection and management, comprised 36% of total global AUM, or more than US$35tn.4 Integrating ESG considerations throughout IPO communications can serve to generate incremental demand from sustainability-focused investors, open up access to larger pools of capital, and signal to the market the presence of a progressive and forward-thinking leadership team.

Source: Global Sustainable Investment Alliance (GSIA)

ESG integration, defined as the systematic inclusion of ESG factors into financial analysis, is among the most popular of these strategies. Investors practicing ESG integration require detailed sustainability-related information to conduct due diligence and assess material ESG-related risks and opportunities. As such, investor demand for disclosure presents another incentive to integrate ESG considerations throughout the IPO process. Articulating a commitment to sustainability and disclosing material information about ESG-related risks and opportunities can serve to open up access to otherwise untapped pools of capital.

Regulatory Developments

The focus on climate-related disclosure requirements by regulators has accelerated over the course of 2021. The EU’s Sustainable Finance Disclosure Regulation, which came into force in March 2021, requires financial market participants operating in the EU to disclose sustainability-related information in an effort to avoid greenwashing and ensure that investors have the information required to make informed decisions. The proposed EU Corporate Sustainability Reporting Directive will build on the existing Non-Financial Reporting Directive and extend reporting requirements to a much broader group of public companies, including small and medium-sized listed companies.

In the United States, the Securities and Exchange Commission (SEC) is currently developing recommendations, expected to be put forth for the Commission’s consideration by the end of 2021, regarding mandatory climate-related disclosures for public issuers.5 In Canada, the Canadian Securities Administrators (CSA) recently published for comment proposed climate-related disclosure requirements that are largely aligned with the Task Force on Climate-related Financial Disclosures (TCFD) requirements.6 Given these considerations, the sooner that companies looking to enter the public market can start working towards a reporting and disclosure process, the easier it will be to meet these potential future requirements.

RBC CM Supports Clients with ESG Integration throughout the IPO Process

Companies looking to enter the public market are increasingly including ESG considerations as a fundamental part of their equity story, and we believe that this emerging trend is primed to accelerate. RBC Capital Markets works in partnership with our clients to help them develop a compelling ESG narrative, prepare ESG disclosures in line with best practices, integrate ESG considerations into the prospectus and investor marketing materials, facilitate introductions to ESG-aligned capital, and advise on post-IPO ESG strategy and access to the sustainable finance market.

1. RBC Capital Markets. “The ESG Stat Pack.” September 28, 2021.

2. RBC Capital Markets. “The ESG Stat Pack.” September 28, 2021.

3. MSCI. “ESG and the cost of capital.” February 25, 2020.

4. Global Sustainable Investment Alliance (GSIA). Trends Report 2020. July 2021.

5. U.S. Securities and Exchange Commission. “Prepared Remarks before the Principles for Responsible Investment “Climate and Global Financial Markets Webinar”. July 28, 2021.

6. Ontario Securities Commission. “Canadian securities regulators seek comment on climate-related disclosure requirements.” October 18, 2021.