Key Points

- Events around GameStop and “meme stock mania” has prompted policy makers to question if PFOF aligns with best-ex (best execution).

- SEC Chair Gary Gensler has said eliminating PFOF was “on the table” given it creates “an inherent conflict of interest”.

- RBC analyzed effective spreads and questioned whether routing client orders without full consideration of effective spreads provides the very best execution.

- To identify the best prices across multiple venues, one should consider the likelihood of finding better-priced hidden orders and displayed odd lots.

In 2021, “meme stock mania” caused sudden rises, and falls, in the stock prices of companies including GameStop and AMC Entertainment. A flood of new users signed up for commission-free trading accounts and engaging in frenzied buying, prompted by social media, which pushed the stock price of GameStop up 2700% between January 8 and 28. It also led to an increase in the number of unique individual accounts trading GameStop on a given day from 10,000 in early January to 900,000 by the end of the month, according to an SEC report.1

These events have prompted policymakers, market participants, academics and other stakeholders to again question whether PFOF, which is one of the ways that commission-free trading apps make their money, aligns with best execution. The SEC has fined some of these commission-free trading platforms in the past2 for failing to properly disclose to users how they earn money from handling their orders, and questioned their transparency to clients about their trade executions.

Subsequently, SEC Chair Gary Gensler has said that eliminating PFOF was “on the table”3 given that it creates “an inherent conflict of interest”. Gensler has also asked SEC staff to draft a report on the effect of PFOF on market consolidation4, conflicts of interest, and investor protection, in furtherance of the SEC’s obligation to protect investors; to maintain fair, orderly, and efficient markets; and to facilitate capital formation.

What’s the effective spread?

Here at RBC Capital Markets, we have analysed effective spreads – the actual, rather than the displayed, difference between the price at which a security is bid and offered on public exchanges – to help shed some light on best prices. Furthermore, we question whether routing client orders without full consideration of effective spreads provides the very best execution. We found that while displayed spreads (known as National Best Bid and Offer, or NBBO) are of course critically important to the price discovery process, they often provide incomplete information. Frequently, there are better-priced odd lot orders and non-displayed orders residing on exchange order books. When these better-priced orders in accessing liquidity are accounted for, the effective spread is often lower than the displayed spread.

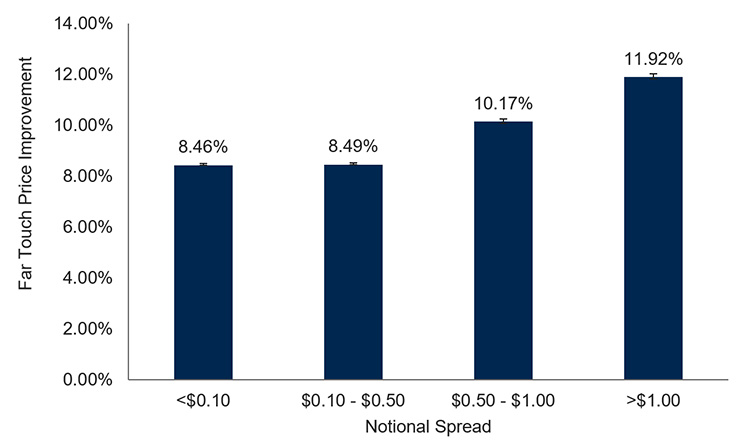

Our analysis, performed across equities traded by RBC Capital Markets on behalf of clients in the US during Q4 2020, found:

- Approximately 10% price improvement on stocks within the S&P 500 and those with spreads greater than $.50;

- Exchanges with at least 1% market share demonstrated a roughly 10% reduction or more in effective spread relative to the displayed spread; and

- Exchanges with substantial midpoint liquidity have effective spreads 15%-25% lower than the displayed spreads.

Source: RBC Capital Markets

This chart is bucketed by notional spread, and shows a roughly 8.5% price improvement (PI) for stocks with spreads up to $.50 and between 10.2% and nearly 12% PI for stocks with spreads $.50 and greater.

Our data shows that a significant percentage of odd lots and hidden resting orders on exchanges may be priced more aggressively than the NBBO, and therefore may provide opportunities for greater price improvement than many off-exchange trading platforms. However, some brokers may not take this into consderation when routing client orders. They may be unaware that the effective spreads on these exchanges may be narrower than the displayed spreads. They may also receive other benefits from alternative venues, such as PFOF, where investors may still receive modest price improvement relative to the NBBO, but not the amount of price improvement that would otherwise be realized relative to effective spreads.

Reference to effective spreads is an important factor in making order routing decisions. To identify the best prices across multiple venues, one should consider the likelihood of finding better-priced hidden orders and displayed odd lots.

Finding best execution

The PFOF debate is similar to the maker-taker fee debate in that both of these models provide monetary incentives that can create conflicts of interest and may impact best execution.

Maker-taker rebates were established in the 1990s and early 2000s as a way for trading venues to attract order flow. The system generally offers a transaction rebate to those who provide liquidity – the makers – and charges a fee to the takers. The process has become increasingly popular in subsequent years.

Fee and rebate schedules are publicly available, but they provide insufficient information to actually figure out the economics of a given trade at the time of execution. Once one starts to compile the data, it quickly becomes apparent that exchange pricing is highly complex. Over time, both the volume of fee and rebate schedules as well as the frequency with which they can change compounds the complexity.

Our updated 2021 analysis of maker-taker fees and rebates identified no fewer than 1,150 “pricing paths” across exchanges, an increase of 37% from the 839 paths observed in 2016. Across all these paths, there are at least 4,025 separate factors than can ultimately determine the fees charged and rebates offered by exchanges. This high number of variables strongly suggests that exchange prices are tailored and offered on a bespoke basis. There are schemas for companies with significant order flow where the rebate tiers are very detailed, which entices business for the exchange, but adds additonal complexity to the ecosystem.

With both effective spreads and maker-taker fees, regulatory changes could help improve best execution for clients.

The route to change

One way to do this would be for the SEC and FINRA to revise best-ex guidance and reporting standards. Best-ex could require brokers to route to the best displayed price or venue, including odd lots if the customer order can be fully or partially satisified with the displayed quantity, as well as to utilize a data-driven approach to consider routing to venues that may have better priced hidden orders. The commission could also consider limiting or prohibiting rebates and other inducements to trade in order to mitigate conflicts of interest between brokers and clients.

The SEC could also investigate requiring brokers to use data from their order executions across exchanges and other liquidity venues to ensure that they have fulfilled their obligation to seek out the best prices for their clients. Brokers would analyze their execution data by symbol and venue in order to better inform and guide routing decisions. This policy would establish more objective criteria for best execution and reduce the risk of conflicts of interest between brokers and clients.

We also believe that amending Regulation NMS Rule 605 to include odd lots, and eliminate the distinction between odd and round lots, would greatly improve transparency. Odd lots now constitute a majority of all trades, so excluding them from Rule 605 means that they’re at a higher risk for inferior trade execution. This is particularly true for odd lot trades by retail market makers, because customers may find it difficult to monitor the quality of trade execution. While the impact of PFOF may not be visible in bid-ask spreads for each transaction, it is likely to affect aggregate spreads as liquidity providers need to account for the payments made to brokers. These hidden costs make the price formation process less transparent and less efficient.

In summary, updated guidance for best-ex is a useful way to tackle the problems with effective spreads, PFOF and maker-taker fees and rebates. A more robust, data-driven definition of best execution could encourage greater transparency, fewer conflicts of interest, and maximum price improvement.

1. https://www.sec.gov/files/staff-report-equity-options-market-struction-conditions-early-2021.pdf

2. https://www.sec.gov/news/press-release/2020-321

3. https://www.reuters.com/legal/litigation/sec-chairman-says-ban-payment-order-flow-on-table-barrons-2021-08-30/

4. https://www.ft.com/content/83dff8fc-14ac-4e67-a969-20b358c349e8