The new market data infrastructure rule ushers in a raft of sweeping changes, including displaying certain odd lot quotes. That raises questions on how accessing better priced, smaller orders could impact order routing and best-execution for brokers and clients. But implementation remains uncertain amid pushback from the exchanges.

The outdated market data systems

We have long advocated for improvements to the SIPs (Securities Information Processors) that form the consolidated quote and trade feeds of the US markets, arguing that they had become outdated and unfit for purpose. The basic problem with SIPs in their current iteration is that they have not kept pace with proprietary exchange market data products, either in terms of content or speed. The sophisticated electronic trading that takes place today is occurring in milliseconds, using levels of pricing information that are missing from the SIPs.

The SEC found that, from 2010 to 2018, traders’ data fees increased anywhere from 967% to 2,916% depending on their business model. A typical midsize firm might now pay $3 million annually for its live stock price data, before additional transaction fees, according to a Wall Street Journal report.

As we outlined to the SEC during the rule proposal comment period, the SIPs need depth-of-book information such as that available from exchanges’ proprietary market data feeds, for which they charge hefty fees. Market participants who choose not to purchase them are currently at a significant disadvantage.

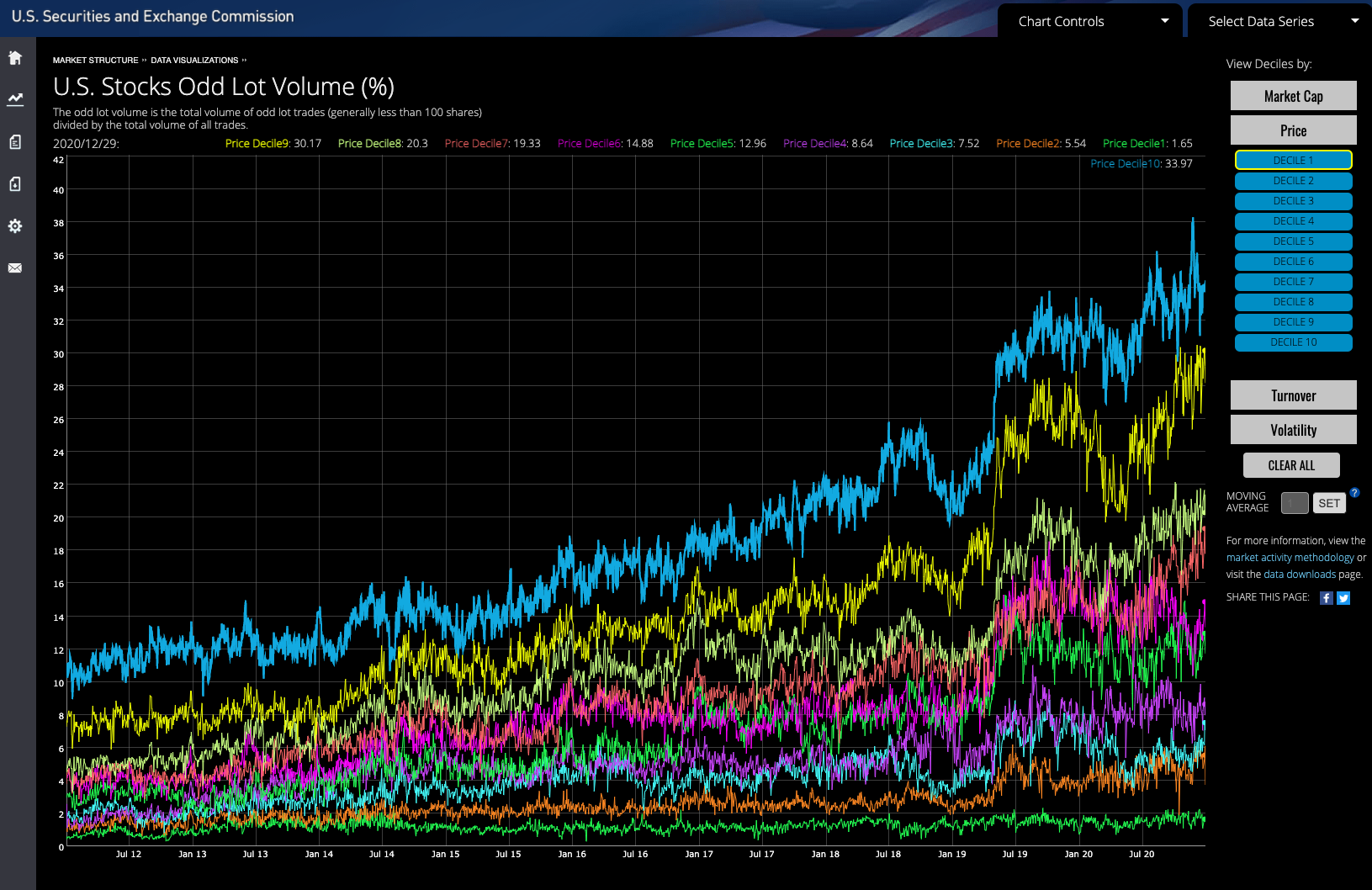

We also advised that odd lot quotes should be included in SIP data. As stock prices have risen and average trade sizes have fallen, odd lots are becoming more important in price formation. According to the SEC’s Market Activity Overview, odd lot trades now comprise approximately 50% of the total trades in the U.S. equity market. What’s more, this trend has been steadily growing, although it was as choppy along with the rest of the market last year.

Source: SEC's - Market Information Data Analytics System

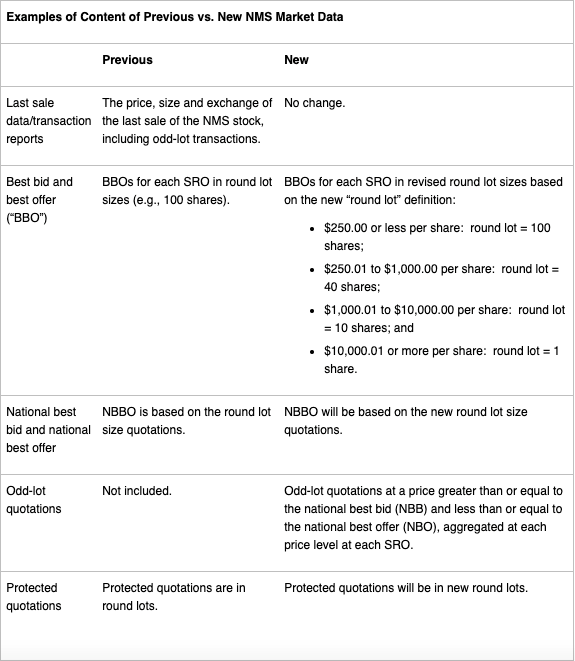

The new core data

The SEC voted 5-0 to adopt this final rule, which represents the biggest overhaul of the SIPs since the rules governing them were first passed in the 1970s. The rule creates a definition of “core data” for the first time, which includes depth-of-book, odd lot quotes, and auction information.

The rule also requires core data and proprietary data to be transmitted using the same format, hardware and method of transmission in a bid to reduce latency between the offerings. And the SEC is replacing the current SIP system of two data streams with a “decentralized consolidation model” that introduces competition to the SIPs for the first time. Exchanges will now need to provide access to their data to SEC-approved competitors who want to provide consolidated market data feeds to the industry (“competing consolidators”).

Implications and implementation

The adoption of the market data infrastructure rule could have wide-ranging implications. We will finally have competition for SIP feeds, and importantly, the feeds themselves will be geographically diversified and provide significantly more robust information to investors and brokers.

For the asset management community, this could mean lower fees for market data. Furthermore, brokers who decide to use the SIPs will have more resources available to invest in their client-facing platforms if they so choose, which of course would benefit investors, too.

However, these benefits are not here yet. There is room for interpretation in how the rule is implemented, which could reduce its impact to a hollow victory. The exchanges need to file plans with the SEC during the transition period. These include plan amendments which must provide the proposed fees to be charged for the underlying market data needed by consolidators. Also, as there will be a new SEC Chair – likely someone who has not yet opined on this rulemaking and who may have other priorities – this is not a done deal.

Another day in court:

Nasdaq, NYSE and CBOE have sued the SEC, asking the DC Circuit Court of Appeals to review the rule and they've had good fortune in the courts recently. In June last year, the DC Circuit Court of Appeals handed the SEC its second loss in as many weeks when it blocked an initiative to test whether the incentive schemes offered by the New York Stock Exchange (NYSE), Nasdaq and CBOE Global Markets created a conflict of interest. Earlier that month, the court ruled that the SEC had exceeded its authority when it challenged certain data fee increases imposed by NYSE and Nasdaq.

In response to the market data infrastructure rule, Nasdaq said the changes "would reduce competition and make markets more costly to all investors". They added that they would be assessing "how to best protect the investing public in light of the SEC's approval", intimating that they would be willing to go to the courts. Now that the exchanges have gone in that direction, it could further complicate and delay implementation. Aside from the outcome of the case itself, there will be the issue of whether the SEC could lay the groundwork for the implementation while litigation was pending.

Source: https://www.sec.gov/news/press-release/2020-311

This may complicate best execution conversations, but may also offer brokers more discretion and nuanced solutions, where they, like RBC, can access the non-protected market. For example, where a stock’s protected best bid and offer price (PBBO) is $10.00 x $10.05, but the national best bid and offer price (NBBO - including odd lots) is $10.01 x $10.03, where should the broker route to?

How about a more expensive stock with a PBBO of $3000 x $3005 and an NBBO of $3001 x $3002? Even five shares would have a notional value of $15,000. Investors need to consider the benefits of accessing better priced liquidity versus the potential for information leakage in doing so. Brokers may consider providing liquidity rather than crossing the spread to take liquidity, as well as the fees or rebates of a venue displaying an odd lot versus those displaying a round lot.

It will become more important than ever for brokers to understand their clients’ viewpoints regarding interacting with non-protected quotes. Order routing may become more customized to satisfy nuances on a client-by-client basis accordingly. Brokers with a more thoughtful view of best execution will stand out to investors.

The final rule is here, but there’s much left in the balance. It will be incumbant on market participants to stay the course and continue to engage regulators and policymakers in this discussion to see it through to a fruitful outcome.