Following the 2022 RBC Capital Markets Global Healthcare Conference, our latest research examines healthcare ESG momentum in more detail, as well as key performance trends and proxy themes to look for this season.

Healthcare ranks lower in ESG momentum

The Healthcare sector has typically held an overweight position in U.S.- and global-focused sustainable equity funds. At the industry level this has been driven by both the Life Science Tools & Services and the HC Equipment & Supplies industries.

But our latest research reveals that ESG momentum scores, which track recent shifts in ESG profiles, have slipped relative to other sectors. Both major subsectors—Pharma/Biotech and Equipment Services—have contributed to the lower readings, driven by controversies related to product quality and safety, such as product recalls and ongoing opioid-related lawsuits, as well as access and affordability concerns.

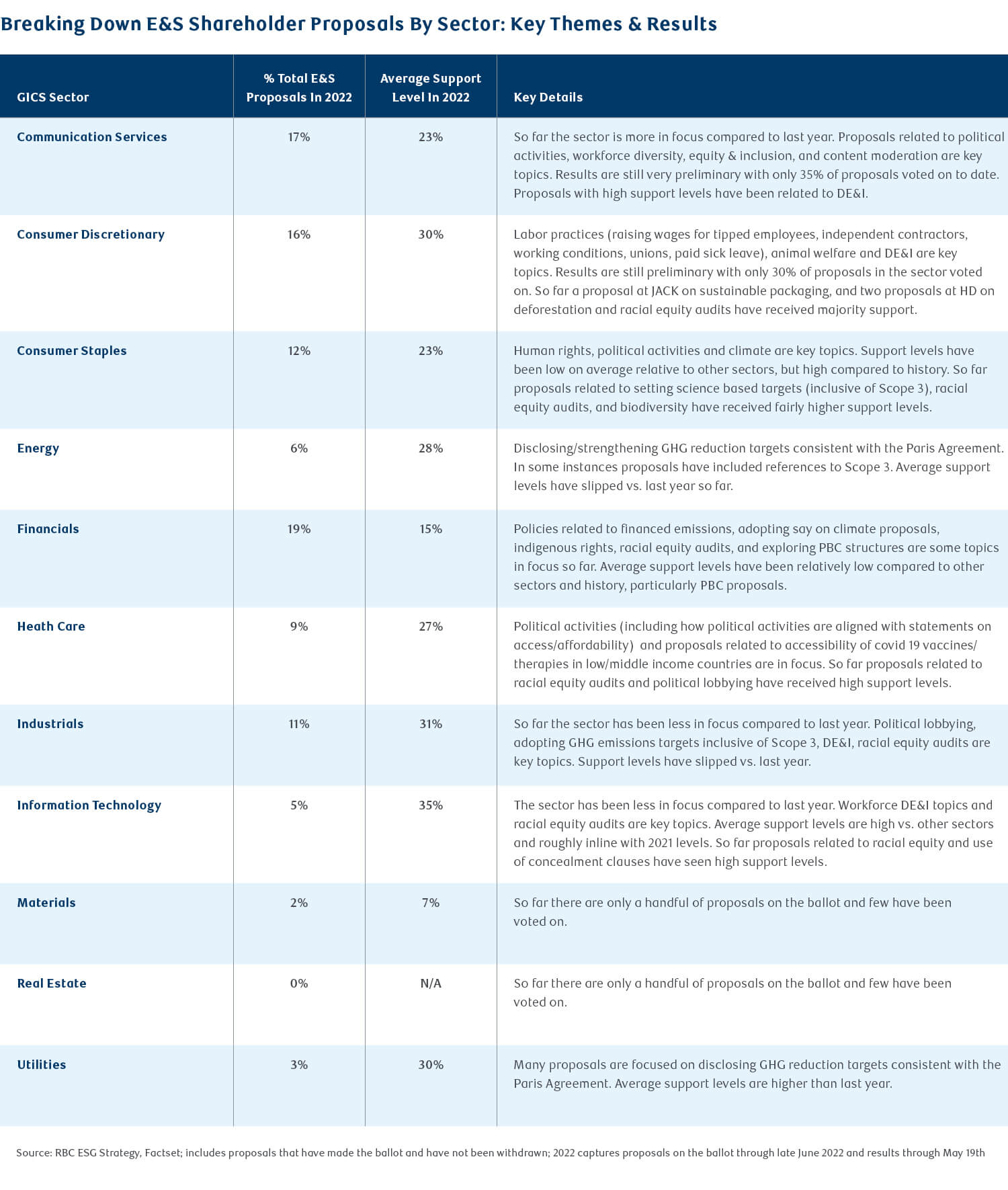

Lobbying and Access & Affordability Have Been Focus Areas in Proxy Season

For Healthcare specifically, this proxy season we have seen a number of proposals on the ballot related to political activities, as well as proposals associated with improving COVID-19 vaccine accessibility in low- to middle-income countries.

Results are still preliminary, but E&S shareholder proposals at healthcare companies have received 25% support from shareholders so far, which is slightly down from last year. One proposal that received majority shareholder support involved a third-party racial equity audit.

Results are still preliminary, but E&S shareholder proposals at healthcare companies have received 25% support from shareholders so far, which is slightly down from last year. One proposal that received majority shareholder support involved a third-party racial equity audit.

So far, governance-related shareholder proposals at healthcare companies have received an average of 45% support from shareholders, slightly higher than prior years.

Healthcare names with stronger ESG profiles have outperformed historically

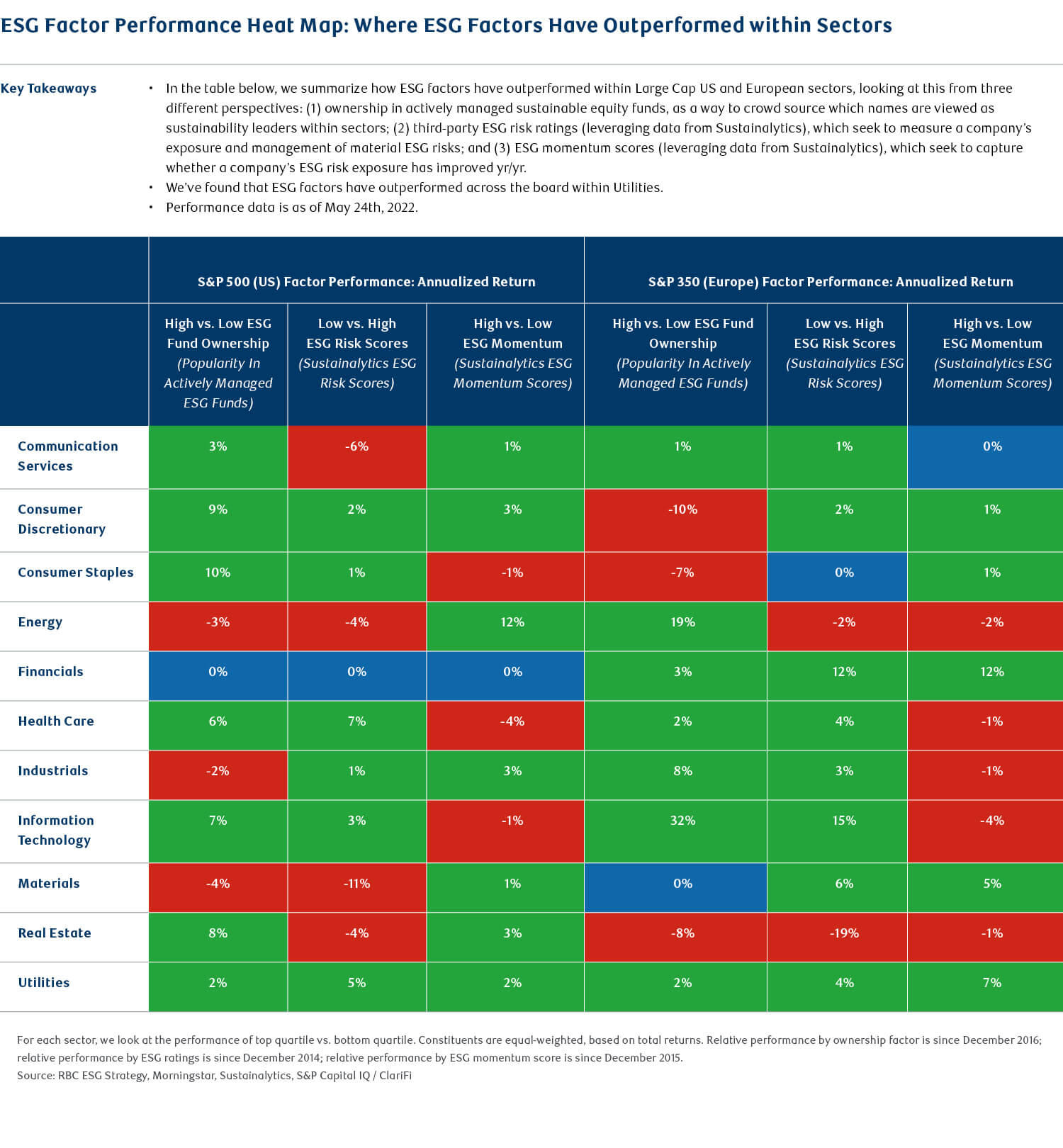

The table below breaks down key performance trends within major S&P 500 and S&P 350 GICS sectors, specifically. We examined performance based on ownership levels in sustainable funds, ESG risk ratings (leveraging ratings from Sustainalytics), and ESG momentum scores (leveraging scores from Sustainalytics) have performed.

Overall, we’ve found that Healthcare companies with leading ESG profiles and ownership levels have outperformed historically, while the ESG momentum factor has underperformed within healthcare in both the U.S. & Europe.

Our Commitment to ESG

RBC Capital Markets’ ESG StratifyTM encompasses all of our ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.

Sara Mahaffy authored “The ESG Scoop: ESG Momentum.” For more information about the full report, please contact your RBC representative.