Key Points:

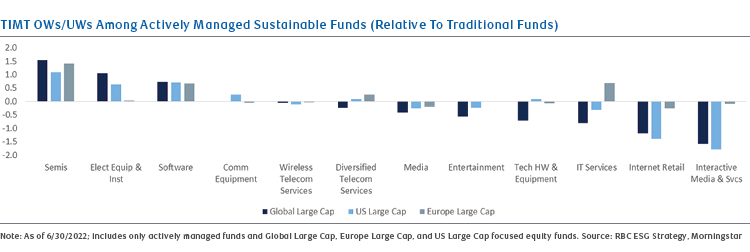

- Heightened exposure to Semis, Electronic Equipment & Instruments, and Software has led to significant Tech weightings for sustainable funds.

- Interactive Media & Services and Internet Retail are deep underweights in sustainable funds due to the sectors’ exposure to high-profile ESG-related controversies.

- Human capital, governance, and emissions and energy management are among the key themes driving ESG-related news activity for TIMT industries.

- S&P 500 Communication Services companies with stronger ESG profiles have outperformed in recent months, as focus on social governance topics have intensified for the sector.

Our latest report highlights key considerations for Technology, Internet, Media, and Telecommunications (TIMT) from our recent ESG strategy work, including ESG sentiment, materiality, fund flows, and factor performance.

Watching ESG Sentiment Signals for TIMT Industries

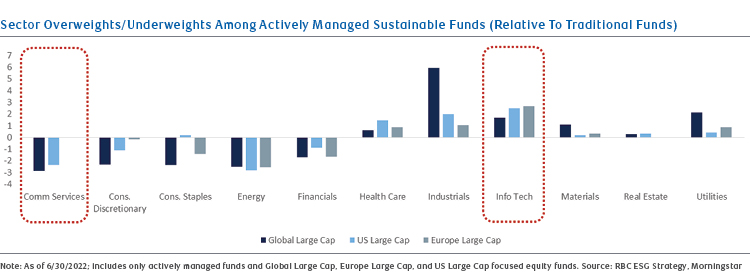

Actively managed sustainable funds have held significant Tech weightings, driven by substantial exposure to Semis, Electronic Equipment & Instruments, and Software. We believe this positioning can be attributed to these sectors’ lower exposure to ESG risks and commitment to producing energy efficient products and services.

On the flip side, recent news activity focusing on governance and labor practices has impacted ESG sentiment and tilted exposure away from Communications Services.

At the industry level, both Interactive Media & Services and Internet Retail industries have been deep underweights due to their involvement in ESG-related controversies.

Social & Governance Topics Have Been Driving ESG Materiality for TIMT

The chart below highlights the topics which have been driving ESG-related news activity for U.S. TIMT industries. We’ve found that these activities are generally good proxies for financial materiality, especially topics related to social (data security & privacy), human capital (labor practices, employee engagement, diversity & inclusion), and governance.

Emissions and energy management have also become key themes for many different industries, particularly as companies increase initiatives to source renewable energy, manage electricity costs, and invest in carbon removal technologies.

ESG Factor Performance in TIMT

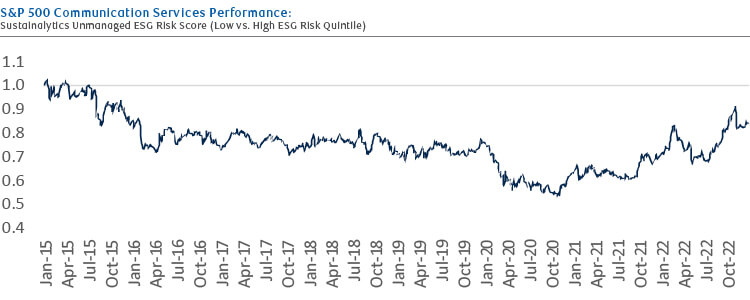

Our analysis of the performance track records of TIMT companies with high sustainable fund ownership and strong and improving ESG profiles (based on Sustainalytics ratings and ESG momentum scores, respectively), revealed that Tech and Communication Services companies with high sustainable fund ownership outperformed their sector peers historically.

Interestingly, we have seen S&P 500 Communication Services names with better ESG risk ratings (based on Sustainalytics ESG scores) outperform in recent months, as focus on social and governance topics have intensified for the sector.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.

Sara Mahaffy authored “ESG Sector Snapshot for TIMT” on November 11, 2022. For more information about the full report, please contact your RBC representative.