- Corporates are increasingly identifying opportunities to catalyze and scale sustainable innovation through venture investing

- A growing field of corporate impact investors are seeking to generate measurable environmental and social impact alongside financial return

- Corporate venture capital investments can drive unique advantages to portfolio companies by providing patient financial capital, mission alignment, in-house technical expertise, and access to new markets

Download the Report

The Evolution of Corporate Venture Capital

Investments in corporate innovation are exhibited through a wide range of approaches such as R&D, internal incubators, and M&A. Perhaps the most widely recognized approach to investing in innovation is corporate venture capital (CVC), whereby companies invest in, learn from, and collaborate with emerging companies.

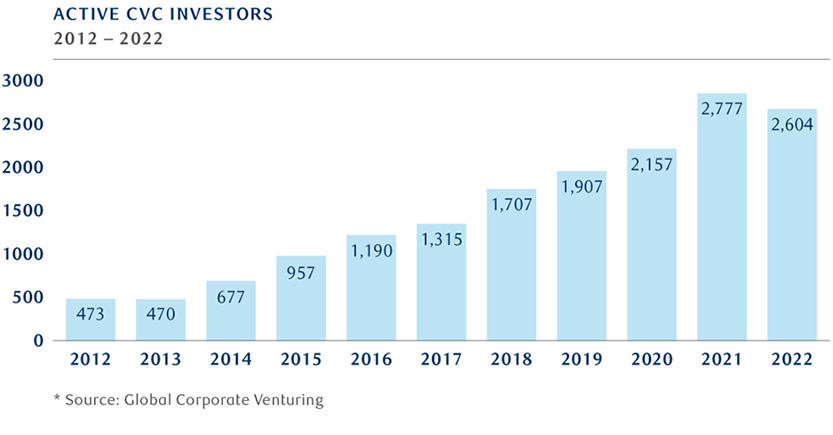

CVC has been in practice for over sixty years and generally refers to a direct equity investment in a start-up company – from seed to late-stage – using balance sheet capital or through an intermediary vehicle. In 2022, corporates invested $108 billion across nearly 3,700 deals.[1] According to Global Corporate Venturing, in 2022, corporate-backed deals accounted for 19% of global venture capital funding activity, up from 15% the year prior, and a record 101 new corporate investment units were launched.[2] In the same year, 2,604 corporates participated in at least one deal, representing a 5.5x increase in active corporates over a ten-year period.

CVCs typically seek to balance two objectives: financial return and strategic value. Strategic value can accrue to a CVC and portfolio company in a myriad of ways, raising capital from a CVC is often differentiated from a traditional venture capital. Taken together, a CVC’s advantages can drive meaningful growth to a portfolio company.

Advantages

Patient Financial Capital:

The longer-term horizon and holding period of a CVC can reduce the pressure of quick exits, as firms typically invest on balance sheet as opposed to a closed-end fund.

Mission Alignment:

CVCs can align company brand and resources towards the mission of an entrepreneur to “do good and do well”.

Managerial / Business / Technical Expertise:

CVCs have in-house ability to provide support beyond financial capital. Access to managerial, technical, and business expertise has the potential to de-risk an investment and generate product insights.

Increased Scalability:

Strategic support from a CVC provides start-up companies with an opportunity to access new markets, customers, and suppliers.

Potential Exit Opportunities:

CVCs can provide an easier exit option, as the CVC may look to acquire the portfolio company.

Market and societal expectations – rising from sustainability challenges such as climate change and inclusive growth – are also influencing corporate innovation priorities. Nearly all global CEOs believe that sustainability will be important to future business success.[3] Evidence from public markets suggests that sustainability leaders may observe long-term outperformance, lower cost of capital, and lower volatility.

By combining the scope of CVC and logic of impact investing – where investors intentionally seek to generate environmental and social impact alongside financial return – a growing number of corporate investors are seeking to generate financial return, strategic value, and impact.[4] Corporate impact investors are making

“investments that are aligned with and amplified by their company’s strategic priorities, market position, and resources, in order to generate measurable, mutually reinforcing social and financial returns.”[5]

In this context, corporates are increasingly identifying opportunities to catalyze and scale sustainable innovation, e.g. investing $70 billion in climate technology businesses in 2022, an 89% increase from 2021.[6] What’s more, the ability to raise significant capital through instruments like green and sustainability bonds gives corporates an immense opportunity to accelerate environmental and social impact by leveraging their core businesses, operations, and global supply chains.

Pioneering the Field

Salesforce is a pioneer in corporate impact investing. When the Salesforce Ventures Impact Fund launched in 2017, it was the first corporate venture program to launch a dedicated impact fund.[7] “Our idea was to marry the mission of impact-driven organizations and the strategic, financial return goals of corporate venture in a really compelling fashion,” said Claudine Emeott, VP and Partner of the Salesforce Ventures Impact Fund.[8]

The $150 million fund invests in “the most innovative enterprise software companies that drive measurable social and environmental impact” across five focus areas: 1. Education and Workforce Development, 2. Climate, 3. Diversity, Equality, and Inclusion 4. Social Sector Technology, and 5. Digital Health.

Last year, the Salesforce Ventures Impact Fund led a $35 million Series B investment in WeaveGrid.[9] The company solves a critical challenge as electric vehicle adoption rapidly increases – how to manage the power grid to support the increased load demand from charging EVs. Estimates suggest that over 25% of all cars on the road will be EVs by 2030, and this market expansion is placing added pressure on power grids that are unable to manage and handle the increased demand for electricity.

WeaveGrid’s solution pulls data from utilities and EVs to predict driving and charging patterns, capacity limits, and activate automatic load shifting, directly resulting in reduced pressure on power grids. With almost a quarter of all GHG emissions in the U.S. coming from transportation, Weavegrid is making an impact for both utilities and automakers.

Weavegrid, along with the fund’s 31 active portfolio companies, have access to the Salesforce ecosystem.[10] As noted above, one of the biggest advantages of CVC investment for entrepreneurs is not just financial capital but also business resources, intellectual capital, and a wide network of customers and stakeholders.

“We aim to be a helpful partner. We work very closely with our portfolio companies and very hard on their behalf. We can connect a portfolio company to internal experts on product, pricing, sales enablement, DEI, and ESG. The Salesforce ecosystem is an incredible resource, and we aim to provide that support throughout a company’s journey,”

- Claudine Emeott, VP and Partner, Salesforce Ventures Impact Fund

For Rachel Romer Carlson, CEO and co-founder of Guild Education, among other things this support included everything from nurturing strategic partnership opportunities between Guild Education and various product teams at Salesforce, to Emeott leveraging her network of investing partners to make introductions.[11] Guild Education is an education platform that connects employers with specific programs and empowers employees to find the higher education program best suited for their schedule and learning style.

“The dedication and thoughtfulness of the Salesforce Ventures Team and the way they go about their work is a true difference-maker,” said Romer Carlson. “They’re activating their network, they’re dedicated to helping our business grow.”

The impact that the Salesforce Venture Impact Fund is making is demonstrable. The Salesforce Impact Fund publishes an annual Impact Report with quantitative and qualitative metrics.[12] More than two-thirds (68%) of its portfolio companies are led by a woman or underrepresented minority founder or CEO. More than 66 million people have been directly served by the fund’s portfolio companies, and notable companies include Andela (engaging in skill development), Ellevest (bridging gender investment gap, Propel (helping the financial livelihoods of low-income Americans), and Unite Us (enabling healthcare outcomes).

De-risking Technology and Scaling Impact

Svante offers companies in emission-intensive industries a commercially viable way to capture large-scale CO2 emissions from existing infrastructure, either for safe storage or to be used for further industrial use in a closed loop.[13] Since its founding in 2007, Svante has developed carbon capture and removal technology using structured adsorbent beds, known as filters. With the ability to capture CO2 from industrial sources and directly from the atmosphere in an environmentally sustainable way, Svante makes industrial-scale carbon capture and carbon removal a reality.

In 2022, Svante Inc. raised a $318 million Series E led by Chevron New Energies, a division of Chevron U.S.A. Inc., to accelerate the manufacturing of Svante’s carbon capture technology. RBC Capital Markets acted as co-lead placement agent on Svante’s fundraising round.[14]

This funding will support Svante’s commercial-scale filter manufacturing facility in Vancouver, which is anticipated to produce enough filter modules to capture millions of tonnes of carbon dioxide (CO2) per year across hundreds of large-scale carbon capture and storage facilities. In 2020, Chevron launched a project to pilot Svante technology to capture CO2 from post combustion of natural gas.

Other fundraising round participants include Temasek, OGCI Climate Investments, Delek US and Hesta AG and new investors, 3M Ventures, GE Vernova, Japan Energy Fund, Liberty Media, M&G Catalyst, Samsung Engineering, and TechEnergy Ventures.

Svante’s Series E round also counts United Airlines Ventures Sustainable Flight Fund (as distinct from United Airlines Ventures) as an investor, which is a “first-of-its-kind investment vehicle designed to support start-ups focused on decarbonizing air travel by accelerating the research, production and technologies associated with sustainable aviation fuel (SAF).”[15]

Svante’s filters can capture 95% of CO2 emissions from industrial sites as well as CO2 that's already in the air. Once the CO2 is captured, it is concentrated and can be used in the creation of SAF or other products. “Carbon capture technology has the potential to be a critical solution in the fight to stop climate change and has the added benefit of helping us scale the product of SAF,” said United Airlines CEO Scott Kirby.

Integrating Inclusion and Impact

The TELUS Pollinator Fund for Good, one of the world’s largest corporate social impact funds, is an extension of TELUS’ long-standing commitment to social capitalism.[16],[17] Since its launch in 2020 with an initial investment of $100 million, the Pollinator Fund has been moving swiftly to find and back companies that are driving compelling solutions in health, education, agriculture, and the environment.

By leveraging the strength of TELUS, the Pollinator Fund is enabling remarkable positive social and environmental outcomes. “The genesis of the global fund started from the top. Our CEO, Darren Entwistle, has instilled a belief that to do well as a company, you have to do good in the communities where we live, work and serve,” says Blair Miller, Managing Partner, TELUS Pollinator Fund for Good.

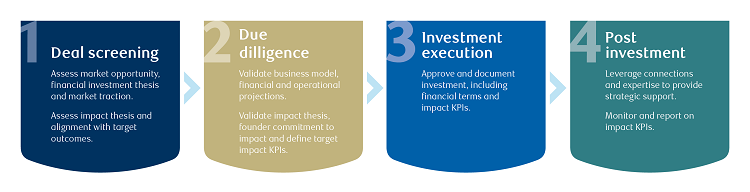

The Pollinator Fund integrates impact throughout the investment process from deal screening to post-investment value add and monitoring. The objective is to invest in for-profit companies that can scale and generate financial returns as well as measurable impacts.

Source: TELUS

The Pollinator Fund is deeply focused on impact measurement and management, and is committed to helping create meaningful, sustained change across the industry. Recognizing the growing momentum and demand to quantify and measure impact, the Pollinator Fund has released the Pollinator Impact Navigation Tool – targeted to help founders adopt stage-appropriate impact management practices, leverage impact as a unique differentiator in investor conversations and ensure impact continues to evolve as business scales.

In just two years, the Pollinator Fund has grown its portfolio to 26 companies, including Toronto-based Gotcare.[18] Gotcare is efficiently matching homecare workers with patients in need by receiving patient referrals from case managers and using its proprietary software platform, along with unique patient matching algorithms, to locate and connect the most ideal care aide. Gotcare’s technology reduces the cost of care delivery and has one of the largest networks of care workers in Canada. Notably, Gotcare founded by Chenny Xia, is among one of the fund’s 42% women-led portfolio companies. “Ultimately, we believe that investing in and empowering women is essential to create a more sustainable and durable economy,” says Blair.

RBC Capital Partners

RBC Capital Partners, the corporate venture unit of RBC, has taken a strategic approach to investing in impact companies and funds.

Through RBC Capital Partners, the bank is an investor in funds such as General Atlantic BeyondNetZero, Evok Innovations, and ArcTern Ventures. RBC has also invested in diverse-led GPs such as StandUp Ventures (focused on women-led ventures), BKR Capital (focused on black-led startups), L’Attitude Ventures (focused on Latinx-led startups) and Raven Capital Partners (Indigenous-led firm investing in Indigenous-led early-stage companies) to enable capital flows to diverse and underrepresented founders. RBC Capital Partners is also an investor in Amplify Capital, which invests in early-stage companies delivering social and environmental impact across education, health, and climate sectors.

RBC Capital Partners also recently led an $8 million Series A for ClearBlue Markets, a technology platform that provides carbon markets services to hundreds of clients worldwide. The investment will enhance ClearBlue Market’s platform and help accelerate client activity.

“Adding ClearBlue Markets and its technology platform to our portfolio is aligned with RBC's climate strategy and will in turn provide our clients with additional access to advisory services and technology needed to support their transition to a more sustainable future,” says Barrie Laver, Managing Director, Head of Venture Capital & Private Equity, RBC.[19]

As part of the value co-creation opportunity, RBC established a newly formed Environmental Markets Solutions Group. Lindsay Patrick, Managing Director and Head of Strategic Initiatives and ESG for RBC Capital Markets, says, “Our new Environmental Markets Solutions Group and partnership with ClearBlue Markets will provide expansive solutions and differentiated advice to help clients navigate this important but complex ecosystem.”

Conclusion

As environmental, social, and governance (ESG) factors are increasingly intertwined with business performance, corporates are identifying opportunities to catalyze and scale sustainable innovation. Furthermore, as sustainability remains a top concern among Gen Z and millennial employees, it is clear that the advancement of sustainable business will remain a key strategic priority.[20] Thoughtful design and execution of impact-oriented investments can activate a company’s purpose, scale sustainability outcomes, and unlock new avenues for innovation.[21]

[1] M&A and CVC in an Economic Downturn

[2] https://globalventuring.com/corporate/corporate-investors-2022-deal-numbers

[3] https://www.accenture.com/gb-en/insights/sustainability/ungc

[4] https://thegiin.org/research/publication/impact-investing-market-size-2022/

[5] https://ssir.org/articles/entry/corporate_impact_investing_in_innovation

[6] https://www.holoniq.com/notes/2022-climate-tech-vc-funding-totals-70-1b-up-89-from-37-0b-in-2021

[7] https://salesforceventures.com/impact-fund/

[8] https://www.salesforce.com/news/stories/salesforces-impact-fund-sparks-change-by-leveling-the-playing-field/

[9] https://salesforceventures.com/perspectives/welcome-weavegrid/

[10] https://stakeholderimpactreport.salesforce.com/governance/impact-investing#portfolio-impact

[11] https://www.salesforce.com/news/stories/salesforces-impact-fund-sparks-change-by-leveling-the-playing-field/

[12] https://stakeholderimpactreport.salesforce.com/governance/impact-investing

[13] https://www.rbccm.com/en/insights/story.page?dcr=templatedata/article/insights/data/2022/12/svantes_36318mm_series_e_led_by_chevron_new_energies

[14] https://www.rbccm.com/en/insights/story.page?dcr=templatedata/article/insights/data/2022/12/svantes_36318mm_series_e_led_by_chevron_new_energies

[15] https://www.prnewswire.com/news-releases/united-announces-5-million-investment-in-carbon-capture-company-svante-301784489.html

[16] https://www.telus.com/en/pollinatorfund

[17] https://www.telus.com/en

[18] https://gotcare.ca/

[19] https://www.prnewswire.com/news-releases/clearblue-markets-announces-royal-bank-of-canada-as-minority-investor-as-part-of-series-a-financing-301776599.html

[20] https://www2.deloitte.com/content/dam/Deloitte/at/Documents/presse/at-deloitte-gen-z-millennial-survey-2023.pdf

[21] https://www.mckinsey.com/capabilities/people-and-organizational-performance/our-insights/purpose-shifting-from-why-to-how

Moses Choi

Director, Sustainable Finance

Barrie Laver, CPA, CA. ICD.D

Head of Venture Capital & Private Equity, RBC Capital Partners

Ricardo McKenzie

Head of Private Placements

Our Experts