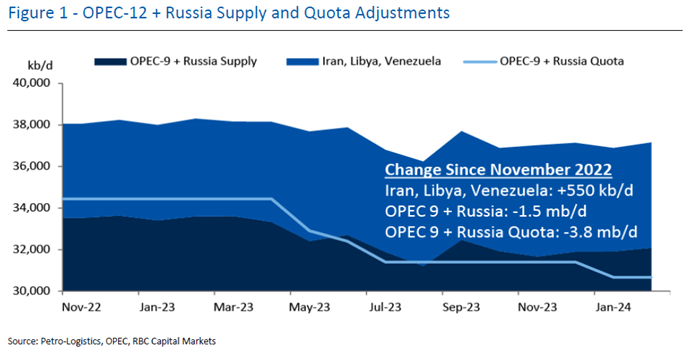

As anticipated, OPEC+ rolled over all the voluntary cuts through the end of 2Q’24 in order to provide continued support to the market and signal unity among the producers.

The June 1st Ministerial Meeting will now be the main event where all the production cuts, collective and voluntary, will be considered. There remains a corner of the market that appears ready to pounce on any indication of exhaustion with market management or internal friction. Nonetheless, we see no indications that a return to a market share war is being contemplated or that another member will follow Angola out the door. If anything, based on our recent travels, the group appears more unified at present. It does not appear that the UAE is making another push for a formal quota revision, having already received an adjustment last June. We continue to contend that the 5-month war in the Middle East has seemingly drawn Gulf leaders closer together as they face a collective threat of attacks on critical infrastructure in the event that the conflict metastasizes.

There also appears to be no looming rift with Russia, as evidenced by the announcement that Moscow would extend their voluntary cuts in tandem with the rest of the group.

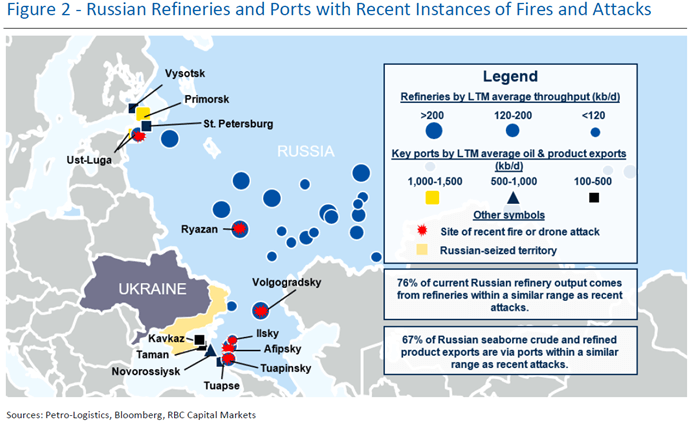

Gone are the days, it seems, when Russia would try to block or reduce the size of a collective OPEC adjustment, as was the case in meetings prior to the March 2020 breakdown. While Russia may not entirely match Saudi’s compliance track record, it has not been an especially egregious cheater either. We do find it noteworthy that Russia has announced a tapering of the refined product mix in voluntary cuts to zero by June given that Ukraine has started to target key refineries. Before general disruptions and drone attacks, those refineries accounted for ~1 mb/d of Russia’s refinery throughput, or 20% of total refinery runs. We will be watching closely in the coming weeks whether these recent attacks affect outgoing flows from Moscow.

We will also be watching whether the Biden administration is successful in brokering a temporary ceasefire between Israel and Hamas before the start of Ramadan on March 10th.

We suspect that some market participants may seek to fade Middle East risk if a ceasefire announcement is forthcoming given how the market sold off after an erroneous Al Jazeera ceasefire tweet several weeks ago. However, we think that a temporary ceasefire would not necessarily result in a more benign environment.

All values in USD unless otherwise noted. Priced as of prior trading day’s market close, ET (unless otherwise stated).

For example, the Houthis have already vowed to continue their maritime attacks until there is a permanent end to the fighting and Israel allows unimpeded aid to Gaza. Moreover, Israeli officials have already indicated that a temporary Gaza truce will not alter the potential plans to launch a ground invasion in Lebanon to force Hezbollah to retreat from the border in compliance with UN Security Council Resolution 1701. Iranian officials for their part have indicated that an Israeli ground offensive in Lebanon would be the redline that would formally bring them into the war. Certainly, White House officials continue to view Lebanon as a potential trip wire for a wider Middle East war and special envoy Amos Hochstein is currently in Beirut trying to stave off a second front from opening, stating “a diplomatic solution is the only way to end the current hostilities” and that “a limited war is not containable,” following a meeting with the Lebanese parliamentary speaker.

Finally, the fact that there are several million OPEC+ barrels sitting on the sidelines has given IEA and some market participants confidence that there is sufficient spare capacity to deal with a potential war- or sanction- driven outage.

However, we would be cautious in assuming that Saudi Arabia would rush to deploy its barrels in the event that there is a run up in oil prices due to a geopolitical event. Having been pressured by the US in 2018 to backfill an Iranian sanctions disruption that failed to materialize and having watched the US release 180 mb from the SPR to mitigate a Russian phantom disruption, we think that Saudi Arabia and OPEC will likely assume a watch and wait strategy until there is a clear and sustained outage.