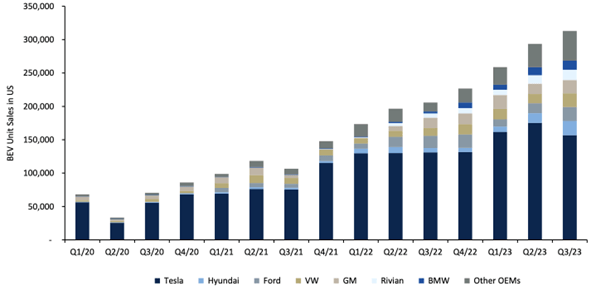

The electric vehicle (EV) market continues to exhibit impressive growth; despite factory shutdowns impacting some major players, year-over-year growth for the industry accelerated in Q3/23. This positive momentum builds on strong gains already seen in Q1/23 and Q2/23, with growth jumping from the high 40s to a robust +52% in the last quarter. This data paints a clear picture: the EV market is thriving, even amidst temporary setbacks experienced by individual manufacturers.

Despite continued strong demand for electric vehicles (EVs) in both the U.S. and Western Europe, a perception of a slowdown has emerged, particularly the America. This perception is fueled in part by a recent IHSM survey which showed a decline in US car buyer interest in EVs. The survey found that only 52% of US respondents were "open to buying an EV" in 2023, compared to a significantly higher 81% in 2021. These results can largely be attributed to three main culprits that are at the heart of the perceived slowdown in the EV market:

- BEV pricing is too high

- Mismatch between consumer preferences and EV availability

- Public charging infrastructure is inadequate

Culprit 1: BEV pricing is too high

A perfect storm has propelled car prices (measured by revenue per unit) in the U.S. and Europe by 25-45% since 2019, far exceeding wage growth. Low interest rates, pandemic stimulus, and supply chain disruptions, including the chip shortage and Russia-Ukraine war, created a scenario where automakers prioritized production of higher-margin models due to component limitations. Growing affordability concerns due to rising interest rates and financing terms are prompting a potential price correction, particularly with rising U.S. dealer inventories.

Despite holding firm on average transaction prices (ATPs), automakers are increasingly offering incentives to attract buyers. This suggests a potential shift towards price/mix normalization in the U.S. market. While significant price cuts haven't materialized yet, rising incentives could be a way for manufacturers to offset potential sticker shock from high interest rates. This trend, coupled with rising dealer inventories, paints a picture of a softening car market where affordability concerns are taking center stage.

However, it is important to note that BEVs still carry a premium compared to their gasoline-powered counterparts (ICEs) in both the US and Europe, even after factoring in federal tax credits. This price gap likely contributes to the softening BEV demand outlook.

“With rising interest rates and overall price normalization across the auto industry, significant price reductions for BEVs are crucial to maintain momentum.”

Tom Narayan, Equity Analyst, RBC Capital Markets

Culprit 2: Mismatch between consumer preferences and EV availability

The past 30 years have witnessed a seismic shift in American car preferences. The once-ubiquitous sedan has found itself in a precarious position, steadily ceding market share to the burgeoning popularity of SUVs and trucks. These giants of the road now rule the market, accounting for a staggering 80% of new vehicle unit sales YTD in 2023.

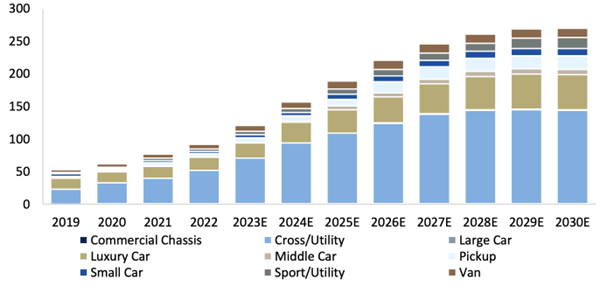

Most current electric vehicle (EV) offerings are sedans or close variations like small crossovers, and the burgeoning popularity of SUVs and trucks presents a significant challenge for the industry: reconciling consumer preferences with optimal electric vehicle (EV) efficiency. Aerodynamics and weight are paramount factors in EV range; at highway speeds, overcoming air resistance alone on these larger vehicles consumes over half the battery's energy. This necessitates significantly larger battery packs to achieve the same range as a smaller sedan, leading to a substantial increase in Bill-of-Materials (BOM) costs.

The resulting price inflation can potentially undermine the overall value proposition of these larger EVs. While this dynamic is likely to persist in the near term, a more optimistic outlook exists for the future. As the EV market expands with a wider variety of models, advancements in battery technology lead to improved cost-effectiveness, and consumer expectations regarding necessary range adjust, a tipping point could be reached.

“The future might see a wider range of larger, efficient EVs emerge that effectively address consumer needs at competitive price points.”

Laura Deng, Analyst, RBC Capital Markets

Culprit 3: Public charging infrastructure is inadequate

Despite a recent survey by IHSM indicating only 22% of potential BEV buyers believe charging infrastructure is adequate, the reality is that charger supply is actually outpacing demand in the US. Analysis shows that infrastructure deployment is happening ahead of widespread EV adoption. This robust network development is being fueled by a diverse set of stakeholders, including OEMs, federal and state governments, and non-network owners who want to offer attractive ancillary amenities, to name a few.

The lack of consumer awareness regarding charging availability may be the bigger factor driving concerns. Unlike traditional gas stations, which are destination points for refueling, EV charging infrastructure is more decentralized.

“EV Chargers are conveniently placed near existing amenities like shopping centers and parking garages, integrating charging into everyday errands. This approach, while cost-effective, might contribute to a lack of visibility and consumer awareness.”

Chris Dendrinos, Clean Energy Analyst, RBC Capital Markets

However, the NEVI program's funding for EV charging signage has the potential to address this concern soon. Furthermore, critics of public charging infrastructure often overlook the fact that many EV owners can charge conveniently at home, further mitigating concerns about range anxiety.