Once again, we believe market participants are far too optimistic about prospects for de-escalation. The Islamic Revolutionary Guard Corps (IRGC) and proxies are unlikely to halt attacks on energy infrastructure unless President Trump pulls back sanctions. While unclear how much additional pain the US Treasury can impose on Tehran, President Trump’s announcement will likely lead to further shows of force from the IRGC as they seek to dictate the terms of any truce. With senior officials in Saudi and US publicly blaming Iran for the unprecedented attack on Aramco’s facilities, and Secretary of State Pompeo calling it an “act of war”, we think risks are high and that this conflict goes kinetic before year-end. Another major attack on Saudi would likely lead Crown Prince Mohammad bin Salman Al Saud to greenlight a military response. Though Saudi is the third largest defence spender globally, the US would likely have to provide significant back-up assistance in the event of a Saudi strike. Hence, our strong view that oil remains an entirely broken barometer.

The attacks on Saudi oil facilities is just the culmination of what we have seen since May, Helima speaks with CNBC.

Oil: Anticipated Physical Tightness?

Conflicting and ambiguous headlines have plagued the oil market. While the duration of the outage, the extent of the damage and the Saudi ability to meet export commitments remains fluid, the market remains paralyzed from a risk deployment perspective until the physical market provides further cues (as indicated by weakening spot prices despite bidding of call skew). Tanker pricing from the US Gulf Coast spiked over 30% earlier this week as Asian refineries scrambled to secure barrels. Refineries keen to lock in cargoes from the US despite lengthy voyage times is a sign of anticipated physical tightness. Even if the outage is short in duration, increased tanker loadings could lead to counter-seasonal draws in US crude this shoulder season, or at a minimum, mean that inventories could be lower and US balances tighter than previously anticipated. Tangentially, this could be exacerbated if Iraqi Basra swing barrels are pulled away from the US and toward Asia to plug gaps.

Michael Tran discusses oil trading after a record spike.

Three Indicators to Watch

1. Asia’s Pull of Atlantic Basin Barrels

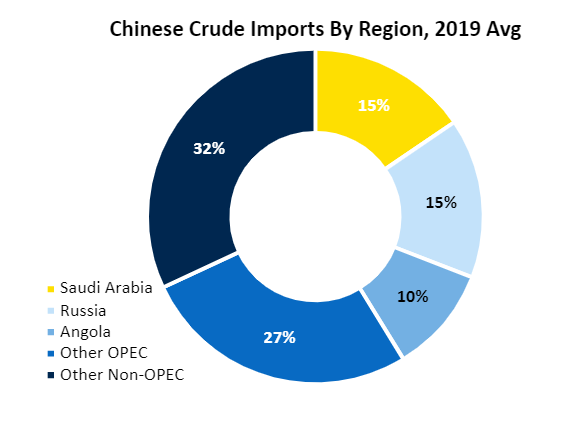

Asia is most impacted by the outage given that some 75% of Aramco’s crude exports deliver into the region, leaving refiners scrambling to lock in alternative sources. China is the world’s fastest import growth hub and while 10 mb/d are purchased from various sources, five countries make up nearly 60% of total Chinese imports. The Kingdom is China’s largest trading partner, owning over 15% market share. While the IEA suggests that the global market remains well supplied, global trade routes are being re-written in real time. US exports to Asia were already scheduled to be heavy this month, but expect Japan, Korea and Taiwan to lean heavily on North Sea and West African crudes as the swing barrel given shorter delivery times. Assessing the daily pull on these Atlantic Basin crudes is the best gauge of real time tightness in the physical market.

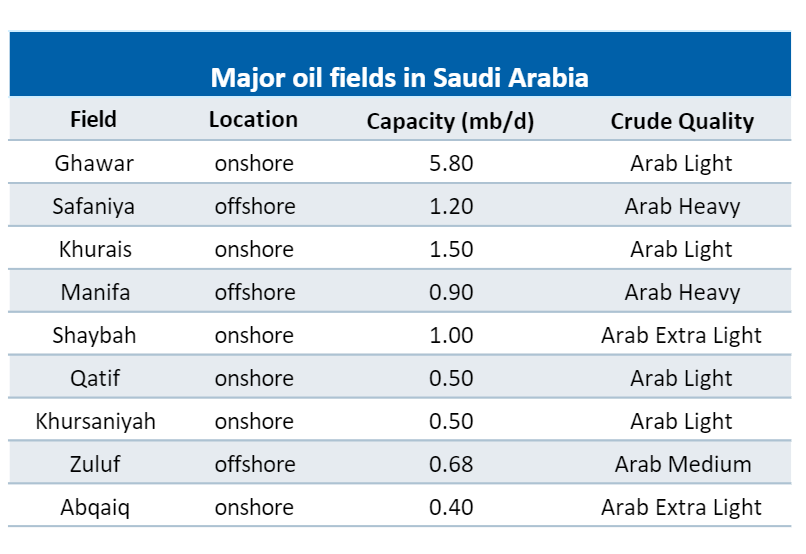

2. Crude Quality

The notional outage grabs headlines, but crude quality dictates market tightness. The global sour market is tight given existing disruptions in Iran and Venezuela, meaning that losing Saudi heavies would exacerbate balances that have already propelled Dubai prices to uncharacteristically narrow discounts to the Brent benchmark. While IMO 2020 loosens heavy, sour balances, the upcoming fuel spec change disproportionately shifts global demand toward light, sweet grades, or the type that makes up over 66% of aggregate Saudi production. The attack on Abqaiq is particularly consequential given it is Aramco’s primary processing center for Arab Light and Extra Light streams. Outages can disrupt global trade patterns and wreak havoc on pairing crude availability and quality with suitable refiners. Delivering the right crude to the right region is critical. Complexities along the supply chain typically lead to higher prices.

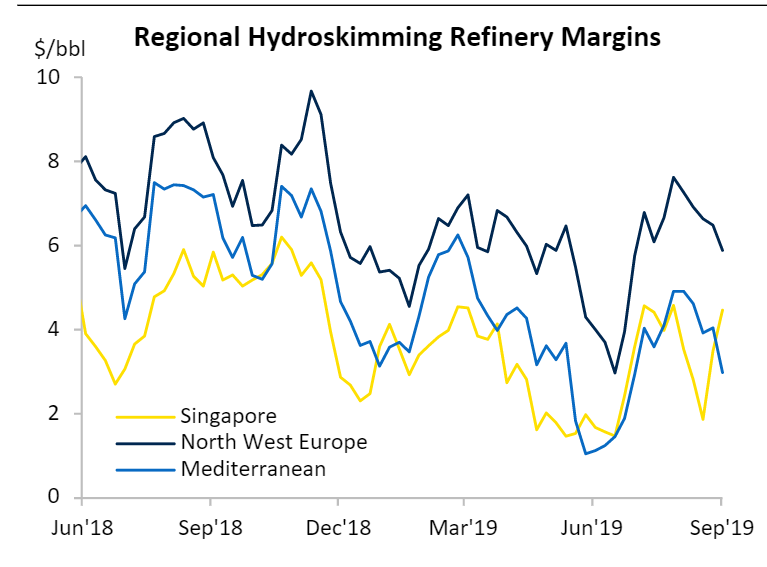

3. Refining Margins – Is Demand Destruction a Moving Target?

While volatile, global refining margins have been trending lower, on balance, over the past year. Weaker margins typically point to soft end use product demand. The market has been classically conditioned to deem major crude outages as bullish, which is usually the case, but exactly how bullish? In a market led by softening demand, a meaningful disruption, triggering a material rally in crude prices may squeeze refining margins from both ends (higher crude prices and lower refined product prices), resulting in weaker or even negative margins. This could lead to wide-spread economic run cuts and the cannibalization of crude demand. Ultimately, product demand, or prices, must improve alongside crude prices to keep margins healthy; otherwise, a spike in crude would prove unsustainable and kick off a vicious cycle of widespread run cuts.

Source: RBC Capital Markets, Chinese Customs General Administration, Saudi Aramco, Oil & Gas Journal, HIS Markit, Bloomberg