If recent flows to environmental opportunities funds are any indication, the risks of climate change-related events may be too difficult for investors to ignore. Flows into climate change and environmental opportunity thematic funds have surged to record highs and nearly doubled in 2020. Amid this rise in demand, asset managers have launched a number of new funds focused on these themes in recent years. In this edition of the ESG Scoop, we explore how climate change and environmental opportunities funds are positioned within the ESG universe and general 3Q20 ESG fund performance.

Here are the key highlights from our report:

Climate change and environmental opportunity fund flows nearly double YTD

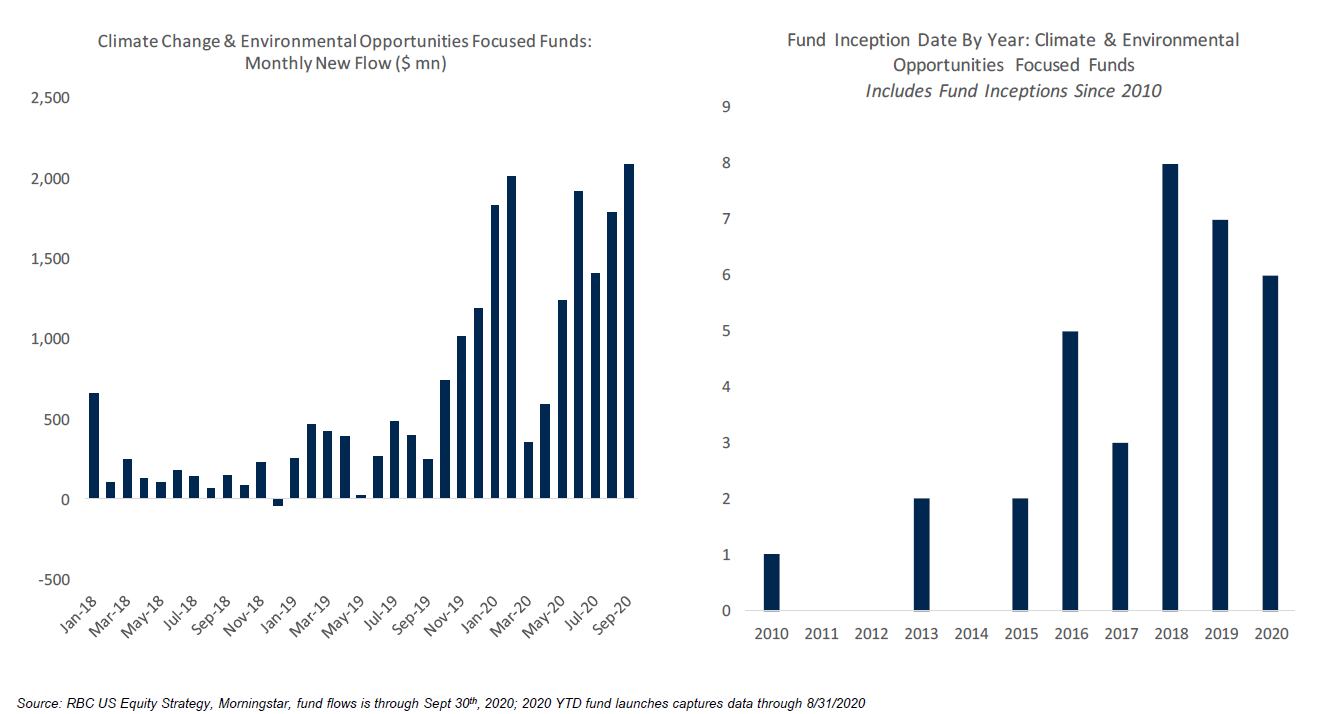

Net flows into climate change and environmental opportunities funds have accelerated. These funds invest in companies that have products or services that positively contribute to key environmental themes (i.e. clean energy, energy efficiency, pollution control, etc.) and companies that effectively manage risks and opportunities from environmental sustainability. Net flows into climate change and environmental opportunities first started to increase in late 2019 as climate change issues came into focus, but slowed during the market drawdown in March 2020.

Since then, net inflows have accelerated once again and hit new monthly highs in September. We have also seen an increase in fund launches focused on these themes in recent years. Given the strong performance of the top holdings in climate change and environmental opportunities focused funds, it is possible that these trends could continue.

Top U.S. & European Names In Environmental Opportunities Have Outperformed In Recent Years

Over half of the climate and environmental opportunities funds in our universe are investing globally in either large cap equities or mid/small cap equities. Among those that are globally focused, the U.S. represents a little over half of the holdings on average. Industrials and Tech make up the largest proportion of these funds, followed by Utilities.

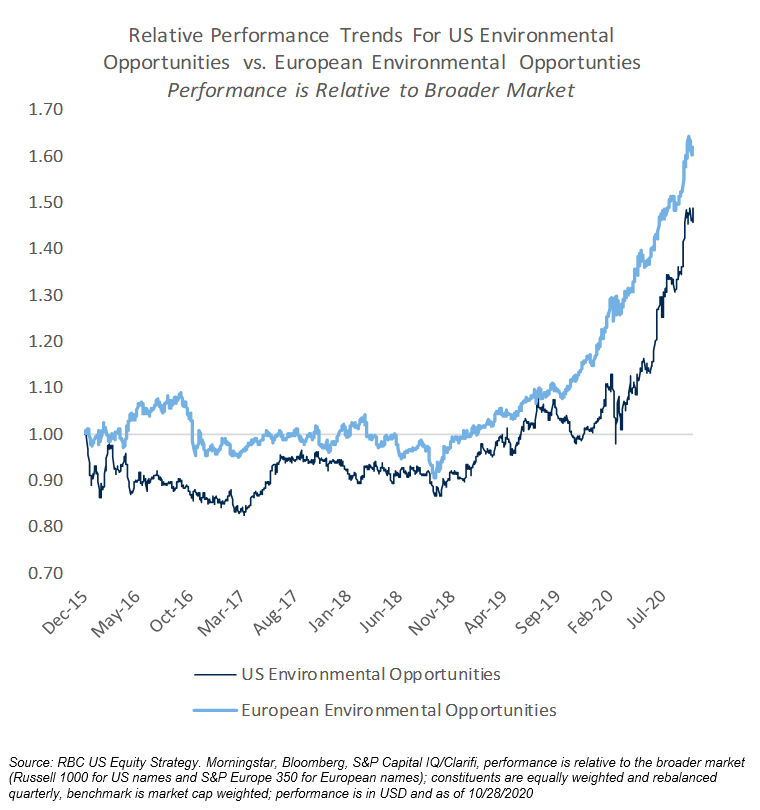

Over the past few years, both U.S. and European names in climate and environmental opportunities focused funds have outperformed strongly and net upward revisions have been steadily improving, recently returning to positive territory. The median relative valuation premiums for the most popular names in U.S. and European environmental opportunities have been expanding for both fund themes since mid-2018, when long-term growth expectations also started to improve.

Strong ESG focus may indicate a longer-term trend among issuers and investors

Thematic funds focused on climate change and environmental opportunities gave ESG investing a healthy boost in 2020. Active managers who embraced top sustainable names in this bucket outperformed and climbed to all-time highs, improving their future growth expectations. Given the strong performance and resilience of both U.S. and Europeans names in these funds, we believe the heightened focus on climate and environmental risk among issuers and investors could represent a longer-term shift.

“Judging from the data, we believe the heightened focus on ESG among corporates and investors represents a longer-term shift...”

Sara Mahaffy authored “The ESG Scoop: Environmental Opportunities.” For more information about the full report, please contact your RBC representative.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.