Highlights

- With Budget 2021, the federal government is betting big that major spending will boost economic growth, with just over $100 billion in new spending over the next 3 years.

- This new spending is at the high end of the $70-$100 billion ‘stimulus’ announced in the 2020 Fall Economic Statement despite a much firmer economic backdrop.

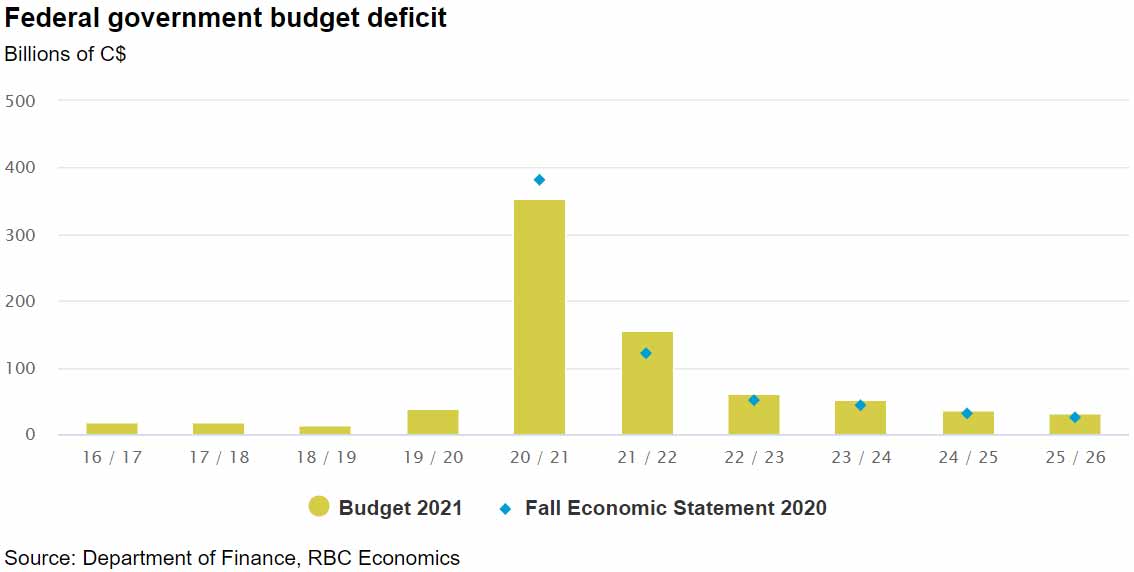

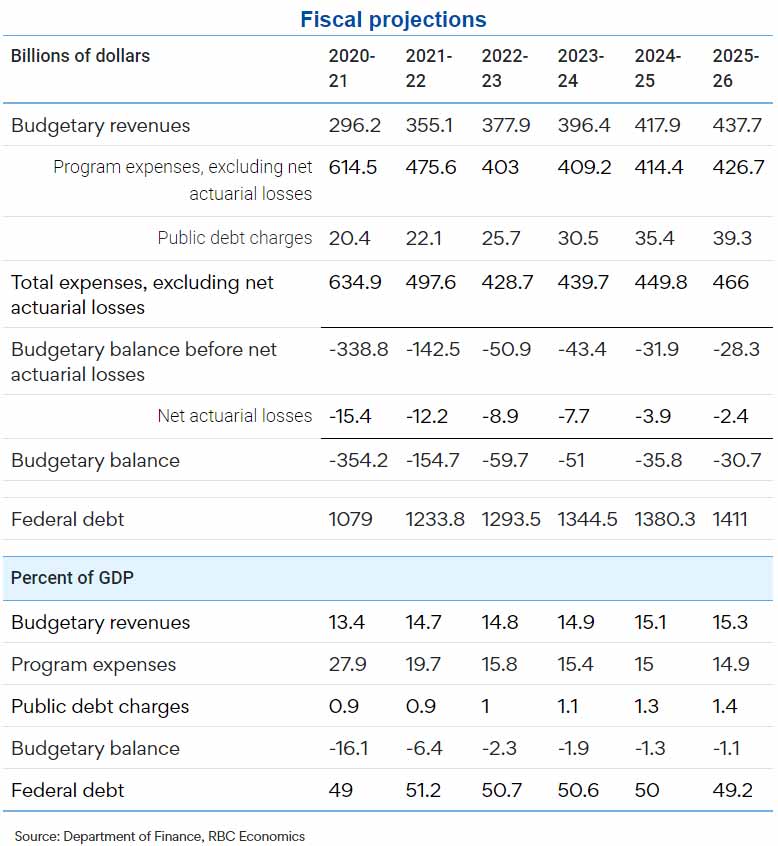

- Deficits are $354 billion for 2020-21 and projected at $155 billion for 2021-22, $50 billion for the next 2 years, and still 1% of GDP at the end of the forecast horizon in 2025-26.

- New spending covers extensions for key pandemic support programs (to slowly be phased out) and more targeted supports for the recovery, including a centerpiece national early learning and eventual $10/day childcare policy, a comprehensive and permanent program intended to boost women’s labour force participation over time.

- But Budget 2021 goes further beyond conventional fiscal stimulus or targeted efforts to boost the recovery, touching everything from expanding EI eligibility to climate mitigation.

- Tax increases are relatively modest mostly confined to previously announced measures, deferring the conversation about growth and potential revenue gaps to another day.

- The new spending is an upside to growth and could lead to the Bank of Canada raising rates earlier or faster than otherwise.

The federal government packed a lot into its first budget in two years. It extended key support programs for households and businesses, delivering on a pledge to “bridge the gap” to the other side of the pandemic. It launched new programs to stimulate hiring, support technology adoption by small businesses, fund training and incentivize business investment—measures that will help accelerate Canada’s economic recovery. It also announced plans for an ambitious child care policy that will help boost women’s labour force participation and should provide a sizeable economic lift over time. And funding through the Strategic Innovation Fund and targeted support for clean tech seek to give Canada an edge in fast-growing, innovative industries.

But Budget 2021’s ambition goes far beyond these targeted efforts to boost the recovery. The government is significantly increasing transfers to older Canadians and lower-income workers. Expanded EI eligibility and sickness benefits are being extended while the government works on a 21st century EI system. Infrastructure, public transit, affordable housing and environmental conservation will also see significant new investments. All told, the government announced slightly more than $100B in new spending over the next three years. It can hardly all be called “stimulus” but it’s nonetheless at the high end of the $70-100B range proposed last fall.

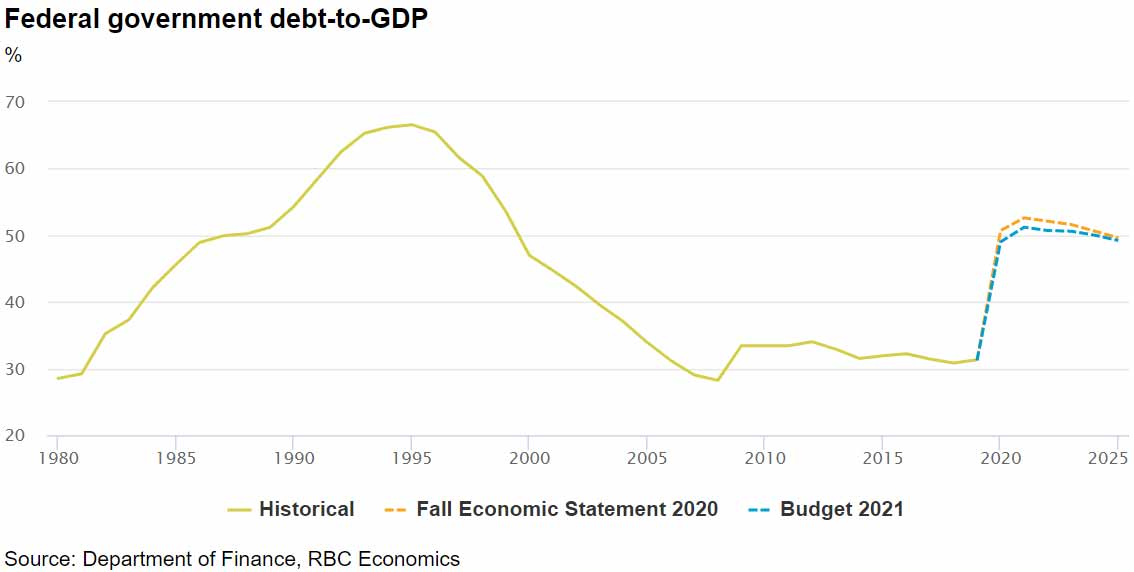

While new tax measures are limited, a stronger-than-expected economic backdrop will deliver enough additional revenue to finance more than half of that new spending. The rest, however, results in larger deficits over the forecast horizon. While the estimate of last year’s shortfall was trimmed to $354B from $382B previously, the current year deficit was marked up to $155B from $121B. Deficits in the next two fiscal years remain north of $50B and budget shortfalls continue to exceed 1% of GDP in the following years. As a result, the debt-to-GDP ratio is only expected to shrink modestly from 51.2% in the current fiscal year to 49.2% at the end of the forecast period—well above its pre-pandemic level of 31%. Disappointingly, the government failed to adopt a strong fiscal anchor, simply committing to “unwinding COVID-related deficits and reducing the federal debt as a share of the economy over the medium-term.”

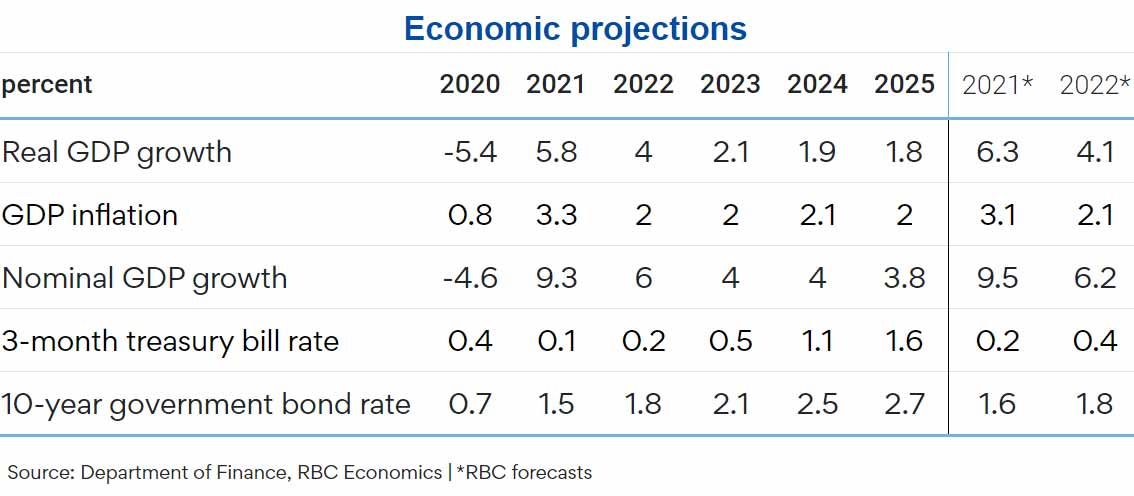

The Finance Department estimates today’s announcements will boost Canadian real GDP by two percentage points over the next two fiscal years. RBC’s GDP forecasts are already slightly stronger than those assumed in Budget 2021, but these new announcements nonetheless add upside risk to our projections. We are concerned, though, about the economic multipliers associated with some of this new spending—infrastructure and housing investments could run into capacity constraints sooner rather than later (these sectors haven’t been as hard-hit as in typical recessions) and additional transfers to households will in some cases add to existing cash piles, though the government has targeted those with lower incomes.

Heading into the budget, we were not alone in warning against excessive stimulus when Canada’s economic recovery should have plenty of its own momentum. Widespread spending that doesn’t efficiently add to the economy’s productive capacity will only increase concerns about crowding out, inflation and debt sustainability. Public debt charges are set to creep higher in the coming years, and an unexpected increase in borrowing costs or disappointing growth could see the government’s debt ratio moving in the wrong direction. Excess stimulus could also result in the Bank of Canada raising interest rates earlier or faster than it otherwise would. The bank’s next rate decision is on Wednesday, but its economic projections won’t include today’s announcements. Expect plenty of questions about risks to growth and inflation forecasts stemming from Budget 2021.

Key announcements in Budget 2021

“Bridging the gap,” finishing the job

As expected, the government is extending key lifelines that have supported households and businesses over the past year and prevented what would have been a more severe economic contraction. Wage and rent subsidies will continue through late-September, albeit with subsidy amounts being reduced starting in July. And a new Canada Recovery Hiring Program will pick up where CEWS leaves off, subsidizing a portion of costs associated with new hires or increases in hours or wages (like CEWS, support is subject to qualifying revenue declines). New funding announced for these three programs amounts to nearly $13B in the current fiscal year.

For Canadians that remain out of work, the Canada Recovery Benefit (CRB) has been extended by another 12 weeks to a maximum of 50 weeks of coverage (this benefit will also be tapered over the final 8 weeks). The government will consult on long-term EI reforms, but for now it will spend nearly $4B over the next three years to maintain flexible access to EI, including reduced qualifying hours, and $3B over five years to enhance EI sickness benefits. These announcements add to earlier EI and CRB extensions worth $12B.

A monumental investment in child care

If there is a centrepiece among the many initiatives announced in Budget 2021, it’s child care. The government is allocating $30B over the next five years and $8.3B per year thereafter to support early learning and child care to address gaps in women’s labour force participation. Working in collaboration with the provinces, the goal is to reduce child care fees by 50% by the end of 2022 and to facilitate regulated child care at an average cost of $10 per day by FY25/26.

This is an ambitious target with sufficient funding to replicate Quebec’s success in delivering affordable, accessible child care. The government estimates this investment could boost the economy’s potential output by 1.2 percentage points, though it could take a decade or longer for the rest of Canada to catch up to Quebec’s women’s labour force participation rate. As those long-term gains accrue, revenues associated with a stronger economy could offset much of the ongoing cost of this program.

Training and education

Budget 2021 provides $2.5B in funding for skills, training and trades, including programs to help small businesses deliver industry-relevant training, apprenticeship opportunities to address shortages of skilled tradespeople, helping workers transition to new jobs and initiatives to help Canadians improve foundational skills. Student grants, modest debt relief, and help connecting with employers will benefit younger Canadians, while adults returning to school will receive additional funding.

Support for SMEs includes $1.4B to improve digital skills and spur adoption of digital technologies (this is also expected to create job opportunities for younger Canadians) and $2.6B to help finance technology adoption through BDC. Immediate expensing of up to $1.5M in eligible investments (building on accelerated capital cost allowances announced in 2018) will also support capital spending.

Green loans and tax cuts, and lots of them

Budget 2021 will cut carbon emissions and protect the environment via 42 programs totaling $17.6B helping bring emissions down 36% by 2030. Altogether, the budget should encourage faster development and uptake of critical clean technologies, and allocates significant funding to conservation ($3.5B) and adapting infrastructure for natural disasters ($1.4B).

Large firms can get help cutting emissions via the $5B announced for the Net Zero Accelerator fund and those that make zero emissions products will have their tax rates cut in half saving them some $45M on the whole. Early-stage clean tech companies can access more funding to scale up. Those that purchase clean tech will be able to write them off immediately. Targeted investments in carbon capture will also get a tax credit (if the carbon isn’t used for oil recovery; other details were scarce) and the government will invest in R&D for minerals critical to battery production. Not to be left out, households will be able to access a total of $4.4B in interest-free loans for retrofitting their homes (though these programs still allow some carbon-based fuels).

Half-hearted on housing

Budget 2021 reacts to blazing hot housing markets across the country, but only half-heartedly—it does little to turn the tide in a rising market.

New and accelerated funding to create and renovate affordable housing units (including converting surplus commercial space to housing) totals $3.8B, building on the National Housing Strategy. But the government didn’t commit to working with the provinces and municipalities on supply of market housing, where pressures intensified during the pandemic.

Notably absent were demand-side measures addressing skyrocketing prices and climbing indebtedness. The government did not align the insured stress test with the tightening OSFI proposed last week for uninsured mortgages. The government resisted stoking demand by helping first-time buyers, but interest-free retrofit loans aimed at cutting emissions could add pressure in an already imbalanced sector.

A 1% tax on vacant housing owned by foreign non-residents will become effective January 1, 2022, with a consultation forthcoming. The $700M in expected revenue over four years is earmarked for affordable housing initiatives, but we think the measure will have a marginal impact on housing demand and supply.

Limited tax measures

Budget 2021 wisely defers consideration of most new tax increases for a later date. With ongoing new spending like childcare and a structural deficit that hovers around 1% of GDP, this conversation might need to be revisited, but does not make sense in the context of the early and uncertain recovery.

Still, Budget 2021 projects $8.3B in new revenues over the five year forecast horizon from tax “fairness” initiatives. These are mostly previously announced measures effective January 1, 2022, including the luxury tax on expensive vehicles, aircraft, and boats for personal use ($604M over five years), tax on unused properties of foreign non-residents ($700M), and the Digital Services Tax (DST) announced in FES 2020 ($3.5B). The DST 3% rate will apply to businesses that rely on data and content from Canadian users and with gross revenue of at least €750M, although it could eventually be replaced with an “acceptable multilateral approach”.

Apart from other mostly compliance-related revenue raising measures, the most notable new tax measure is a limitation of “excessive” interest deductions for businesses that could represent significant tax base erosion risks ($5.3B over five years starting in 2023). Pitched as aligning Canada with its G7 peers, it would limit interest deductions to 40% in the first year and 30% thereafter, with draft legislation and consultation expected in the summer.

Financing requirements

Financial requirements for FY21/22 were more than C$35B above the deficit estimate at C$190.7B, mostly reflecting a C$30B requirement in accounts payable, receivable, accruals and allowances. The category was a source of C$27B in FY20/21, which helps explain why financial requirements for FY20/21 were much lower than the Fall Economic Statement estimate at C$340.6B (vs C$448B). Another factor was lower lending through loans, investments and advances, including to Enterprise Crown corporations. In terms of Government of Canada bond issuance in FY21/22, the main development was further emphasis on a terming out of debt, with 10y issuance rising C$10B to C$84B despite an overall reduction in bond issuance to C$286B from C$374B in FY20/21. 30y issuance was steady at C$32B, while 2y, 3y and 5y issuance all saw material declines (from C$267B to C$160B in aggregate). Outside of the core sectors, ultra-long issuance was allocated C$4B, while C$5B of green bond issuance was also planned in the Debt Management Strategy. The estimated treasury bill stock at the end of FY21/22 is slightly higher than at the end of FY20/21 at C$226B (vs C$219B). Looking ahead, the government is projecting financial requirements of C$51.1B in FY22/23 and C$62.4B in FY23/24, with the lower requirement in FY22/23 due to expected repayment of CEBA loans.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.