In this report, our EM FX Strategists discuss the resurgence of the ‘Pink Tide’ in Latin America.

Key takeaways

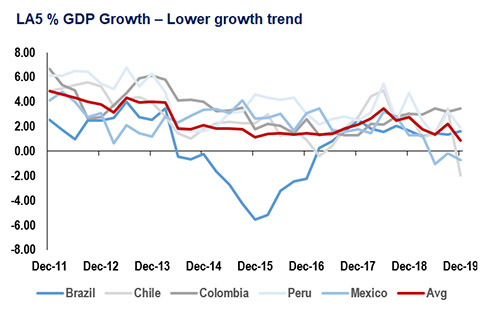

While lower growth rates and a general left-wing fatigue pushed some analysts to declare the death of the ‘Pink Tide’ in 2015/16, the last presidential cycle in Latin America wasn’t particularly good for the right-wing either.

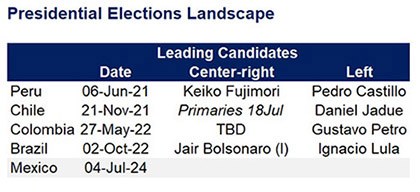

Peruvian elections are the first big test for the left revival. As we go to press, the results for the election are still trickling in, putting Pedro Castillo, a teacher whose economic policies include nationalization of assets and others similar to Bolivia and Venezuela, against the right-wing candidate Keiko Fujimori, who is facing prosecution under the Car Wash investigation.

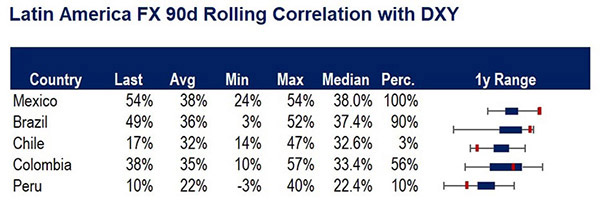

Price action of LatAm FX crosses with high idiosyncratic risk have been trading with a lower correlation to DXY while others like MXN has been basically trading 1:1 with the global dollar environment.

Although we don’t believe this will be a return of the ‘Pink Tide’ that took power in South America in the early 2000s. The reshuffling of the Latin American political landscape will imply larger governments and ultimately more spending at the cost of higher debt-burden, in some cases debt restructuring (e.g. Ecuador, Argentina) and ultimately weaker currencies.

The last presidential cycle in Latin America wasn’t particularly good for the right-wing either…

The Brazilian based company Odebrecht corruption scandal extended to right wing strong holds such as Peru resulting in three presidents for the country since 2016. In Argentina market-friendly president Mauricio Macri’s austerity measures collided with a debt crisis and cost him the 2019 elections against the left-Peronist Alberto Fernandez who was supported by former left-wing president Cristina Fernandez de Kirchner.

Widespread social discontent will make matters worse….

Violent protests in Chile and Colombia in 2019, forced Chile to re-write the constitution and saw many deaths on the streets of Colombia. Ultimately these protests were eclipsed by the COVID-19 health and economic crisis less than two years into the new presidential cycle. Although we may not be on the brink of a sweep of the left across Latin America like in the early 2000s, the region’s left is showing signs of revival.

What is the market pricing?

In Brazil, the annulment of the corruption convictions against former President Lula has opened a potential path for him to run for the presidency in 2022. Many things can happen – especially in Brazil – but Lula as a candidate in 2022 would divide the country much like in 2018. The likelihood that the Partido dos Trabalhadores (PT) will regain power has effectively elevated the risk premia that Brazilian assets will have to carry moving forward, thus limiting the potential strength of BRL. In our best-case scenario, we now think that BRL will remain highly undervalued for longer and the risk/reward is now low.

Colombia was recently downgraded by S&P on the back of weaker public finances and the government’s inability to pass reforms, raising alarms for the 2022 presidential elections risk. The currency retraced some of the gains made in the last few weeks, but the expectation of another agency adjusting the sovereign rating below IG and the potential forced selling of local assets by the offshore investors community will continue to add pressure on the currency in 2H of 2021.

The beginning of a more pragmatic approach?

Although we don’t believe this will be a return of the ‘Pink Tide’ that took power in South America in the early 2000s, the results might turn away the political landscape from the extremes and towards a more pragmatic/center-like approach against dire challenges in healthcare, education and ultimately poverty. However, this will also imply larger governments and ultimately more spending.

Source: RBC Capital Markets

Source: RBC Capital Markets

Source: RBC Capital Markets