In this report, our EM FX Strategist discusses the outlook for Asia EM.

Asia’s shifting growth nexus

Key takeaways

The growth nexus in Asia-Pacific is shifting to Southeast Asia.

The pandemic's retreat in Southeast Asia, the global commodities boom and the gradual reopening of international travel are brightening the region's economic prospects.

Malaysia is one of the few net oil and gas exporters in Asia-Pacific, and oil revenues are especially important for the fiscal balance.

Indonesia is relatively insulated from the Chinese growth slowdown, while benefitting from broadly higher commodity prices, and enjoying a domestic equities IPO boom.

The Southeast Asian currencies appear relatively undervalued compared to Northeast Asian currencies, especially MYR and SGD.

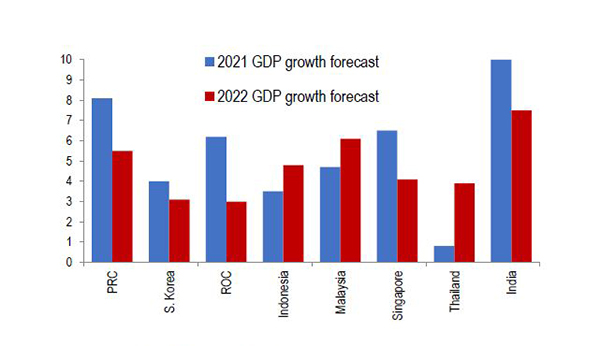

Northeast Asia recovered more quickly from the pandemic, but the growth nexus in Asia-Pacific is shifting to Southeast Asia. The Chinese growth slowdown will have ramifications across Asia-Pacific, but Northeast Asia (China/Taiwan/South Korea) is more exposed. The pandemic's retreat in Southeast Asia, the global commodities boom and the gradual reopening of international travel are brightening the region's economic prospects.

The easing of social restrictions is critical in allowing domestic consumption to rebound in Indonesia and Malaysia, and powering the broader growth recovery in both countries. Malaysia is also one of the few net oil and gas exporters in Asia-Pacific, and oil revenues are especially important for the fiscal balance. Climbing palm oil prices are also a positive factor, as is the gradual resumption of international tourism. Indonesia, on the other hand, is relatively insulated from the Chinese slowdown, while benefitting from the general commodities boom. It also offers some of the highest real bond yields among major EM economies, which should continue to be a draw while global risk sentiment remains supportive. The country is also in the grip of an equities IPO boom.

Finally, the Southeast Asian currencies appear relatively undervalued compared to Northeast Asian currencies, especially MYR and SGD, looking at long-run real effective exchange rates.

Source: Asian Development Bank

Source: Bloomberg