Key Points:

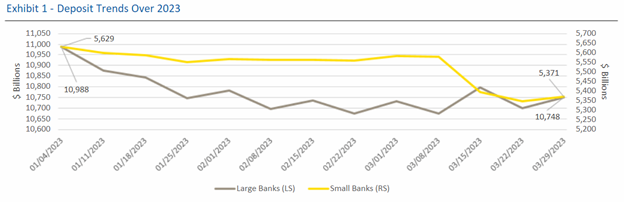

- Based on the macro deposit trends disclosed by the Federal Reserve and conversations with bank executives, small bank deposit outflows look to have stabilized.

- Though the deposit flight appears over, well-capitalized large banks may be called upon by regulators to help with other banks experiencing interest rate duration problems.

- Regulatory changes often lead to lower profitability and lower valuations for the industry; changes will take time to implement but may be crafted over the next 6-9 months.

- The brunt of the regulatory changes will likely impact banks with assets between $50-$250 billion, or alternatively Category IV banks holding $100-$25O billion in assets.

The evolving deposit narrative

The deposit flight appears to be over. Based on the macro deposit trends disclosed by the Federal Reserve and conversations with bank executives, small bank deposit outflows look to have stabilized. As a result, we believe the deposit flight triggered by the Silicon Valley Bank (SIVB) and Signature Bank (SBNY) failures has flamed out, and these failures appear to be asymmetric events.

When the Federal Reserve publicly releases their findings around SIVB on May 1, we anticipate their conclusions as to why the failure occurred will point to securities losses created by a classic interest rate duration mismatch, combined with an extremely high level of uninsured deposits which also were highly concentrated with a limited number of depositors. These findings should also point out that the failure was unique to SIVB (and SBNY) due to their business models.

Source: Federal Reserve, RBC Capital Markets

Still, well-capitalized large banks may be called upon in the future to assist regulators with other banks experiencing the same interest rate duration problems that plagued SIVB and SBNY.

Balance sheet duration mismatches will likely continue to weigh on select banks. Some banks have been forced to borrow from the Discount Window or BTFP (Bank Term Funding Program) at market rates, which average between 4.85% and 5.0%, likely causing severe downward pressure on net interest income. This slow bleed could lead to operating losses and a reduction in capital levels.

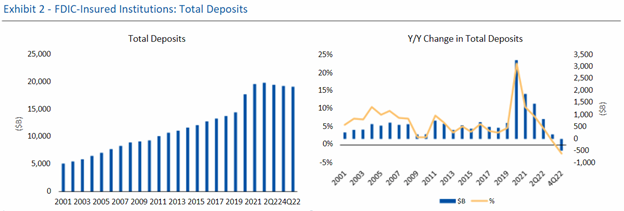

In addition, the Federal Reserve’s ongoing efforts to reduce its balance sheet, referred to as Quantitative Tightening (QT), continues to drain deposits from the banking system as intended, in our view. Quantitative Easing (QE) is another factor which we believe has created over $3 trillion in deposits.

Source: FDIC, RBC Capital Markets

Lower profitability awaits the banking industry

In the past 40 years following banking crises, the industry has been swept up in regulatory changes. As a result of the SIVB and SBNY bank failures, expect to see more of the same. Regulatory changes often lead to lower profitability and lower valuations for the industry.

To ensure the deposit flight experienced by these institutions is not repeated, we expect changes to look like those following the 2007-08 Financial Crisis. The implementation of the Dodd-Frank Wall Street Reform and Consumer Protection Act reduced bank profitability due to greater liquidity and capital requirements. This next wave of regulatory changes should impact profitability once again, especially for banks with assets between $50-$250 billion but less so for the money center banks.

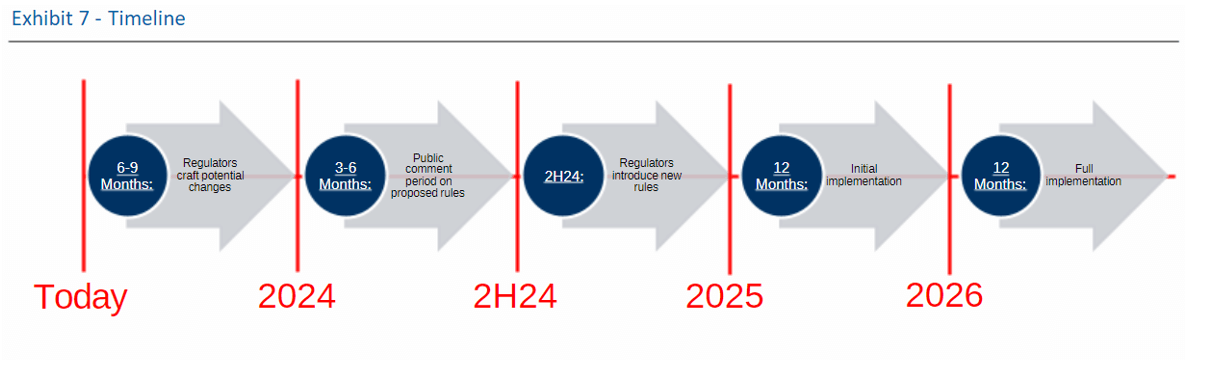

Regulatory changes will take time to implement and may be crafted over the next 6-9 months by the Federal Reserve, Comptroller of the Currency and Federal Deposit Insurance Corporate (FDIC). That means new regulations might arrive by the second half of 2024, with full implementation likely by 2026.

Overall, we believe new regulations will be handled over time by the banks but could lead to further consolidation among the banks most affected.

Source: RBC Capital Markets

Specific regulatory changes on the horizon

The brunt of the changes will likely impact banks with assets between $50-$250 billion, or alternatively Category IV banks holding $100-$25O billion in assets. Below is the list of changes that we anticipate banks will see on the horizon:

- Annually DFAST (Dodd Frank Act Stress Test): Banks with $50-$250 billion in assets will likely be required to go through the DFAST annually rather than the current requirement of every other year.

- LCR (Liquidity Coverage Ratio): We expect banks with total assets of $50-$250 billion to be subject to the LCR or something like it, which would increase the proportion of highly liquid assets they are required to hold. Additionally, banks that are subject to the LCR may need to assume faster and greater deposit flight when they calculate it. Currently, a bank must hold HQLA (High-Quality Liquid Assets) that equal a 30-day period of liquidity stress, but we can envision the 100% of the 30-day outflow being increased to a higher percentage (possible 125% or even 150%).

- TLAC (Total Loss Absorbing Capacity): We’re also likely to see some type of TLAC requirements on banks with $50-$250 billion in assets. TLAC today requires G-SIB (Global Systemically Important Banks) to carry total capital (includes debt) of at least 18% of RWA (Risk Weight Assets) or 7.5% of leverage exposure depending on the bank.

- AOCI (Accumulated Other Comprehensive Income): Advanced Approach banks and NTRS include the AOCI marks in their regulatory capital. Expect that requirement to apply to any bank with more than $50 billion in total assets.

- Capital Charges: We anticipate that banks that buy long-duration securities and take in excessive amounts of non-insured deposits (commercial and high-net-worth deposits) will be assessed a capital charge based on the amount of the exposure. Capital charges will likely be on some type of sliding scale.

- FDIC Insurance: Over the near term, as the Deposit Insurance Fund (DIF) is reduced to handle the sale and liquidation of assets of SIVB and SBNY, the industry will be assessed a special charge to replenish the fund. Additionally, if deposit insurance limits are lifted above $250k, higher insurance charges will be required to build up the DIF to the higher required levels. Presently, the DIF needs to be at least 1.35% of insured deposits.

- Guardrails: From a public policy standpoint, the Federal Reserve, FDIC and Treasury will need to figure out what guardrails can be installed to handle the supersonic speed at which money moved out of the depository system, and the speed of dissemination of the news that accelerated deposit outflows. The most likely guardrails will be higher liquidity levels.

While we expect banking regulation to increase, changes will take time as regulators determine how best to handle the challenges confronting the banking system today. That said, regulators are under heightened political scrutiny, and we expect them to react immediately with more rigorous examinations that may make things more challenging for the industry moving forward.