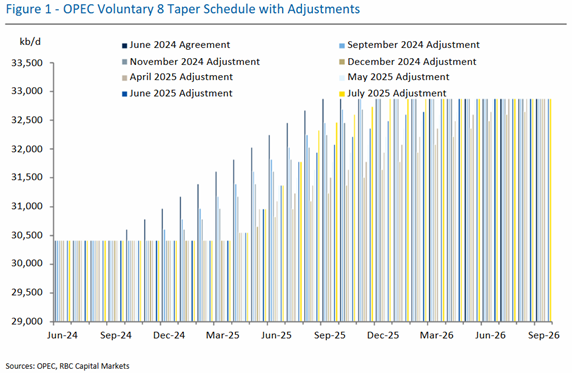

This morning, the 8 OPEC+ countries tapering voluntary cuts announced a surprise decision to bring forward four months of production (548 kb/d) instead of the anticipated three-month 411 kb/d increase. With this decision, nearly 80% of the 2.2 mb/d V8 reduction is back in the market, though the actual adjustment has been smaller than the headline number and has been largely Saudi barrels.

We think it is noteworthy that the virtual meeting purportedly only lasted ten minutes, which we believe speaks to a lack of dissent over the decision. Officials maintain that they can still pause or reverse the phase in, but we sense no real anxiety at this stage from decision makers about the price path from April onwards.

Certainly, the Gulf countries retain the ability to borrow and retrench spending to make the math work. While a lot of ink has been spent on Saudi Arabia’s ability to weather a more muted price environment, Kuwait is also moving forward with an ambitious plan to pare back expensive subsidies and pursue other key fiscal reforms. We have also repeatedly heard officials indicate that their internal analysis shows stronger demand than the market consensus. We will be looking for more color on the OPEC policy trajectory for the remainder of the year when the ministers meet in Vienna this week for the 9th OPEC International Seminar.

Helima Croft authored “OPEC Quick Take: With a Twist…,” published on July 5, 2025. For more information on the full report, please contact your RBC representative.