Sunday’s EU agreement to purchase $750bln of US energy over the next three years is the biggest deal of this kind to date, but there are many remaining implementation questions. While there are scant details about the energy deal, it would represent an unprecedented surge in US volumes and entail the US providing the lion’s share of European imports.

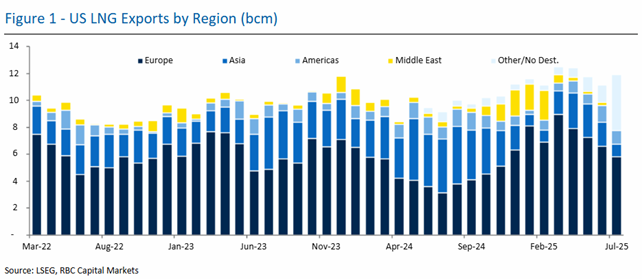

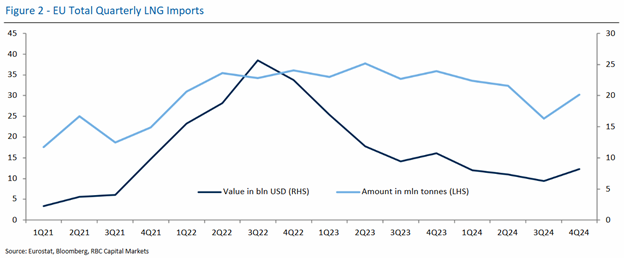

Moreover, we do not know the specifics of what energy products are in the agreement or which individual member states have agreed to take the additional US volumes. LNG is expected to play a starring role in the agreement, and while there is theoretically scope for a sizeable increase in flows to the continent, with US LNG export capacity set to increase by 60- 70% by the end of 2028, or nearly 10 Bcf/d versus last year’s levels, the matter of practically meeting these targets remains elusive.

Nevertheless, there would likely have to be a redirection of flows to try to meet this ambitious target as the overall share of LNG cargoes heading to Europe would have to increase further. Thus, unless there is strong production growth to meet the call of LNG exports and power demand, including for data centers, there otherwise would be a greater pull to keep US gas resources at home after 2030 to meet the expected data center demand spike.

Crude still represents the vast majority of European energy imports, but it is unclear how many additional volumes the US will supply given the anticipated price-driven production slowdown. We have consistently pointed to a seeming contradiction in President Trump’s quest for higher volumes at a lower price point, and we see this as a potential limiting factor in achieving the agreement’s lofty ambitions.

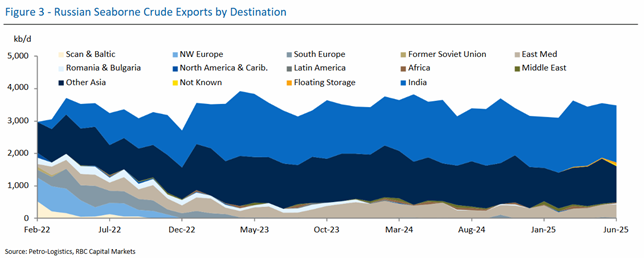

From a geopolitical standpoint, the Russia question looms large over this trade deal. On Monday, President Trump announced that he was shortening the timeline for Moscow to agree to a ceasefire to 12 days and reiterated his threat to impose crippling economic sanctions. President Trump warned earlier this month that he would impose a 100% secondary tariff on countries trading with Russia, and the bipartisan Sanctioning Russia Act of 2025 bill would impose a 500% tariff on countries that continue to sell, supply, transfer or purchase Russian oil, uranium, natural gas, petroleum products, or petrochemical products. That bill currently has over 80 co-sponsors and would undoubtedly pass if the White House indicated that it supports the measure, though that support has yet to come as the President has continued to maintain near total control on trade negotiations.

Today, President Trump threatened to impose a 25% tariff on Indian imports “plus a penalty” over its substantial Russian oil imports. The President’s India threat comes one day after Treasury Secretary Bessent said he warned Chinese officials that they could face serious tariffs if they continue to purchase Russian energy.

Despite the stepped-up rhetoric, we still think it is unlikely that President Putin will agree to any ceasefire that does not entail a sanctions rollback that would enable Russia to regain access to its all-important European energy export market. At a minimum, the surge in US exports envisioned in the EU trade deal would seem to back out the remaining Russian flows, particularly LNG volumes. Hence, it seems hard to see how President Trump could simultaneously pursue a trade deal that would cement the loss of Russian market access with an agreement to end the war in Ukraine.

Hence our base case is that Russia will resist making serious concessions, believing that President Trump will blink at imposing measures that could push energy prices materially higher and that the White House’s newfound support for Ukraine will dissipate. To that end, the second Trump administration to date has not always backed words with actions when it comes to energy sanctions targeting key foreign adversaries. Iranian oil exports remain elevated despite numerous maximum pressure declarations and additional OFAC measures. Similarly, the White House reversal on the Chevron license in Venezuela also seemingly reflects concerns about sanctions-induced price increases.

That said, the decision to take military action against Iran was not risk-free from an oil perspective, and therefore we cannot entirely rule out that the White House will move forward with material measures targeting Russian energy even if they fall short of the full 100% secondary tariffs. Neither Gazprom nor Rosneft have been subject to serious secondary sanctions to date. It is also worth remembering that the Trump administration did zero-out exemptions for importers of Iranian oil in May 2019 and killed IRGC Quds Force leader Qasem Soleimani in January 2020—two actions that cannot be described as oil price agnostic, especially given Iran’s targeting of critical energy infrastructure at the time.

While it might be challenging to convince China to curb its Russian imports, we do think the types of secondary measures being discussed could cause India to pare back Russian purchases, which are currently running at 1.7 mb/d.India did cut Iranian imports in 2012 and 2019 in the face of US sanctions. President Trump is adopting an air of nonchalance about the potential oil price implications of secondary tariffs, referencing abundant US production and saying that current prices are low. However, given the US production profile, any decision to move forward with serious energy measures would likely be accompanied by another round of White House outreach to key OPEC producers. With Russia remaining the OPEC+ co-chair, we suspect there could be some trepidation amongst the membership about providing a barrel backfill beyond the previously planned sunsetting of the V8 voluntary cut.

In his first seven months in office, President Trump has prioritized lower energy prices as he sees them as a path to a Fed rate cut. While past practice would seemingly point to him blinking on Russia this time around given the oil price risks, we continue to see scope for him to potentially endure a period of moderately elevated prices to try to drive his declared aim of bringing the Ukraine war to an end.

While on the one hand, the TACO thesis leaves us wondering if President Trump will at least kick the can down the road, on the other hand, his recent statements about US supplies and previous instances where he has taken escalatory actions risking higher energy prices may indicate he is willing to follow through on these threats to bring Russia to the table without regard to energy price risks. Due to the cross-purpose nature of all these goals, it is now a question of which priority wins out.

Helima Croft authored “Washington strategy: EU trade deal and Russia energy threats,” published on July 30, 2025. For more information on the full report, please contact your RBC representative.