We still do not anticipate any diplomatic agreement to be inked before 1Q’24, and certainly success is by no means guaranteed. Nonetheless, we contend that a comprehensive deal which would include Israeli normalization, civilian nuclear assistance, new security guarantees, and energy cooperation, stands a higher chance of being enacted than many market participants realize.

During our trip to Washington last week, we were struck by the intensity of the Biden team’s effort to get the MoU on the economic corridor across the finish line, as well as the number of trips made by senior White House officials to Saudi Arabia in the recent months. The India Middle East-Europe Economic Corridor is a massive international infrastructure project strengthening various logistical connections between the three regions. Secretary of State Antony Blinken and National Security Advisor Jake Sullivan made visits to the Kingdom over the summer, in addition to Special Presidential Coordinator for Energy Security Amos Hochstein and White House Coordinator for MENA Brett McGurk making a number of trips over the recent months.

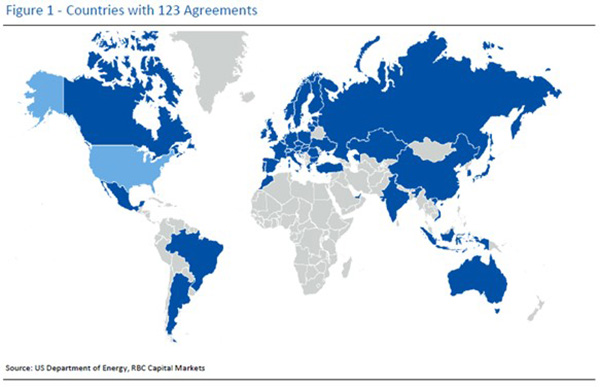

A deal involving significant assistance from the US on a civilian nuclear program would require several non-proliferation obligations as a prerequisite for congressional approval. This would include nonproliferation criteria set by the signing of a 123 Agreement ensuring peaceful use, as well as the ratification of the Additional Protocol with the IAEA which guarantees the organization’s access to inspect the signing country’s nuclear facilities. Once negotiations are complete, the White House is then required to submit the proposed agreement for congressional approval, which could take up to 90 days.

President Biden would likely have to rely on support from Republicans given the skepticism of some senior Democrats. Nevertheless, some veteran DC watchers contend that such a deal actually stands a better chance of passing while President Biden is in the White House because he will be able to get some support from Democrats who would probably vote against a deal if there was a Republican occupant at 1600 Pennsylvania Avenue. Some in Washington are maintaining that it will be more difficult to get Congress on side with Brent above $90/bbl.

However, we think it could prove challenging to convince Saudi Arabia to front load any significant energy assistance before a comprehensive deal is essentially done. Hence, our view that this sweeping grand bargain will be a 1Q’24 occurrence at the earliest.

Lastly, another energy issue that may arise in the conversation is China’s apparent push to have a percentage of oil sales settled in local currency. We expect that the Biden administration will work hard to maintain the primacy of the dollar in such transactions for a prolonged period.