“We are already seeing a shift towards value-seeking behavior from consumers across all global markets, as shoppers seek lower price-tier goods, smaller pack sizes, and turn towards private label goods”

Nik Modi, Managing Director, RBC Capital Markets

Consumers will be under increased pressure in 2024, especially during the start of the year. Across most locations, these pressures are being driven by continuing inflation and higher interest rates, leading to a cautious consumer outlook.

Regardless of whether or not we tip into recession in 2024, we are already seeing a shift towards value-seeking behavior from consumers across all global markets, as shoppers seek lower price-tier goods, smaller pack sizes, and turn towards private label goods and “dupes” (products that mimic features of more premium brands).

As consumer demand moderates, companies will need to look towards increasing margins and boosting profitability; this could likely be delivered via a shift of emphasis towards organic growth strategies and placing an increased focus on volumes.

Election fever

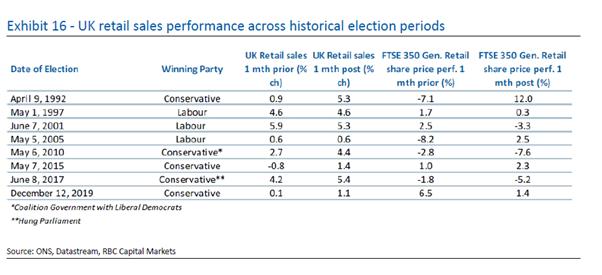

A wave of elections could also create disruption in 2024, with more than 20% of the world’s nations set to hold elections, notably in the US and UK, as well as within the EU. Elections can have differing impacts on consumer spending. Historically, US elections have led to an increase in consumer spending, although Presidential elections can signal divergent shifts in the labor market. In the UK, by contrast, consumer spending tends to be more restrained in election periods.

Despite the need for investor discernment in the coming year, 2023’s more cautious investment outlook is easing in some notable segments such as the US consumer staples sector, and among Europe’s retail sectors. Nonetheless, a general note of caution is advisable.

Investor discernment needed

“Investors can benefit from seeking out names with distinctive growth drivers that place them above industry average, or which have a compelling turnaround story.”

Nik Modi, Managing Director, RBC Capital Markets

RBC Capital Market’s recent 2024 Global Consumer Outlook report highlights consumer sector success stories, while also signaling areas for investor caution. For example, the US restaurant sector will moderate in 2024, likely experiencing mid-single-digit growth which will be dependent on improved traffic after CPI growth dropped from 8% to 5% in 2023.

Despite a moderate tailwind from pricing, and a modest upside within RBC Capital Markets’ restaurants coverage group, ongoing uncertainty around consumer financial health makes it advisable to remain selected within this space. Investors can benefit from seeking out names with distinctive growth drivers that place them above industry average, or which have a compelling turnaround story.

In the retail space, the majority of risk lies at the margin line as the consumer environment deteriorates, with excess savings winding down and a shift of consumer spending towards services. Management teams will face pressure to find cost savings and may need to increase marketing spend to drive demand.

Canada and Australia face consumer challenges

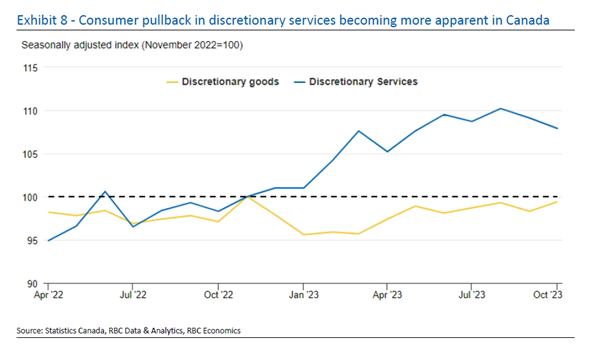

In contrast to the US, Canada currently operates within a more challenging consumer environment, with the rising burden of debt service costs weighing on aggregate consumer spending on both staples and discretionary. This picture is likely to continue throughout the first half of 2024, before potentially finding a more stable footing later in the year following an anticipated easing of rates.

In the face of a dampened consumer outlook, Canadian consumers are expected to dine out less and seek out value options in stores. In this context, RBC has assembled a basket of quality growth names, consisting of standout performers driven by better-than-expected growth; with earnings momentum expected to accelerate in 2024.

Another jurisdiction facing tough consumer challenges is Australia, which is suffering from high inflation and record interest rate increases. The impact of these factors is being felt most keenly on the younger population, who are disproportionately likely to feel the burden of increased interest rates, be non-homeowners in a high-rent environment, and have their purchasing power further eroded by increased transportation costs. In contrast, older generations are more likely to have paid-off mortgage obligations and be sitting on cash that is benefiting from above-average returns, making them much more insulated from a downbeat macro backdrop. This could mean that companies which typically serve an older consumer base will be more resilient amid a tough operating environment.

Europe’s standout growth sectors

“General Retail has been one of the best performing sectors in 2023, helped by strong wage growth and an improved sourcing outlook for apparel retailers. While we don’t expect a dramatic re-rating next year, we do still see opportunities for the stronger retailers to win share, rebuild margin and show healthy earnings growth and returns on capital.”

-Richard Chamberlain, Analyst, RBC Capital Markets

The European general retail space has been one of the best performing sectors this year, helped along by relatively strong wage growth and an improved sourcing outlook for apparel retailers. While a re-rating next year is not anticipated, there remain opportunities for strong retailers to win market share, rebuild margins and deliver healthy earnings growth and returns on capital.

However, it should be noted that softening wage growth could moderate consumer spending in Europe, although the cost pressures faced by retailers should ease in the context of a more benign interest rate outlook. In a bid to grow, retailers will start placing an increased focus on personalization and hyper-localization in the retail space.

Despite Europe’s internet sector performing poorly in 2023, the space now appears to be at an inflection point for growth; which will likely accelerate due to a combination of more attractive value propositions and increased marketing spend driving a return of consumers to stores.

Growth for this sector will also be driven by volumes in 2024, with prices expected to stabilize against a backdrop of cost deflation and normalizing rates. 2024 will also be a year that sees European food delivery companies generate positive free cash flow on a four-year basis, with these companies likely investing selectively in their key market.

Europe’s market for sporting goods looks attractive as we enter the first half of 2024, with the sector projected to see 9% organic growth and 25% organic EBIT growth across the three main stocks in RBC’s coverage. This is a sector that is benefiting from tailwinds such as reduced freight costs and an improved sourcing environment in Asia. This could likely see margins expanding across the sector, boosting its resilience in a tougher macro environment. Interestingly, this is a space that is outperforming the luxury goods sector, where defensive picks remain more favorable due to a lack of pricing support within the space.

M&A

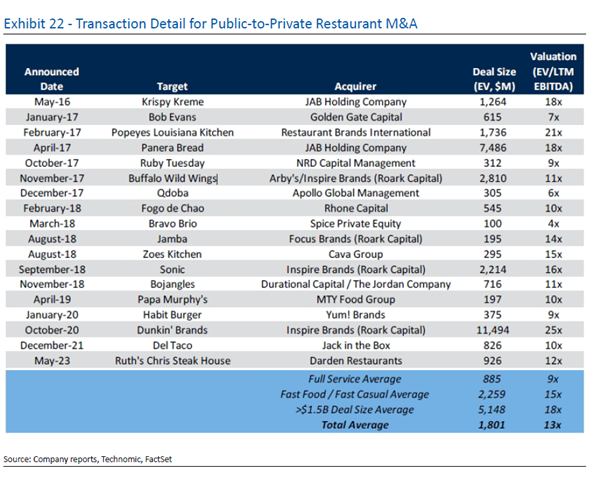

Following a stagnant deal market in 2023, M&A activity will likely pick up pace in 2024. This shift could be motivated by slowing growth, reduced valuations, and a potentially more favorable interest rate environment. These transactions could well be expansionary in nature, but may also take the form of spin-offs and divestitures. Sectors where M&A is looking especially likely include restaurants, beer breweries, property classifieds companies, and the European retail space.