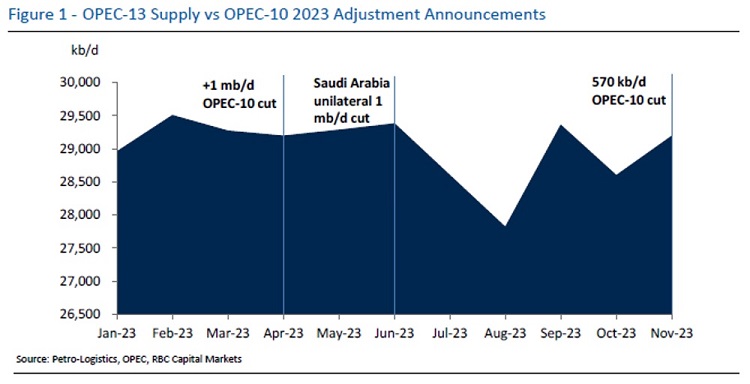

The delayed OPEC+ ministerial meeting finally yielded the anticipated announcement of a Saudi-Russia unilateral rollover through 1Q’24, plus an additional pledged adjustment of ~900 kb/d by a coalition of individual members.

Instead of announcing everything all at once at a virtual press conference, individual producers were left to make their own production announcements, which yielded some initial confusion about the actual size of the adjustment, as well as who was in or out. That said, we find several aspects of the meeting noteworthy beyond the drawn-out delivery.

The UAE’s inclusion in the voluntary cut stands out because the country lobbied so forcefully for an additional increase in June.

Certainly, we think the Emirati leadership is likely happy to turn the page on this meeting and focus global attention on the climate commitments that are going to be unveiled in the coming days at COP28 in Dubai. Just this morning, ADNOC CEO and COP28 President Dr. Sultan Al Jaber pledged a $100mln national contribution to the Loss and Damage Fund designed to help vulnerable nations pay for the impacts of climate change.

We also find it notable that the official announcement included language that these voluntary cuts will be returned “gradually subject to market conditions.”

So much of the market chatter in the run up to this meeting revolved around whether Saudi Arabia would add back the entirety of the 1 mb/d unilateral cut all at once. The last OPEC JMMC announcement was accompanied by market theories that the Kingdom could sunset its unilateral cut as part of a grand bargain with Washington. In addition, in the run up to this meeting there were also theories that the Kingdom could phase back its 1 mb/d cut in January in order to regain market share. We see this added timing language as an attempt to squash speculation that they will flood the market with those barrels at some point in the near future. As always, there will be some market skepticism about how many members will comply with the new production commitments. We continue to view the Saudi statement as most material because they have consistently backed words with barrels.

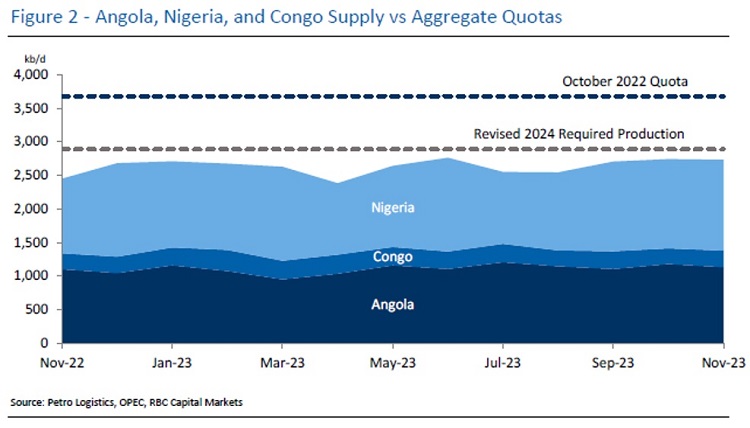

At first glance, the 2024 African producer drama was put to rest with the official announcement that Nigeria, Angola, and Congo would receive new quotas of 1.50 mb/d, 1.11 mb/d, and 277 kb/d for 2024, respectively.

However, Angola provided something of a cliff hanger ending when they announced that they would not comply with the new number and instead would seek to push production to 1.18 mb/d. That said, we do not think Angola’s TBD status is especially meaningful for OPEC operations as they are not an outsized producer.

We will be watching whether the White House will strengthen enforcement of Iran energy sanctions.

We anticipate congressional pressure on this issue will only mount as the US election season gets into full swing. Moreover, we also think the Israeli government could lobby the White House to curb Iranian crude exports in order to defund Hamas and Hezbollah.

While Venezuela was not a big factor in this meeting, due to the continued exempted status, the country has been making headlines last week over a planned referendum on Guyana’s Essequibo territory.

While there is concern in the market that Venezuela could potentially seize the oil rich region, Biden administration officials do not seem alarmed that such a scenario could materialize. Guyana has an extremely close relationship with the United States, while Venezuela is in the midst of negotiating additional sanctions relief with Washington.

Brazil’s decision to join OPEC+ in 2024 could be an important medium-term development if the South American producer eventually agrees to collective output management.

Brazil will not participate in the latest round of cuts, and we will be closely watching whether they do so at upcoming meetings. The country’s leadership has targeted 5.4 mb/d of production by the end of the decade, ~2 mb/d higher than current levels, and is viewed as one of the most significant sources of non-OPEC supply growth over the medium-term.