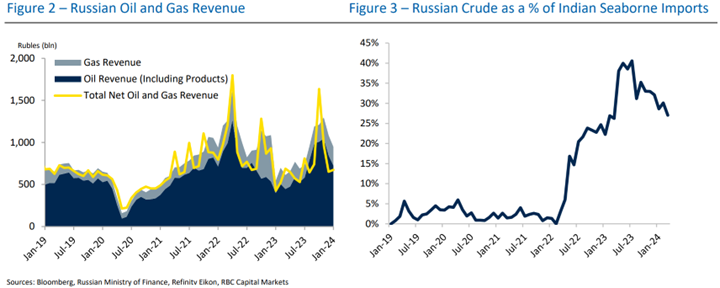

The Russian economy and military machine have proven remarkably resilient despite Western sanctions and weapons shipments to Ukraine. A key reason for Russian staying power has been the continued strength of its oil exports as the Biden administration has skewed the sanctions regime in way to avert a major supply disruption. We continue to contend that the G7 price cap plan was essentially an inflation reduction measure designed to ensure that the Russian barrels that were locked out of Europe would find a home in Asia. India has proven to be the principal release valve, with Russian exports to the country climbing to 1.5 mb/d last year from negligible volumes pre-invasion. In total, Russian oil exports have been largely flat and oil revenue has strengthened ₽90bln on a 3-month average compared to pre-invasion levels. The US also strongly signaled to Ukraine that it should avoid attacking Russian energy infrastructure despite Moscow blocking Ukrainian grain shipments and targeting its grain depots.

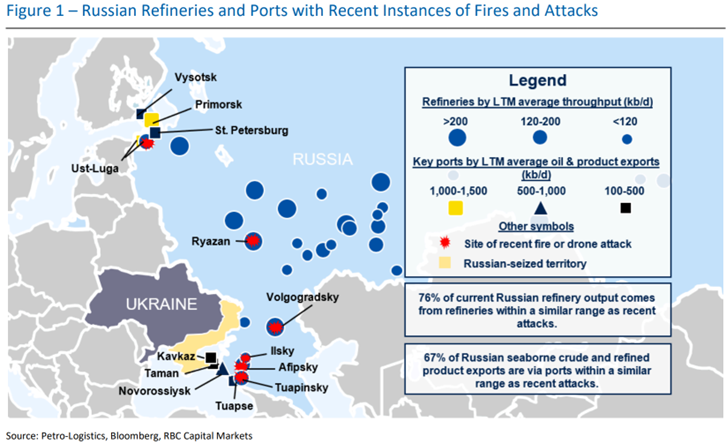

Ukraine may no longer view the “hands-off Russian energy bargain” in its best interest with US financial and military assistance being held up in Congress, and Russia making battlefield gains. In recent weeks, Ukraine has launched a number of drone attacks on key Russian refineries, including the Ust-Luga refinery which supplies Russia’s largest port for crude and product exports. Though Russian export infrastructure has not yet been targeted, we would note that key pipelines and export facilities are well within range of Ukrainian military capabilities. Certainly, last summer Ukrainian officials expressed a desire to close the Russian oil ATM. A senior adviser to President Zelensky stated then that “from a legal and moral perspective, it’s completely unjustified for these vessels to continue to deliver Russian oil,” and Ukrainian forces struck a tanker in the Black Sea. Ukraine halted such maritime attacks following US pressure to allow a “commodity safe transit corridor” in the Black Sea.

All values in USD unless otherwise noted. Priced as of prior trading day’s market close, ET (unless otherwise stated).

We have also heard frustration from Ukraine’s Baltic allies about Russia’s financial resiliency. With increasing uncertainty over US assistance to Ukraine, we anticipate a renewed push on the part of Ukraine’s allies to strengthen the European energy sanctions architecture, potentially by pushing to significantly lower the price cap from the current $60/bbl level. The prospect of President Trump returning to the White House has probably added to their sense of urgency to turn the tide in the war before Washington potentially pulls the plug on support for Ukraine.

We view the US Treasury Department announcement that it will sanction the Russian tanker company, Sovcomflot, as an attempt to signal a tougher price cap enforcement regime and move the Russian oil trade away from the grey tanker fleet market. The fact that the 14 sanctioned tankers will be able to offload their current cargoes appears to be another White House attempt to avert a Russian oil disruption. This is not the first time the company has been sanctioned. Sovcomflot and its subsidiaries were targets of new G7 sanctions issuances multiple times last year. Hence, we are not certain that this will be viewed by Ukraine and its regional backers as significantly moving the needle on defunding the Putin war machine, especially as it was not accompanied by a lower price cap target announcement.

Meanwhile, fears of a wider Middle East war continue to mount. In recent weeks, the Saudi Foreign Ministry has made more forceful calls for an immediate ceasefire in Gaza and for Israel to abandon the planned invasion of Rafah. Biden administration officials had initially insisted after October 7th that the Kingdom was committed to normalization with Israel. However, it has become increasingly clear that the Saudi term sheet for such a diplomatic deal has shifted, with clear progress on the creation of a Palestinian state along 1967 borders now a prerequisite to normalization. The evolving Saudi position likely is reflective of public mood, as the Palestinian issue appears to resonate deeply with the under-35 majority. We have also heard broader fears that if this war does end soon, Hamas will become an “idea” and a source of regional radicalization. In addition, there seems to be increasing concern that the “day after” scenario being discussed by Washington may be unrealistic, as Arab states appear unwilling to participate in a post conflict peacekeeping effort or entirely underwrite the Gaza reconstruction effort.

For now, the diplomatic agreement that the Kingdom signed with Iran appears to be yielding security dividends as the Houthis appear to be avoiding targeting Saudi vessels and critical energy infrastructure. Talks between the Houthis and Saudi government to end the nearly nine-year conflict are ongoing, despite continued maritime attacks in the Red Sea. And yet, there are clear concerns of a return to a 2019 scenario of energy infrastructure attacks if the Gaza war metastasizes. It is our understanding that the Houthis retain the capabilities to hit such targets as the flow of Iranian missiles and drone technology has continued despite the US strikes in Yemen. Certainly, the Houthis have seen their regional stock rise after they formally entered the war and vowed to continue their attacks until a lasting ceasefire is declared.

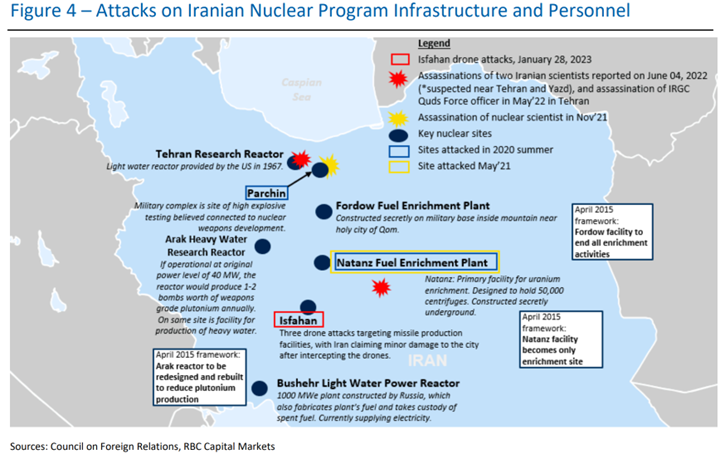

We are also closely watching for signs that Israel’s shadow war with Iran may be entering a more provocative phase. Washington continues to make it clear that it wants to avoid a direct confrontation with Iran and has assiduously avoided targeting Iranian officials in military engagements in Iraq and Syria. Yet, Israel appears more willing to send direct warnings to its regional Axis of Resistance adversaries. Israel is widely viewed as orchestrating last weekend’s attacks on two of Iran’s main natural gas pipelines that provide gas transmission throughout the country from offshore fields. Over the years, Israel has carried out numerous covert attacks on Iranian military facilities and key nuclear program personnel. To date, these covert activities have failed to trigger a retaliatory cycle ending in a hot war. However, given the much-changed security backdrop in the region, such tactics could potentially produce a more escalatory response this time around.

At the same time, the situation on the Israel-Lebanon border remains exceedingly tense and all indications are that the Netanyahu government has not ruled out a ground invasion of southern Lebanon to force Hezbollah to withdraw from the south of the country in accordance with UN Security Council Resolution 1701. Even in the event that a deal can be concluded to secure the release of more hostages, it may not be sufficient to de-risk the other regional flashpoints.