The drive to adopt liquid cooling systems

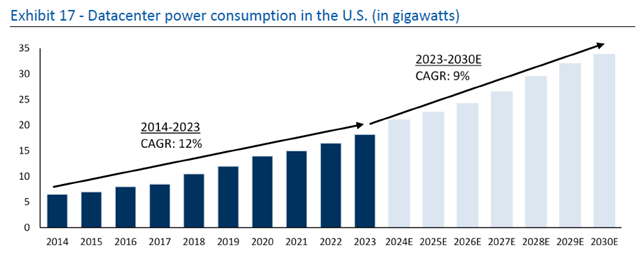

Computer Room Air Conditioning (CRAC) systems and chillers used to regulate the temperature of datacenter “white spaces” (air-conditioned room) are expected to remain relevant for most datacenters that operate below ~30kW rack density. That said, many hyperscale and colocation datacenters supporting AI-workloads with a higher GPU deployment are expected to reach a state where their current cooling solutions are no longer effective. Increasing datacenter capex and AI training requirements are driving a greater need for more robust and efficient cooling systems to offset the excess heat generation within datacenters.

Liquid cooling is a new revolutionary technology, transforming the way datacenters are designed and operated. Although still in its early innings, the industry’s technology is poised to accommodate the needs of companies which require higher density and capacity for datacenters. Factors driving adoption include the demand for higher processing capabilities, new chip technologies with higher heat loads, environmental considerations and the quest for energy efficiency. Industry participants, including nVent, Vertiv, and Supermicro, expect liquid cooling to represent ~20%-25% of total datacenter thermal market by 2028 versus mid-single-digits currently.

Meeting massive computing needs

RBC estimates indicate over $100B worth of datacenter projects announced in North America – from the likes of Google, Meta, Microsoft and Amazon – since January 2023. The liquid cooling market has seen an uplift in investments, with interested parties witnessing a favorable stock movement in the past 8+ months.

Many of the newly constructed datacenters employ designs that seamlessly accommodate liquid cooling technologies, advanced uninterruptible power supply and smart power distributions to optimize their operational efficiency. For example, Meta’s new $800M datacenter, announced in January 2024, in Indiana will include liquid cooling hardware to support the computing needs of AI. Cooling efficiency will become critical for datacenters as their power consumption increases.

Aerospace and defense: innovation and process-improvement

Integrating AI into product capabilities and organizational processes within the Aerospace and Defense industry is becoming increasingly important. GenAI continues to expand capabilities, innovate in-field capabilities and improve internal processes. Defense in particular has stressed the importance of increasing overall investment and research into AI, which is being leveraged in drone swarms, data processing, target recognition, cybersecurity and more.

Today there are multiple programs seeking drone support alongside crewed missions, notably fighter aircraft. The US Airforce’s Collaborative Combat Aircraft (CCA) program, for instance, is looking to develop manned and unmanned systems to advance its air superiority. To achieve this, the CCA incorporates AI to increase battlefield survivability, offering comparable capabilities to crewed aircraft but with considerably lower costs.

Powering ADAS and AVs

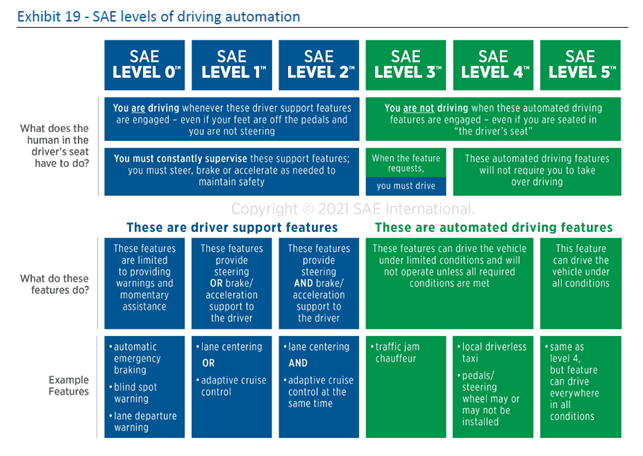

GenAI could spearhead the potential of fully autonomous driving in the Auto industry. SAE International’s categorization of driving automation covers five levels; 0-3 include advanced driving systems (ADAS) where an available driver can take over the vehicle, while 4-5 involve fully autonomous vehicles with no human driver. In this instance, passengers can sleep, work, or entertain themselves while the vehicle assumes all driving responsibilities.

GenAI has an important role to play in the safety of passengers and pedestrians, which is paramount in the Auto industry, and is becoming a key driver for ADAS adoption. For example, deep learning can be used in applications like voice recognition, voice search, recommendation engines, imagine recognition and motion detection. More broadly, machine learning can be used in ADAS to deal with any obstacles to the vehicle, including debris and blind spots.

AVs would likely use AI in a greater, if broader capacity – for predictive modeling, sensing and perception, decision-making and language processing. In some cases even, entire cities would have to be re-engineered to safely accommodate privately owned AVs and robotaxi fleets.

The RBC Global Equity Research team authored “RBC Imagine™: A cross-sector view of GenAI,” published on June 27, 2024. For more information about the full report, please contact your RBC representative.