Policy pivots

Based on our recent meetings in Washington with senior officials from the previous Trump administration, we think there could be significant shifts on foreign policy if the 45 th president returns to office. Policy pivots on Russia and Iran could have implications for energy markets, with the former possibly securing a measure of sanctions relief and the latter facing a new raft of coercive measures come Q1 2025. Though a number of Senate Republicans, including Sen. Lindsey Graham (R-SC), continue to call for supporting Ukraine, there is a clear opposing view within Trump’s inner foreign policy circle on the efficacy of pouring so many resources into a war that they view as unwinnable. Hence, these advisors insist that a key priority of Trump 2.0 would be to push for a peace settlement as soon as possible, even if it entails allowing Russia to consolidate its territorial gains.

Russian sanctions architecture

If such a position does indeed become official policy, we can envision that the Russian leadership might be offered sanctions relief as an inducement to shelve further territorial claims. Of course, a real question will be how much a US shift will alter overall Russian sanctions architecture, given that many of the most punitive energy measures were imposed by Europe. Nonetheless, there are sanctions that have been imposed unilaterally by the US and we see them as candidates for easement if Trump prevails—including those that impose restrictions on energy industry investment and related technology exports, as well as punitive measures on entities engaged in the Russian energy trade. We also think it will be important to watch whether cracks emerge in the collective European resolve to support Ukraine if there is a clear US policy pivot on the war.

Boost to opponents of the Iranian regime

Iran, on the other hand, could find itself the principal target of US sanctions in a change of power scenario. The officials we spoke with were adamant that the maximum pressure policies will be making a return, and reducing Iranian oil revenue will be a top agenda for President Trump. Unlike the case of Russia, where there are some splits within the party, we do not envision any GOP resistance to curtailing Iranian oil exports. We also do not believe a Trump White House will need any new measures, as it would really come down to a more determined enforcement of the existing sanctions that have remained on the books; specifically, the secondary sanctions that mandate significant reductions in Iranian oil imports in order to have continued access to US capital markets. These officials also suggested that tightening these sanctions would give a boost to opponents of the Iranian regime.

Securing barrels to backfill

As opposed to Russia, where the Europeans are a major player in the sanction regime, we do think there is more scope for unilateral US action on Iran to be materially impactful in the near-term for balances. We believe the bigger challenge for the Trump White House will come in securing additional barrels to backfill a sanctions-driven supply disruption. We do not think OPEC members are especially eager to repeat the ill-fated summer of 2018 supply surge and will seek clear evidence of an outage before they open the taps to help Washington.

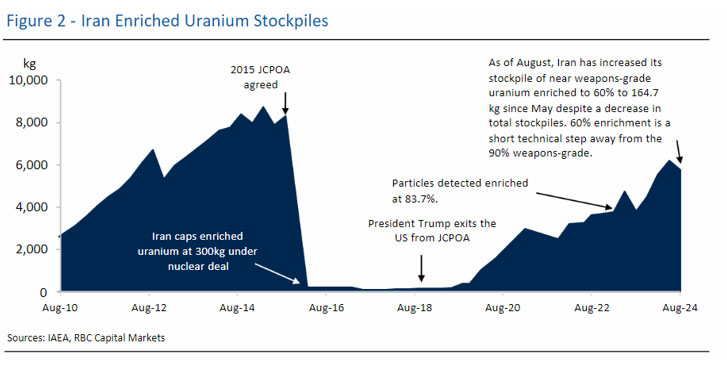

Iranian nuclear facilities

We were also struck by the expressions of enthusiasm for an Israeli strike on Iranian nuclear facilities. Some of the well-placed former officials we spoke with stated that Prime Minister Netanyahu is facing a historic opportunity to erode the Iranian nuclear threat and reset the Middle East chessboard, given the elimination of the top ranks of Hezbollah and Hamas. They suggested that if the Israelis take a pass at this stage as part of a deal with the Biden administration, Israel could pursue such a goal early in 2025 if Trump returns to office. President Trump certainly showed no enthusiasm for foreign military entanglements during his previous time in power. However, we do take seriously the potential for him to support more aggressive Israeli action, including targeting nuclear facilities, given the views of some of his closest advisors, as well as with where the broader GOP stands on this issue.

Helima Croft authored “Beyond the Ballot: The Undoing?” published on October 21, 2024. For more information on the full report, please contact your RBC representative.