Key Points

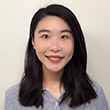

- Within the wider macroeconomic environment, investor sentiment for biotech remains relatively high, potentially due to defensiveness against the volatile backdrop.

- Innovation remains a key theme for the sector and major clinical data events this year could provide renewed impetus for investment.

- Regulatory and policy moves from the FTC on M&A, and the government on drug pricing could have significant impacts.

- The FDA is due to make key decisions in gene therapy, and novel Alzheimer’s and liver disease treatments that will have wider ramifications across biotech.

Source: RBC Capital Markets

Biotech is beginning to show some signs of life in the second half of 2022, after a difficult start to the year. While the sector is, like all others, impacted by the wider macroeconomic picture, there are sector-specific fundamentals that remain strong. Innovation is, as always, very high in the sector, and the back half of the year should continue to see a number of key clinical data announcements on progress in new treatments. There are also a number of regulatory and policy developments that will greatly impact the sector’s trajectory, including important litmus tests for how industry-friendly the FDA will be on groundbreaking treatments and signals from the FTC on the viability of mergers and acquisitions.

Sentiment runs at a relative high

Biotech’s key market index, the XBI, continued to test new lows in the first half of 2022, but this was in an atmosphere of stocks falling across the board. Focusing on biopharma stocks alone paints a brighter picture, with commercial-stage large and mid-cap names beginning to recover as investors recognize the sector’s defensiveness against inflation and recession fears. Biotech’s relative value versus big pharma is holding up well.

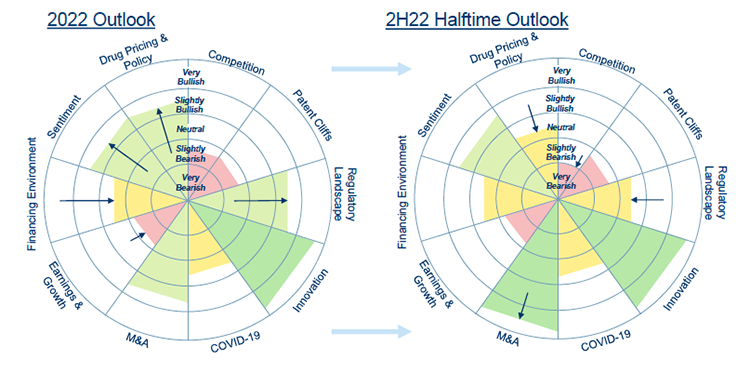

Historically, biotech and the wider healthcare sector tend to be somewhat insulated against greater market movements and this seems to be reflected in investor views in our latest survey. Just over half of investors (55%) see the sector as undervalued heading into the second half of 2022, and 43% believing that stocks are fairly valued. Although sentiment has weakened since the first half of the year, the majority of investors (64%) are still bullish on how the biotech sector will perform vs the S&P 500. The weakening is in line with the prevalent downturn in sentiment on equity markets, but the fact that investors remain relatively bullish on biotech is a strong signal that they see this as a defensive investment.

Source: RBC Capital Markets

Most recently, there’s been a mini-rally that’s improved the XBI by around 30%. Even smaller firms are beginning to participate, fueled by some positive clinical and regulatory catalysts and a recognition that capital is still available for those companies that post good data or regulatory outcomes. Secondary offerings have also started to pick up and that could pull through the second half of 2022 and into 2023.

Major clinical catalysts could push momentum

There are several large phase three clinical data events that are beginning to create significant reverberations across the sector. There’s the potential for the first new class of drugs for schizophrenia in years, a key heart disease study and new data on treatments for Crohn’s disease and cancer. Perhaps most keenly awaited are results for two Alzheimer’s drugs, which could open up a mostly-untapped $15 billion plus market for biopharma.

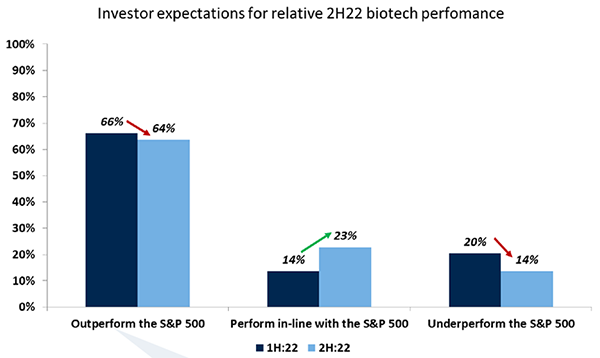

Positive results are starting to reaffirm the benefits of investing in earlier stage R&D in the sector and illustrate the potential markets that innovation can reach. There are still substantial opportunities for returns for investors willing to shoulder risk, although company selection will be increasingly important in the near-term as markets may be less likely to support unproven concepts than in previous years, given the wider macroeconomic picture.

Source: FactSet, RBC Capital Markets, NIH

Spending on R&D by top large-cap U.S. pharma companies remains strong and though some variation in spend persists, both absolute spend and return on invested capital should remain favorable. The National Institutes of Health (NIH) 2022 estimated budget of $45.2 billion, which is up around 5% year-over-year, suggests a continued public sector interest in funding biomedical research and there should be medium-to-long term gains in innovation and research productivity.

Uncertainty in regulation and policy

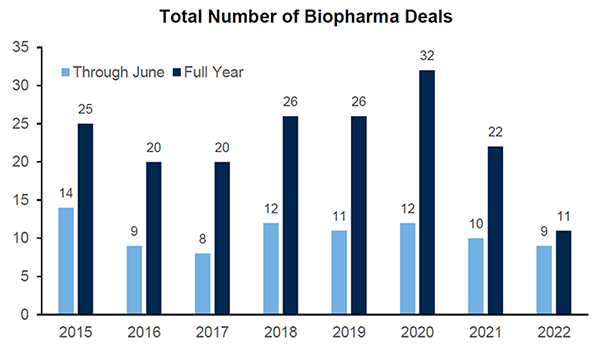

There are a number of regulatory and policy moves that need to be made to help clear up some overhangs in the sector. The Federal Trade Commission (FTC) has been increasingly vocal about anti-competitive practices and they may consider blocking large pharma mega-mergers. This shouldn’t substantially impede biotech, where the deals are smaller, but if the FTC begins to scrutinize this area, it could limit the ability of larger pharmas to bring in complementary assets.

M&A activity in the sector has been somewhat surprising given how depressed valuations of potential acquisition targets have been – though this may be because of a focus on strategic fit rather than pricing. The space is ripe for a pickup in acquisitions, particularly since larger biopharmas are flush with cash and there’s a need for pipelines to replace looming patent cliffs.

Note: 2021 excludes SPACs; graphs based on announcement date

Source: RBC Capital Markets, Company reports, FactSet

But investors aren’t just looking to the FTC, they’re also focused on drug pricing. Democrats were able to push through a prescription drug cost-cutting plan as part of the Inflation Reduction Act of 2022, something that hasn’t come to fruition in years past. Interestingly, recent headlines around this haven't seemed to deter stock appreciation for the group, but the totality of the changes in the bill may be somewhat underappreciated on the Street potentially because the bulk of the bill only goes into effect in the latter part of the decade.

There also remain a number of variables that are difficult to predict, including the U.S. Department of Health and Human Services’ (HHS) discretion in choosing drugs which are negotiated, how certain potential exemptions may be applied and to what extent the less permissive pricing environment overall could empower other payers to push back more on drug prices. That said, the impacts are likely to be tangible, but manageable, for most companies depending on their level of Medicare exposure.

Even though negotiated pricing would not begin until 2026, biotechs have far fewer drugs impacting Medicare budgets versus pharmas and there are carve-outs for small biotechs. The 25-60% discounts for legacy products could incrementally erode out-year revenue for companies with relatively high Medicare exposure. They could also usher in a more cost-sensitive milieu across both public and private payers, though the impact should generally be manageable.

Tough calls for the FDA

The FDA has appeared more cautious in recent months, but there are signs that decisions will become more predictable. Those decisions made in the next 12 months should provide key insights into how the agency is going to react in debated areas like gene therapy, NASH (a nonalcoholic fatty liver disease) and Alzheimer’s.

It’s difficult to recall another time in history when the FDA was tasked with making decisions on so many novel modalities all at once than in the coming months. The agency will have tough calls on potentially tripling the number of approved gene therapies, approving the first CRISPR-based therapy and allowing the first in-vivo CRISPR-based gene editing and base editing trials to take place with U.S. patients.

These decisions will all have to be made even as bandwidth for reviews and inspections is reduced due to COVID-related delays. But there have been some bright spots for regulatory permissiveness recently, as well as some cautious calls, with new FDA Commissioner Robert Califf seeming open to innovation and the genetic medicine space.

As a whole, there’s reason for optimism in the sector. Valuations continue to generally underappreciate commercial prospects and if high innovation starts to make returns, that will steadily build on appetite. Outside of innovation, biotech remains a defensive position in a volatile macro backdrop, proving that selectivity is used to optimize appreciation.

Brian Abahams, Gregory Renza, Luca Issi, Leonid Timashev and Yinglu Zhang authored “2022 RBC Biotech Halftime Report: Attractive Setup and Defensiveness, If Key 2H Catalysts Work Out,” published on July 19, 2022. For more information about the full report, please contact your RBC representative.