Published September 21, 2023 | 6 min read

Key Points

- There continues to be strong innovation across the biopharma space, with stunning technological breakthroughs in new modalities generating widespread enthusiasm in this industry.

- The long-term impact of IRA remains uncertain, but an anticipated reformation of the drug development landscape is causing pharmaceutical companies to shift their development strategies to reduce the risk of IRA negotiations.

- With a number of blockbuster drugs losing exclusivity this decade, biopharma companies are exploring a diverse set of management strategies to offset this revenue loss.

- Biotech has continued to underperform the broader market in 2023; however, analysis of historical data suggests biotech should be well positioned to withstand both recessionary and inflationary pressures.

- For COVID vaccine/drug developers, there is a large potential for revenue as COVID contracts transition away from the government to the commercial environment, with price of COVID vaccines expected to increase 4-5x.

Strong innovation in biopharma

Innovation continues to be a hallmark of the biotech sector. New modalities, from emerging antibody constructs to genetic medicines, have flourished and enabled increased target interrogation. Further exploration and utilization of these modalities is likely to be a key factor for biopharma growth in the coming years.

Once-dormant spaces of medicine are also experiencing enthusiastic attention from biopharma. Metabolic diseases, for instance, have undergone a treatment revolution, as both small and large players look to take on and potentially reform diabetes and obesity therapeutics. There has been a shift from contemporary single-receptor agonism to bispecifics, which indicates that the industry is looking to target weight loss as well as glycemic control. Clinical management remains top of mind as real-world tolerability is brought into question; adverse events such as nausea, vomiting, and diarrhea are impacting quality of life and serve as a clear gating factor to substantial market opportunity.

Alzheimer’s, immunology and inflammatory diseases have similarly seen a wealth of development focus, which is putting a positive light on the industry as a whole.

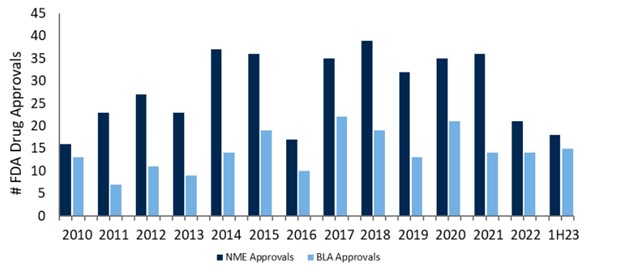

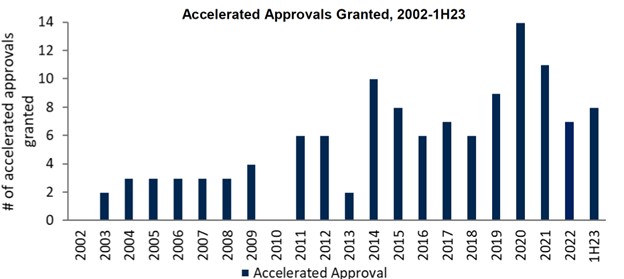

Innovation can often be stymied by regulatory hurdles, but FDA Commissioner, Robert Califf, remains open to innovation. With U.S. drug approvals and accelerated approvals on the rise, the FDA is demonstrating an increasing flexibility for earlier approvals in unmet need diseases.

Biotech innovation not without setbacks

As new modalities and diseases take center stage, corresponding considerations have arisen, largely around manufacturing, safety, and treatment protocols.

In the manufacturing arena, challenges with the scalability of some products, particularly for CAR-T, gene therapy, and radiopharmaceuticals remain. Biotech production is inherently complex, and further exacerbated due to limited capacity and bandwidth as facilities and skilled talent become overextended, leading to setbacks and delays.

Safety remains top of mind as developmental therapies are being explored with novel modalities and targets; this is yet another risk to consider, especially with the FDA expediting approvals (with greater post-marketing tracking).

Treatment protocols are also being more closely examined. Many novel drugs entering the market are short course or one-time therapies; this presents a complicated commercial challenge that will need to be addressed given its significant implications for revenue opportunities.

The unintended consequences of the Inflation Reduction Act (IRA)

The long-term effect of the drug pricing provisions in the IRA could have a detrimental effect on the industry at large, with biopharma taking a significant revenue hit. Beyond the obvious financial burden, the IRA will also impact drug development and the initiation of new products. The shortened exclusivity lifespan of small molecule drugs and biologics has companies questioning whether drug development in certain spaces may be as worthwhile. With the accretive value effectively reduced, companies are being forced to explore more lucrative options, which may have a negative impact on innovation in this space.

Larger players and industry groups have taken legal action against CMS drug price negotiations, noting specifically the impact this legislation could have on innovation in drug development and long-term value. Challenging the IRA is likely an uphill battle that could prompt Congressional retaliation, but preliminary injunctions could delay IRA implementation enough to have a positive effect on perceived revenue tails and stocks.

Notably, drug pricing reform is not isolated to the U.S.; EU regulators are proposing measures to reduce the timeframe for regulatory exclusivity and to have drugs launched as single market, which will effectively reduce the pricing power of drug companies

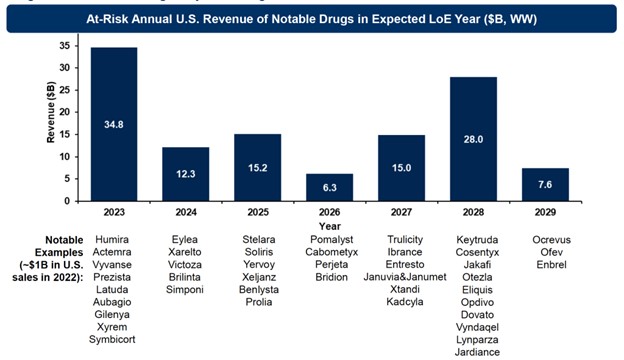

Facing a patent cliff

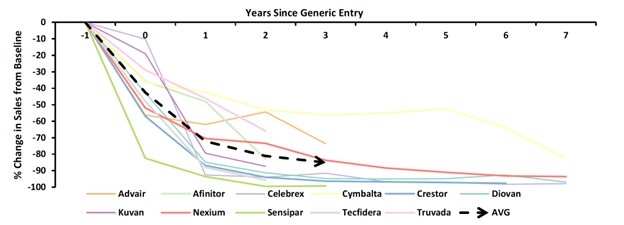

Several blockbuster drugs are losing exclusivity in 2023 and beyond, which will result in revenue hits to their corresponding pharma companies as lower-priced generics and biosimilars enter the market. Histological trends indicate that around 70% of market erosion is likely within the first 4-5 years of biosimilar entry, regardless of disease area. New and updated policies underscore the latest regulatory and legislative push to facilitate biosimilar product development and subsequent adoption. This support may facilitate a quicker and larger market uptake for future generic products. At a recent workshop, the FDA Commissioner, Dr. Califf, highlighted his plan “to ensure the patent system is not used in ways that unjustifiably delay generic drugs and biosimilar competition beyond that reasonably contemplated by law” and “support increased competition in the health care market…by encouraging development of generic and biosimilar products.”

Biopharma companies are preparing for the patent cliff through diverse management strategies across regulatory, internal R&D, M&A, and commercial strategies. Some internal R&D strategies include development of next-generation products with improved efficacy and tolerability profiles, novel formulations with less frequent or more convenient dosing, combination therapies, label expansion, and even entry into the generic business.

Competition in biopharma

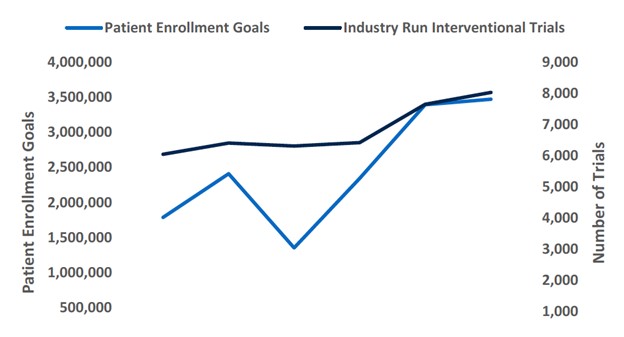

Multiple companies are operating in overlapping therapeutic areas and often pursuing similar modalities, leading to fierce competition and the threat of price wars. Competition is being felt earlier, with companies fighting for clinical trial enrollment and market share upon commercialization. This overlap is likely to impact revenue opportunities, while also requiring increased marketing efforts and greater selling, general and administrative expenses. Biotech companies will have to examine their capital allocation given the current landscape, and narrow in on innovative and differentiated approaches. Out-year estimates across numerous therapeutic areas often fail to take into account future competition, pricing in too much growth given the circumstances.

While competition in the biotech space is largely problematic, there are some benefits. Data from competitors could serve as a positive catalyst in understudied areas where mechanisms are less validated, and highly competitive environments may encourage M&A as companies consolidate. Furthermore, having multiple effective drugs for a given indication could be useful down the line for novel combinations, or determining lines of therapy (first-line v. second-line treatments), which has the potential to both grow the market and benefit the patient.

M&A: In the shadow of the FTC lawsuit

The FTC’s unexpected lawsuit to block Amgen’s acquisition of Horizon Therapeutics has had a noticeable chilling effect on the M&A space. Despite high cash levels for large pharma, companies are not using their funds for M&A, buybacks, or dividends, indicating a continued conservative attitude towards cash. Furthermore, the lack of visibility into broader macro trends around market volatility and cost of capital is serving as a deterrent to M&A activity. The perceived “safer” option is engaging in collaborative deals - it mitigates risk while simultaneously supporting growth and innovation.

While the FTC lawsuit has disincentivized M&A, the revenue loss from COVID-19 (prominently for PFE) and patent cliffs should encourage M&A activity in the second half of 2023. Additional positive forces include the resetting of smid-cap biotech valuations to be more feasible, making them more attractive M&A targets. And we believe resolution of the FTC concerns with currently proposed deals could restore comfort and increase M&A activity.

COVID’s changing status and its impact on biopharma

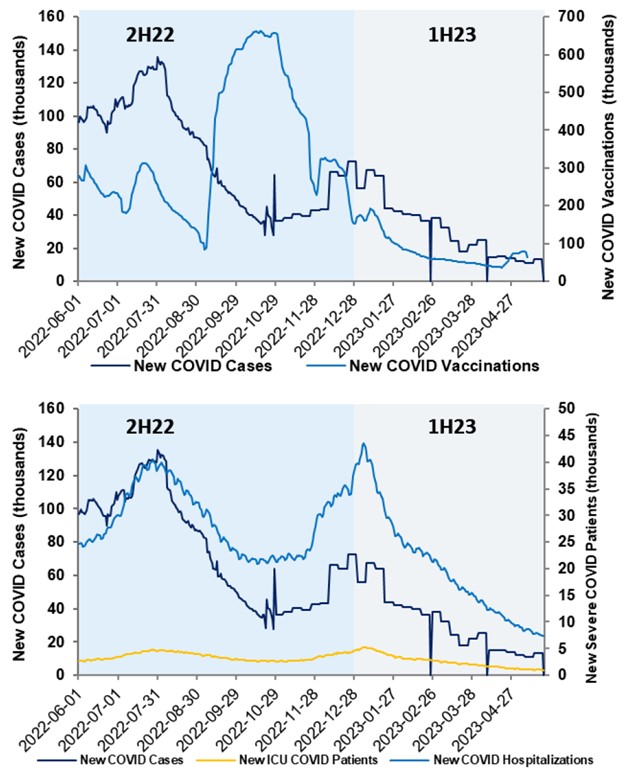

For COVID vaccine/drug developers, there is a large potential for revenue as COVID contracts transition away from the government to the commercial environment. While 2023 is expected to have relatively low vaccination rates, the rates are projected to increase in 2024 and beyond as COVID vaccinations will assume schedules similar to seasonal influenza. In this commercial environment, vaccines are expected to increase in price 4-5x.

The new dominant variants (XBB.1.5 and XBB.1.16), subvariants of Omicron, are believed to be the most contagious strains yet, with better immune evasions to both vaccinations and prior infections. There is a concern that if these strains further mutate, they could become more pathogenic and disrupt the status quo. VRBPAC has recommended a monovalent vaccine be developed against the XBB variant, with 100m million doses being rolled out in 2023.

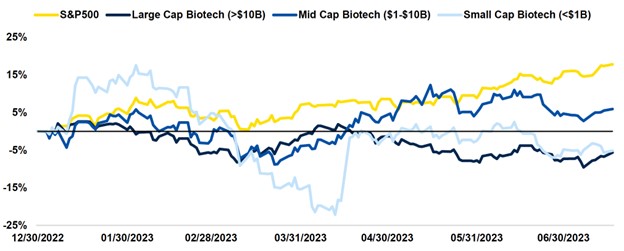

Biotech under pressure

Biotech has continued to underperform relative to the broader market in 2023. Higher interest rates play a key role by decreasing funding opportunities across the space and subsequently hindering innovation and company growth. Recessionary fears similarly fuel a risk-off environment, which is further exacerbated by multiple headwinds, including the expected loss of COVID treatment revenue, patent cliffs, FTC deal scrutiny, and the IRA. All of these place pressure on biotech as a whole.

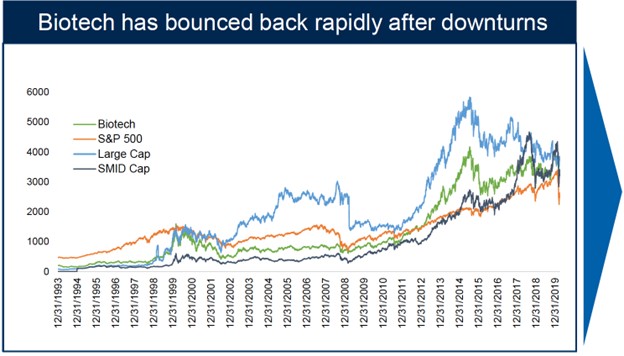

However, historical data suggests that biotechs are able to withstand both recessionary and inflationary pressures; given their growth profile, they tend to recover faster than the S&P500. With inflation abating and a soft landing looking more probable than a full recession, biotech is expected to grow into any economic turnaround.

Furthermore, biotech markets are indicating early signs of stabilization, with the XBI hovering around early-year levels. The IPO market has remained unmoved thus far in 2023, but there is potential for companies with clinical assets to go public as private funding has cooled off.

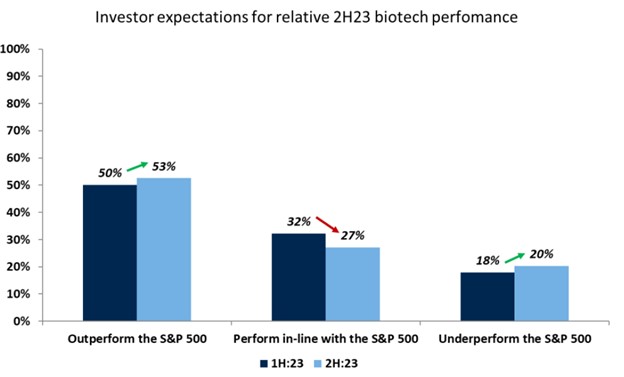

Investor sentiment in the second half of 2023 is positive, with investors we surveyed expecting biotech to outperform the broader market.

Brian Abrahams, Luca Issi, Gregory Renza, and Leonid Timashev authored “2023 RBC Biotech Halftime Report: Window Cracks Open, But Need 2024 Events To Revitalize Generalist Engagement,” published on July 27, 2023. For more information about the full report, please contact your RBC representative.