Published February 14, 2023 | 5 min read

Key Points

- Despite macro-headwinds, the XBI biotech index has rebounded with attractive valuations and strong fundamentals driving investor optimism for biotech growth.

- Large-cap stocks are proving their recession resilience and are likely to keep pace with market expectations as many firms reposition for future growth and diversification across new therapeutic areas.

- Small-cap firms may be primed to outperform in the year ahead, in part due to a more permissive regulatory environment.

- Key factors that will shape the sector in the year ahead include M&A, innovation, changes in the regulatory landscape and patent cliffs.

After a challenging year, we are finally starting to see biotech show signs of life. Following a decline of nearly two-thirds from its early-2021 highs, the XBI biotech index finally rebounded in the second half of 2022, driven in part by favorable drug launches and clinical readouts.

Major clinical catalysts finally started to go positively, reminding investors that the previous onslaught of clinical trial and regulatory setbacks likely stemmed from expanded numbers of unproven early-stage recent IPO names, rather than any intrinsic changes in the risk profiles of more established biotech companies. Commercial performance also continued to outperform expectations, highlighting biotech's relative insulation from inflation and recession concerns.

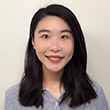

Source: RBC Capital Markets Survey

Large caps maintain momentum

We expect larger-cap companies, with revenue resiliency, less binary risk and solid sentiment, to maintain momentum into early 2023. Several larger companies have set themselves up better for future growth and diversification through new therapeutic areas, patent resolutions and life cycle successes. That said, for many large caps, 2023 will be a generally flat earnings year, coming off key patent cliffs and COVID-19 revenue drop offs, which could cap upside. The market appreciates these more visible drivers but it may take several years to pull through to numbers.

We also expect prescription drug demand for well-established commercial franchises to remain relatively inelastic, with fewer "binary" events for large caps now that lecanemab (BIIB), high-dose Eylea (REGN) and TROPiCS-02 (GILD) data events are behind us. However, solid operational performance on the backdrop of a quieter data year could expand the types of investors interested in the group.

Small is the new big

We expect even better performance for higher quality, catalyst-driven small and mid-cap companies as 2023 progresses. Smaller cap biotechs, while rebounding modestly off of mid-year lows, have still meaningfully underperformed large and mid-cap biotechs, pharma and the S&P, with a more challenging capital environment forcing greater dilution and program deprioritizations.

However, the market has rewarded - and should continue to reward - shares when key derisking catalysts provide visibility to large future market opportunities. As such, we believe there are select, high-quality, catalyst-driven smaller-cap companies which remain underappreciated and should perform well in 2023, helped by increasing regulatory permissiveness in key areas of innovation and M&A, even if restructuring and dilution among weaker stories limits overall index performance.

A more permissive regulatory environment in areas like rare disease or gene therapy – to which many small-cap companies are tied – should spur overall sentiment, while continued consolidation and restructuring around challenged stories (while potentially placing a ceiling on broader small-cap index performance) will be a good thing for the group longer term.

Key headwinds and tailwinds

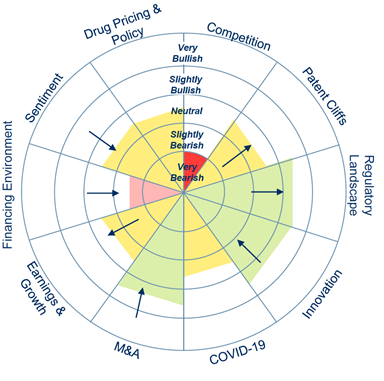

Source: RBC Capital Markets

Potential tailwinds

Innovation

Biotech innovation remains a key driver of value in the sector. It is expected to continue at a steady pace as companies pursue new targets and modalities, with the potential for make-or-break advancements in large therapeutic areas and emerging modalities like gene editing, gene therapy and protein degradation. However, capital constraints and limited derisking catalysts could weigh on earlier-stage small-cap companies with the market’s bar for derisking data now higher.

M&A

We hold an optimistic stance for M&A going into 2023, as large biopharma sits on all-time high balance sheets, patent cliffs loom and policy clarity improves. This could help expand M&A momentum into the small and mid-cap space more broadly, though recent trends and mixed expressed levels of urgency may make a major M&A inflection point less likely than previously anticipated. An uptick in M&A activity could provide a much needed next-leg catalyst for biotech stocks, improving growth and diversification among larger-caps facing headwinds.

Regulatory landscape

We see an improving regulatory environment in 2023, with several key FDA decisions expected this year. The FDA has shown increasing permissiveness of late for limited and mixed clinical data in unmet need indications, a trend we expect to continue in 2023, especially with regard to gene therapies.

This year will also bring a number of key regulatory decisions that should establish how penetrable many major markets – including Alzheimer's, DMD, hemophilia, NASH, chronic cough, and depression – can be for biotech companies. On the less positive side, there have also been a few recent regulatory setbacks for filings of ADCs and TKIs, indicating the FDA retains some stringency in certain areas.

Potential headwinds

Financing environment

There were slowdowns across all financing channels in 2022. Deal numbers and capital raised decreased significantly from previous years, though follow-on activity started showing signs of recovery in the second half of 2022. There were positive fundamental catalysts of quality stories being rewarded by the market and companies leveraging creative financing options to meet capital needs.

Even with some companies cutting operating expenses (OpEx) to extend near-term cash runways, we continue to see increasing financing needs in both the public and private markets in 2023. We are also keeping an eye on whether recent strength in larger-cap names evolves to greater risk appetite for smaller cap companies.

Competition

We continue to have a pessimistic outlook on competition in the sector, with multiple companies pursuing similar modalities in identical indications (sickle cell, DLBCL, TTR), increasing competition for clinical trial enrollment and the looming threat of generic and biosimilar entry weighing on the long term potential of blockbusters (such as Humira, Keytruda, and others). We see increasing competition necessitating biotechs to take a critical look at capital allocation across their portfolios and focus on more innovative leaps.

Additional factors

Investor sentiment

Overall, investor sentiment into 2023 looks a bit less optimistic vs. our last check, though still generally favorable. Half of the investors surveyed expect biotech to outperform the broader market this year, but conviction has declined since our last check-in and fewer are planning to increase their exposure vs. prior (52% vs 36%).

Nonetheless, most (63%) still plan to maintain their exposure to the sector, and very few (2%) intend to decrease their exposure. M&A remains the biggest perceived tailwind entering 2023, but investors lack strong conviction on whether a large acquisition will take place, with increasing concerns around drug pricing and policy.

Drug pricing and policy

Drug pricing policies stemming from the Inflation Reduction Act (IRA) – while likely in our view to have underappreciated (albeit manageable) implications for medium to long-term biopharma earnings – helped to take worst-case concerns off the table and improve perceptions about the sector’s investability. We see 2023 as a transitional year, one where we expect companies, investors and the government to take a “wait and see” approach as the impacts from the IRA and recent midterm elections begin to play out.

We expect the US government’s focus to continue to be on inflation concerns, recession fears and global policy rather than healthcare prices, which could make negative headline risk much lower than in recent years. However, we could see a negative impact to revenue numbers, earnings expectations, strategy and M&A activity start to play out this year.

Earnings and growth

Biotech’s relative insulation from inflation, recession and international instability should continue, though 2023 may be an earnings down year for several large-caps and maturing franchises, pending patent cliffs and if tougher comps continue to raise the bar for innovative R&D and business development. Drug pricing policy changes may also create an underappreciated long-term headwind for earnings, albeit likely a manageable one.

COVID-19

Relatively manageable COVID case and hospitalization rates give us confidence that societal restrictions will continue to have limited impact on the sector in 2023 and beyond. As normal social and clinical behaviors return, we believe the strength in drug demand and prescription growth we saw in the second half of 2022 will carry over into this year. However, this could challenge COVID vaccine and drug developers, particularly given the likelihood of steep revenue drop offs this year. We also anticipate lingering headwinds to clinical trial enrollment.

Patent cliffs

With several blockbuster drugs set to lose exclusivity in 2023, we believe market/patent exclusivity and life cycle management of key drugs and franchises will be at the center of investor focus. Regulatory and legislative focus on generics/biosimilars and inconsistent court rulings may add uncertainty around branded drugs’ overall longevity. However, we believe that the development of numerous and effective life cycle management strategies deployed by biotech companies should help sustain revenues from, or diversify around, core franchises, and pharma patent cliffs could prompt more M&A activity.

Brian Abrahams, Luca Issi, Gregory Renza, Leonid Timashev and Yinglu Zhang authored “2023 RBC Biotech Outlook Report: Small is the New Big, as Expect Momentum to Shift Down Cap,” published on December 13, 2022. For more information about the full report, please contact your RBC representative.