Published February 14, 2023 | 3 min read

Key Points

- Higher interest rates, inflation and reimbursement challenges are putting pressure on providers' costs, increasing the need for outsourcing and smart technology.

- While falling biopharma funding will have some impact on projects and dollars available to CDMOs this year, it’s likely to be a short-term impact.

- The move towards value-based care is inevitable and accelerating, making this a top issue to watch.

- The market adjustment offers opportunities as well as challenges, and private equity and M&A activity suggest that digital health can quickly recover in better macro conditions.

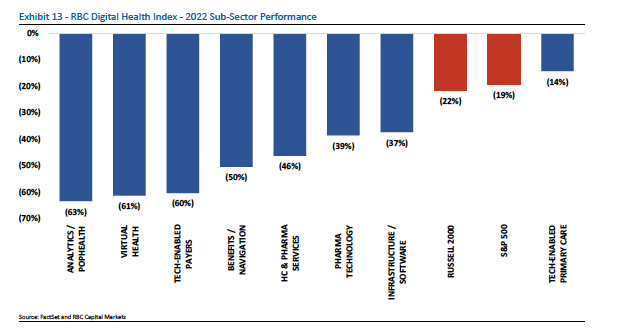

The difficult macroeconomic climate has been tough for tech stocks and digital health firms have been hard hit as well. However, this downturn – RBC’s Digital Health Index of 62 stocks fell 37% in 2022 after a 17% fall in 2021 – appears to be as much an opportunity as a challenge. The fundamentals of the sector remain strong, which makes the current outlook compelling for select stocks and subsectors. The proliferation of technology across healthcare holds significant potential; it is accelerating and the vast majority of the opportunity still lies ahead.

The need for outsourcing and tech investments

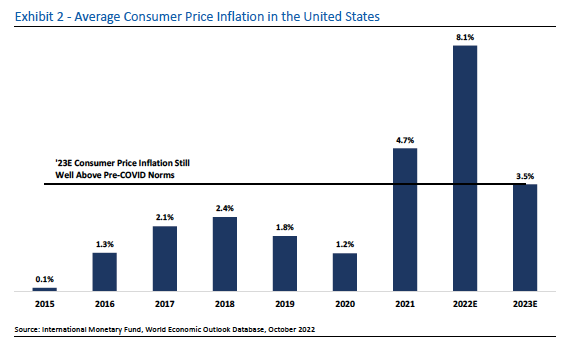

Inflation isn’t only having a negative impact for digital health. Because healthcare provider costs are rising, and interest rate increases are making borrowing more expensive, companies will need to build more efficient cost structures. This is likely to lead to more outsourcing in functions like production and IT and a greater need to integrate smart technologies like automation and enterprise resource planning (ERP) systems.

During the pandemic and peak inflation last year, companies were essentially papering over the cracks with quick fix solutions. Now, more companies will look for longer-term ideas that can keep their costs down. Dominant vendors with differentiated offerings, for both outsourcing and technology, are well-positioned to benefit.

Falling funding impacts CDMOs

CDMOs are facing a challenging year in which they are likely to be competing for fewer dollars and fewer projects. Biotech funding slowed meaningfully over the course of 2022, and this will now start to impact the dollars available for development. Vaccine production has also slowed significantly, opening back up existing capacity, with a considerable amount of planned new capacity coming online over the course of the year. Again, in the long term, the sector will stay strong, but over the course of 2023, there will be uncertainty around pace and price.

Moving towards value-based care

The transition from fee-for-service (FFS) care models to value-based care (VBC) has been going on for more than a decade, but various factors are helping to accelerate the trend. The pandemic showed the dangers of FFS models for providers as utilization dropped significantly and since then, there is still pressure on provider margins. Providers are looking to enhance their income and there are new and innovative solutions available to help physicians to move onto VBC programs.

Digital health companies in this space are offering new payment models that help minimize the complexity, cost and risk involved. They can handle the complexities of payer contracting and regulatory compliance, and equip providers with better technology and insights to more effectively coordinate patient care.

This is a subsector that investors should look closely at as the transition is inevitable and the total addressable market is very large – the US spends more than $4 trillion a year on healthcare. This year, valuations have reset across the space, offering a much more attractive entry point and many of the pure play companies that went public in 2020/21 have had a couple more years to demonstrate the efficacy of their strategies and path to profitability.

This is also an area of the digital health universe that saw a considerable amount of M&A in 2022, which will likely continue into this year. In many cases, larger firms are swooping in, such as Amazon announcing its intent to buy 1Life Healthcare, Village MD, which is majority-owned by Walgreen’s, revealing plans to pay nearly $9 billion for CityMD, and CVS Pharmacy acquiring Signify Health. This is a space where existing players are looking to scale, providers and payers are looking for vertical integration and non-healthcare firms are seeking out entry points.

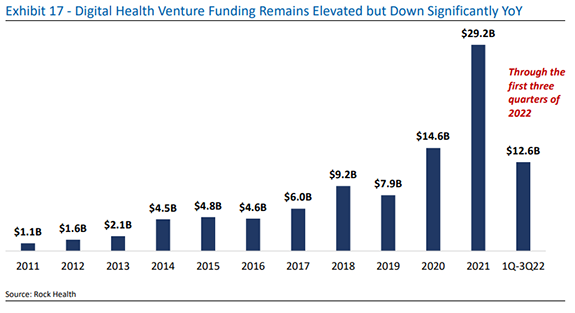

A market adjustment

Speculation around who might be next in the M&A market helped buoy some companies, but the fall in digital health stocks was broad-based. This weakness is largely down to the macro climate, with high interest rates impacting high-multiple growth stocks, few of which are EBITDA positive. IPO activity was also significantly depressed, with zero public offerings or de-SPACing across the group. This was compared to more than 20 digital health firms that went public via IPO or SPAC in 2021 and ten in 2020.

However, as the market adjusts under pressure from macro factors and investors hold fire, appetite builds for when the tide turns. Companies are still active raising money on the private side, with $12.6 billion of venture funding raised in the first three quarters of 2022, according to Rock Health. While this is down considerably from the previous year, it remains higher than 2020 and 2019. The private equity activity over the last three years points towards a market that could quickly shift positive once the backdrop improves.

Sean Dodge authored, “2023 RBC Digital Health Outlook” published on January 5, 2022. For more information about the full report, please contact your RBC representative.