Published March 7, 2024 | 2 min read

Key Points

- Lower interest rates and a constellation of other positive factors should drive outperformance in the HCIT sector for the first time in several years.

- Strong innovation and growing openness to adoption will support the use of AI and automation at all stages of patient care.

- Virtual care is expanding to new use cases, while cost and convenience will also drive more at-home and near-home care.

- Adoption of technology and alternative care sources are helping the system deliver better, lower-cost care, which is allowing providers to adopt value-based payment programs.

“The fundamental outlook remains very healthy: investors continue to hunt for innovation, the long-term opportunity for HCIT and value-based care remains very large, adoption is accelerating, and consolidation has begun to hasten.”

– Sean Dodge, Analyst, RBC Capital Markets

After years that saw performance stymied by higher interest rates and competitive noise, the digital health sector is poised to outperform. Lower interest rates are a key factor, but companies will also be boosted by accelerating revenue growth, an intensified focus on profitability, growing consolidation, innovation, and valuations that are still close to multi-year lows.

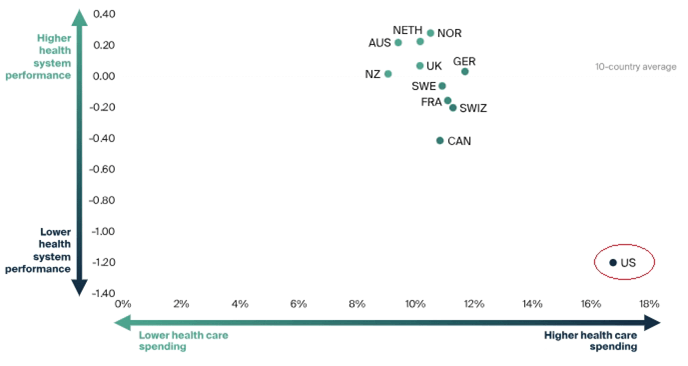

With U.S. healthcare spend growing at an unsustainable rate, yet failing to achieve outcomes comparable to other high-income countries, the HCIT sector’s task is to deliver better healthcare at lower costs. There is no single silver bullet. Success will depend on a convergence of three key disruptive forces: technology, alternative sites and sources for care, and payment reform.

Graphic: U.S. Healthcare Lags Developed Countries on Both Cost & Quality

Source: The Commonwealth Fund, 2021. Health Care in the U.S. Compared to Other High-Income Countries

Tech will streamline the entire patient journey

We expect the adoption of automation and AI to accelerate. Recent labor tightness and inflationary pressure have generated more urgency to control spending. At the same time, innovation has led to better, more accessible and user-friendly tech. Data digitization techniques are generating real-world use cases that help to build trust and credibility as well as demonstrating returns.

Adoption should accelerate across the entire patient journey. From the point where a patient experiences symptoms, AI can help them decide whether they need to seek medical help.

From the provider’s viewpoint, technology can streamline patient intake, optimize staffing, and help to cut the burden of clinical documentation. It can also read medical imaging scans with greater speed and accuracy, support clinical decision-making, and even alert physicians to clinical trials for drugs with potential to treat their patient’s condition.

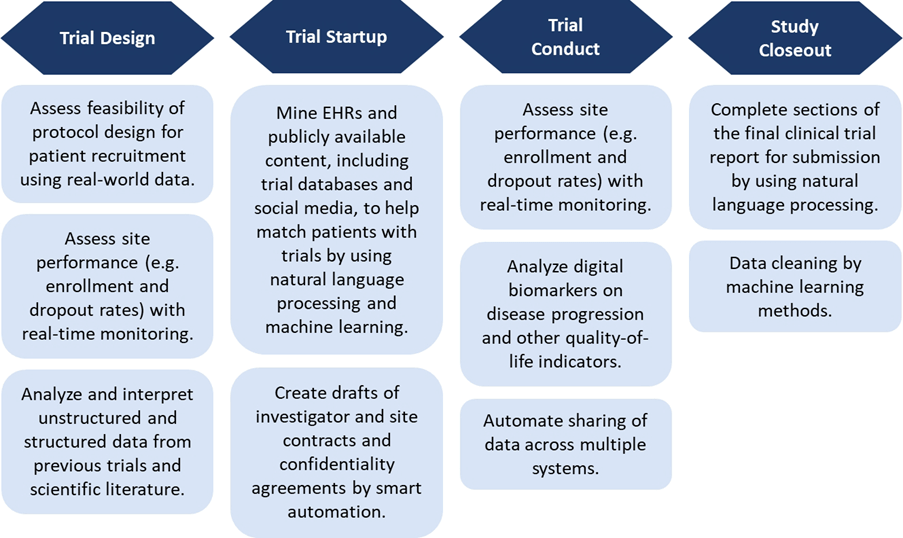

Graphic: Applications of AI-Enabled Technology in Clinical Trials

Source: Deloitte, 2020. Intelligent Clinical Trials: Transforming through AI-enabled engagement

A growing number of providers are also using automation and AI to gather data from patients and engage with them – whether to help them manage chronic conditions, or simply to remind them to take medications and show up for appointments.

Care at home, at the store, on screen

“Our two guiding principles that frame how we think about the future for healthcare are -- that anything that can be digitized or automated, or delivered at home, eventually will be.”

– Sean Dodge, Analyst, RBC Capital Markets

We expect to see a greater mix of healthcare services being delivered outside traditional care settings.

Consumers are shouldering a rising share of medical costs. Tech-savvy populations are increasingly willing to use more convenient sites of care. Innovation and growing competition are accelerating. All these factors will push care delivery towards lower-cost virtual, at-home, and near-home channels.

The COVID-19 pandemic accelerated use of virtual urgent care, a phenomenon that is here to stay. Virtual capabilities are now expanding to new use cases: in primary care, chronic care, and mental health, for example.

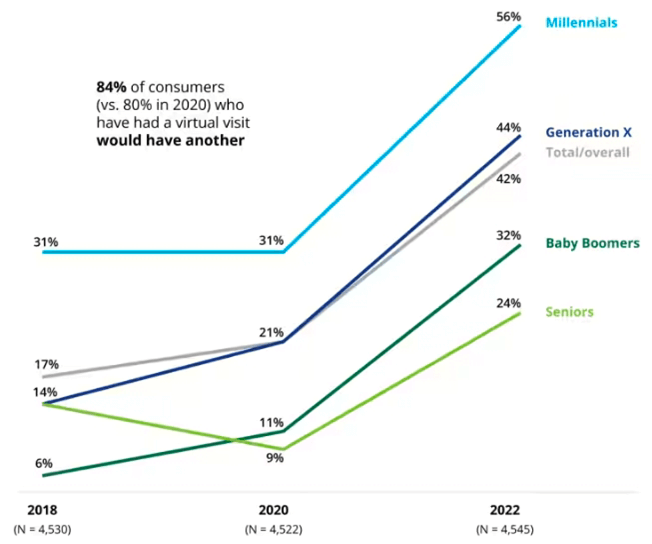

Graphic: Percentage of Consumers Who Had a Virtual Visit in Last 12 Months

Source: Deloitte 2022 Survey of Health Care Consumers

Where virtual care is not feasible or preferred, non-hospital clinics are another option. In many cases, these come with significant convenience, being co-located at a neighborhood pharmacy or grocery store. At-home care is growing too, not only through increased availability of self-testing kits, but via a number of companies offering in-person services.

Providers will embrace value-based models to survive

The third disruptive force is the rise of value-based payment models. Unlike the current system, which incentivizes additional services regardless of impact, value-based care (VBC) rewards services delivered at lower cost while maintaining or improving quality.

Providers that use AI capabilities and value-based payment systems – which promote the use of lower-cost care settings even if that means referring care to external sources – should perform better over the long run. In fact, we believe it will start to become essential for providers to follow these trends and take part in VBC models in order to stay competitive and financially viable.

In combination, these three disruptive forces are setting off a virtuous cycle. Tech and alternative care sources are helping the system deliver better care and experience at lower costs, which is also equipping more providers to participate in value-based programs. Together, we see these trends accelerating healthcare towards a brighter future.