Published May 12, 2021 | 3 min read

Key Points

- Pharma has historically scored poorly in ESG ratings, but RBC’s Equity Research Team believes the sector is poised to build a more positive image that could attract investor interest.

- Past scandals and pricing controversies have weighed down Pharma’s ESG performance and reputation, but data analysis shows litigation payouts and drug prices are falling.

- Pharma’s leading role in accelerating vaccinations and therapeutic interventions in the fight against COVID-19 is also helping to boost its public image.

- Potential changes in legislation under the Biden administration could also play to the sector’s strengths, particularly as Pharma leaders accelerate their ESG efforts.

ESG is a growing factor in the global investment process. Flows into dedicated sustainable equity funds across the world have been swelling for a couple of years. We expect them to remain strong globally in 2021, as momentum builds on environmental policies.

Within the $829 billion AUM now channeled into dedicated sustainable equity funds, healthcare figures prominently – yet Pharma remains relatively underweight.

That’s partly a natural result of the trade-off between benefit and risk in pharmaceutical use. Historically, most ESG ratings have applied a risk management approach to sustainability disclosures. As the pharmaceutical industry is one of the most tightly regulated industries across the globe, there is, in relative terms, more risk.

Pharma’s historically poor ratings also reflect the impact of various controversies, from price fixing to opioids. However, RBC’s Equity Research Team identified a series of trends that could lift Pharma to a positive ESG inflection point.

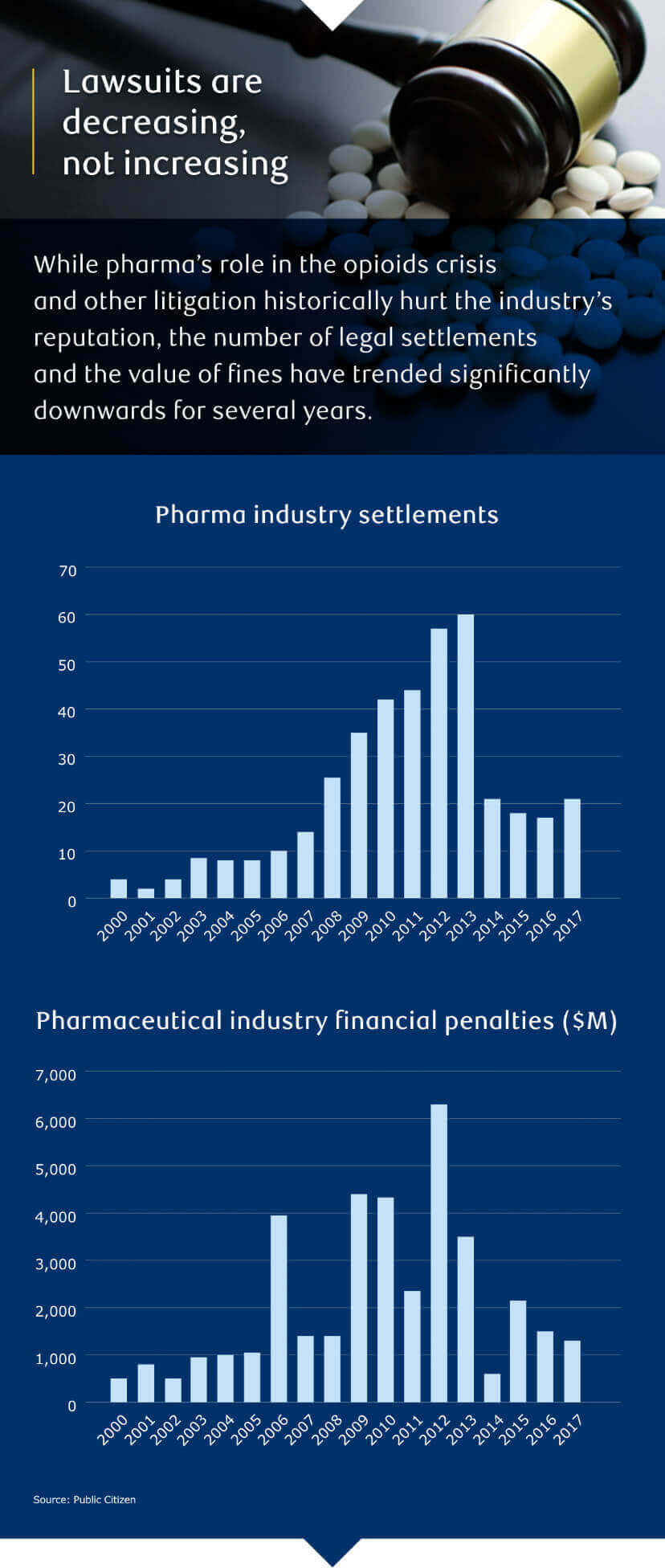

Litigation in decline

ESG risk scores among Pharma companies are higher than for other healthcare industries. In part, that’s a reflection of the industry’s exposure to controversial litigation.

Unresolved disputes around opioid promotion, talc products and generic price fixing will continue to dog some companies. Elsewhere, however, the industry is to a degree being penalized for past transgressions.

The overall picture, reflected in data from Public Citizen, shows a drop in the number of industry settlements over the past few years. The value of financial penalties has also fallen considerably since hitting a peak in 2012.

Much of the decline is attributed to a drop in fines for unlawful promotion of drugs. If these trends are sustained, and no further scandals emerge, it could boost Pharma’s ESG scores over time.

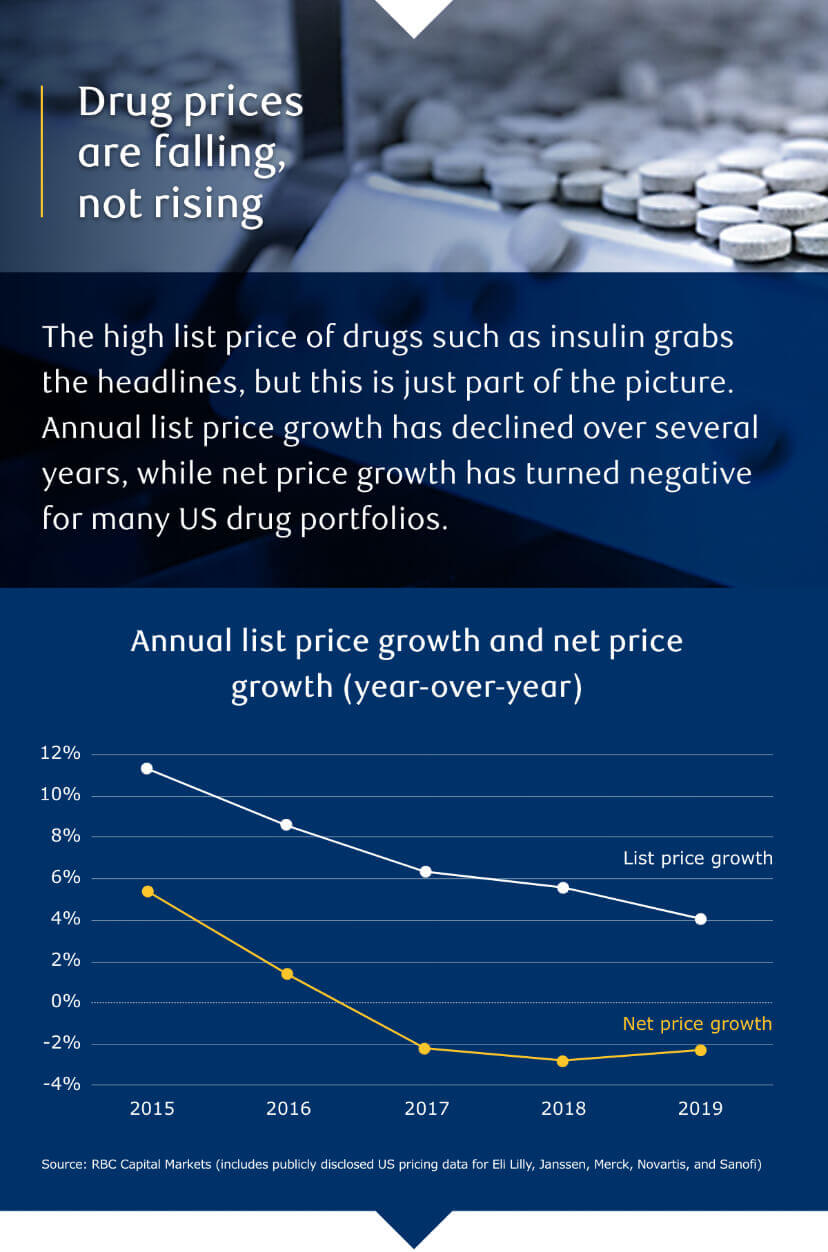

The truth about prices

Rising drug list prices regularly draw negative headlines and public censure. The debate is dominated by high-profile cases such as pricing for EpiPens and insulin. While few patients pay the list price for these drugs, the effect of pricing practices for these products has been hardship for some.

Again, however, public perception lags behind the reality when it comes to the bigger picture. A generally more responsible stance on drug pricing by the industry in recent years has gone largely unremarked.

Average list price increases have trended lower since 2015. In fact, once rebates, discounts and fees are taken into account, average net price growth has turned negative for many companies.

If ESG-focused investors understand and act on these trends, drug pricing could become an important ESG tailwind for Pharma.

Efforts to provide access to portfolio drugs or compounds should not be overlooked. The more companies can describe their business models and commitment to access, quality and responsible operations, the more investors will gain an accurate understanding of the work they do.

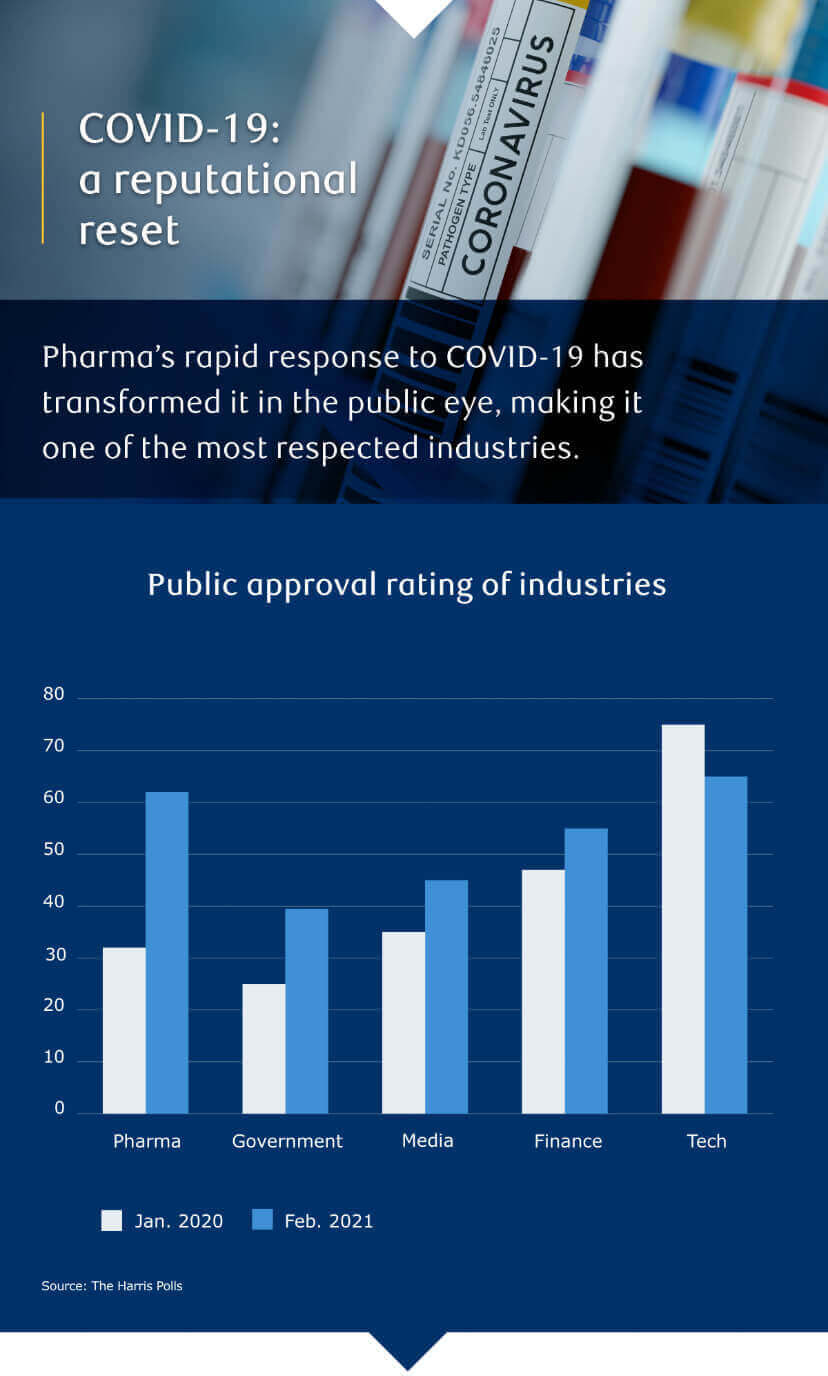

Public image transformed

One development that has not escaped public attention is Pharma’s rapid response to the COVID-19 pandemic.

The development of vaccines, treatments and tests has transformed attitudes. Almost two-thirds of Americans now view the industry positively, according to a survey by The Harris Polls – nearly double the pre-pandemic rate.

This suggests the pandemic has potential to turn around the sector’s ESG image. But while there is definitely a positive impact on public perception in the short term, whether that will translate into a lasting ESG boost remains to be seen. Additionally, third party rating providers would need to adjust their methodologies to incorporate COVID-19 related efforts.

Leadership initiatives

There is significant action at management level too, as Pharma leaders put greater emphasis on their ESG agendas to advance shareholder value. ESG is routinely emphasized by senior leaders in public pronouncements and earnings calls.

It’s clear that the effective management of ESG matters is now a business fundamental that underpins shareholder value and long-term success. The ESG factors on which companies choose to focus are diverse. Across the industry, Pharma Investor Relations and ESG teams are prioritizing broad topics such as access to health, environmental action, and inclusion and diversity. Providing a great workplace and being a trustworthy partner are among the aims cited, alongside more specific goals such as packaging sustainability and reducing energy use.

The Biden administration’s ambitious plans to legislate on climate change may also benefit Pharma’s ESG position. Compared to industries such as oil and gas, the sector has consistently scored well on environmental factors.

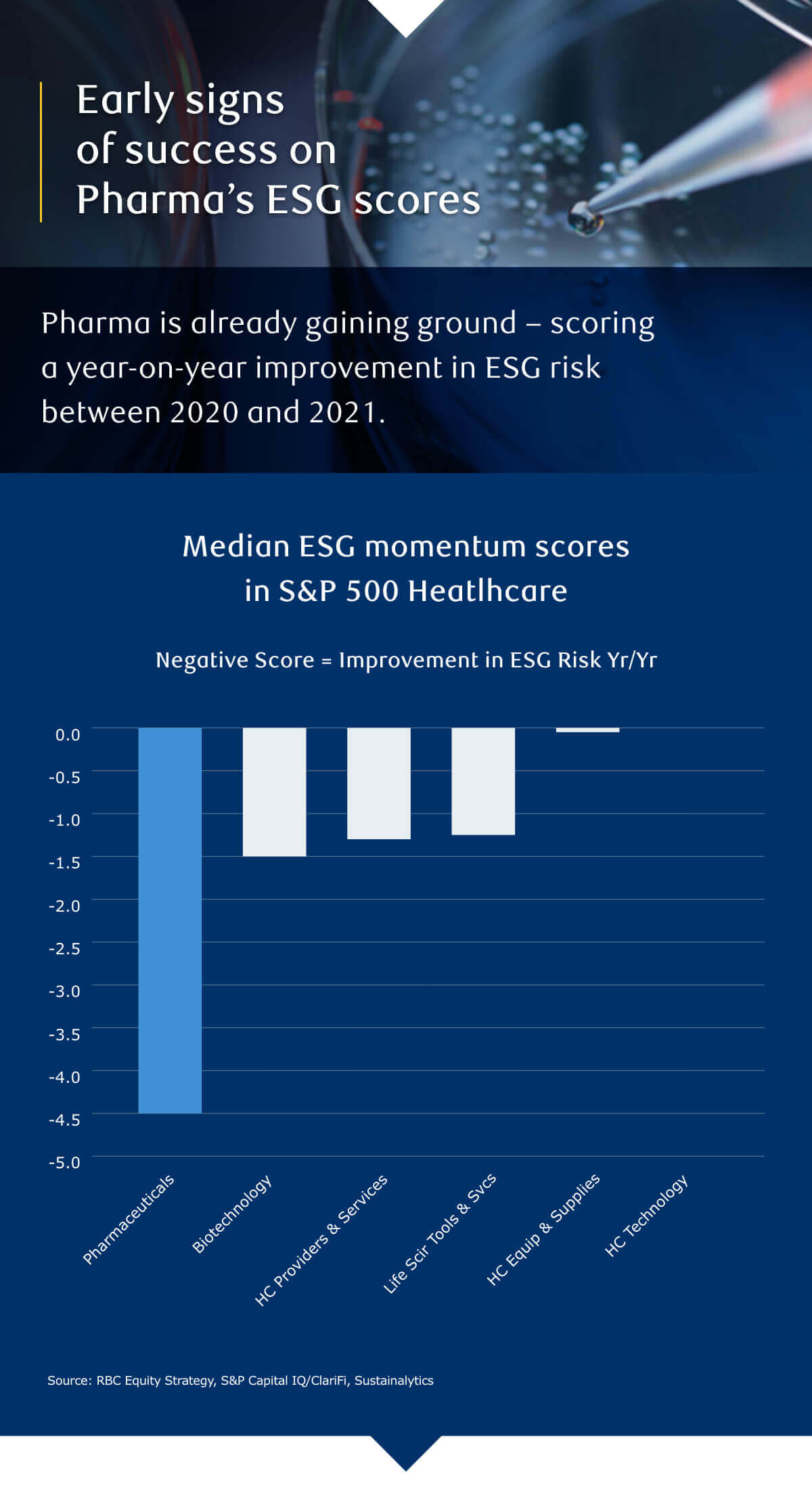

Pharma’s ESG potential

All these shifts may combine to create a positive change in Pharma’s ESG image. In fact, our analysis shows Pharma’s ESG ratings in actively managed sustainable funds have improved recently, in part because fewer ESG controversies in the sector have led to improved Product Governance scores.

More widely, we’ve found that healthcare companies with stronger ESG assessments – based on our own and third party data – have outperformed over time. Sustained action by the sector could see more Pharma companies joining that elite group and attracting the attention of ESG investors.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.