Required Conflicts Disclosures

With strong inflows and mainstream acceptance, sustainable equity investing is well beyond the tipping point. In fact, our team predicted that 2020 would be the year that sustainable finance would reach exponential growth.

Yet since most asset growth into these strategies occurred over the past five years, some investors have wondered how Environmental, Social, and Governance (ESG) funds might fare during a market correction.

Now, with the markets trending downward as a result of COVID-19, we have the chance to find out.

As part of our mission to help our clients integrate ESG factors into their investment strategies and decision making, we took a deep dive into fund factors, flows, and performance from the market’s peak on February 19th to the present to assess how they’re are holding up.

For our analysis, we examined inflows into our entire scrubbed universe of sustainable equity funds (Morningstar-tracked U.S., global, and sector-focused equity funds) with significant assets invested in U.S. stocks with a clear, heavy emphasis on ESG sustainable investing practices, representing $250B AUM.

Our research uncovered some striking results that may help investors maximize their ESG strategies in terms of societal impact and financial returns.

Here are three key findings from our research:

1. Sustainable equity investing shows strong momentum since market peak

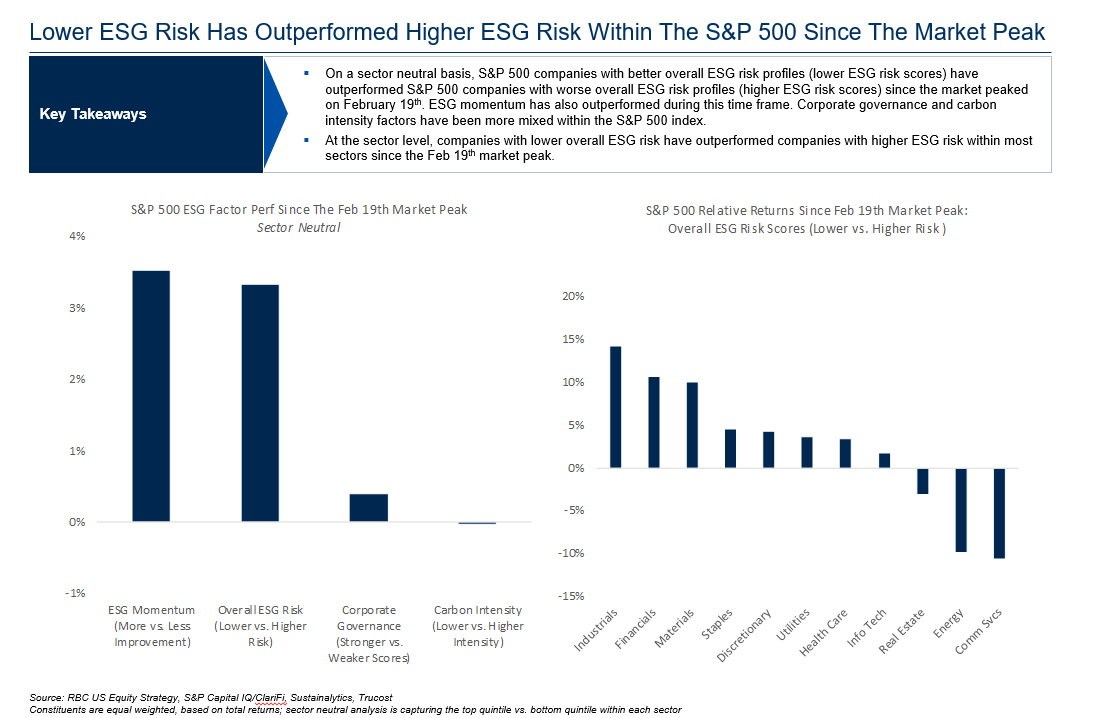

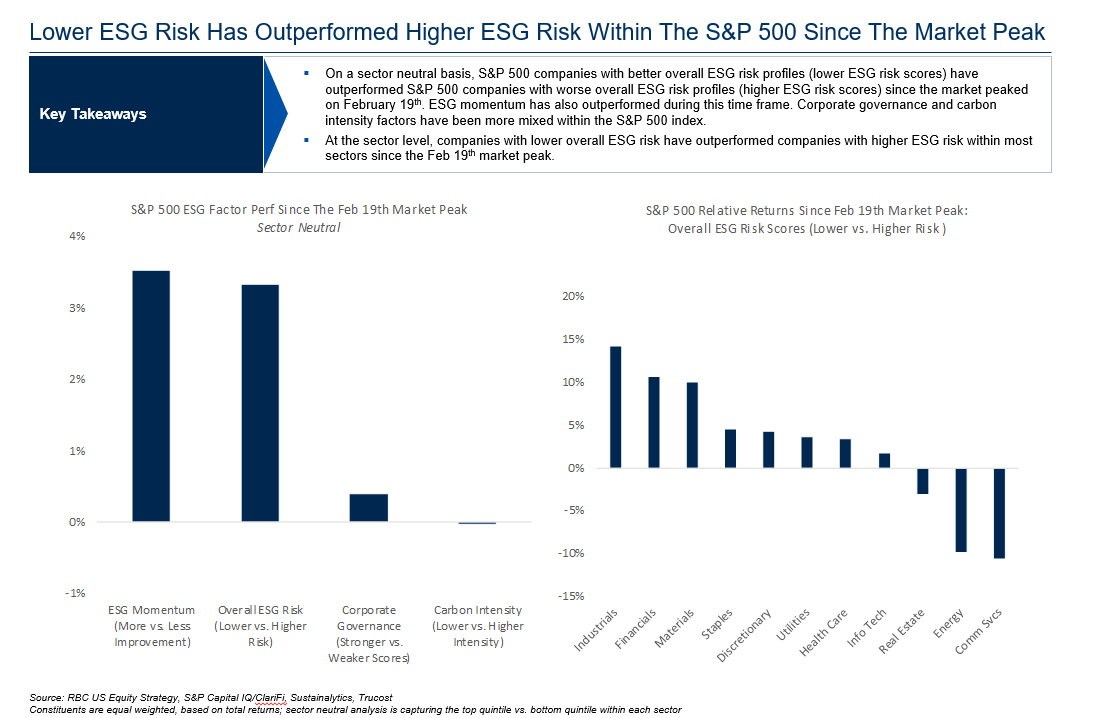

S&P 500 companies with stronger ESG risk profiles have generally been outperforming those with weaker ESG risk profiles since mid-2017, with the latest growth surge beginning in January 2020.

Through late March, our analysis reveals that S&P 500 stocks with better overall ESG profiles have outperformed those with worse profiles within sectors since the S&P market peak on February 19th. These companies tend to have higher multiples, higher return-on-equity, and slightly higher growth rates than those with higher ESG risk scores.

2. Sustainable ETFs post consistent flows through March

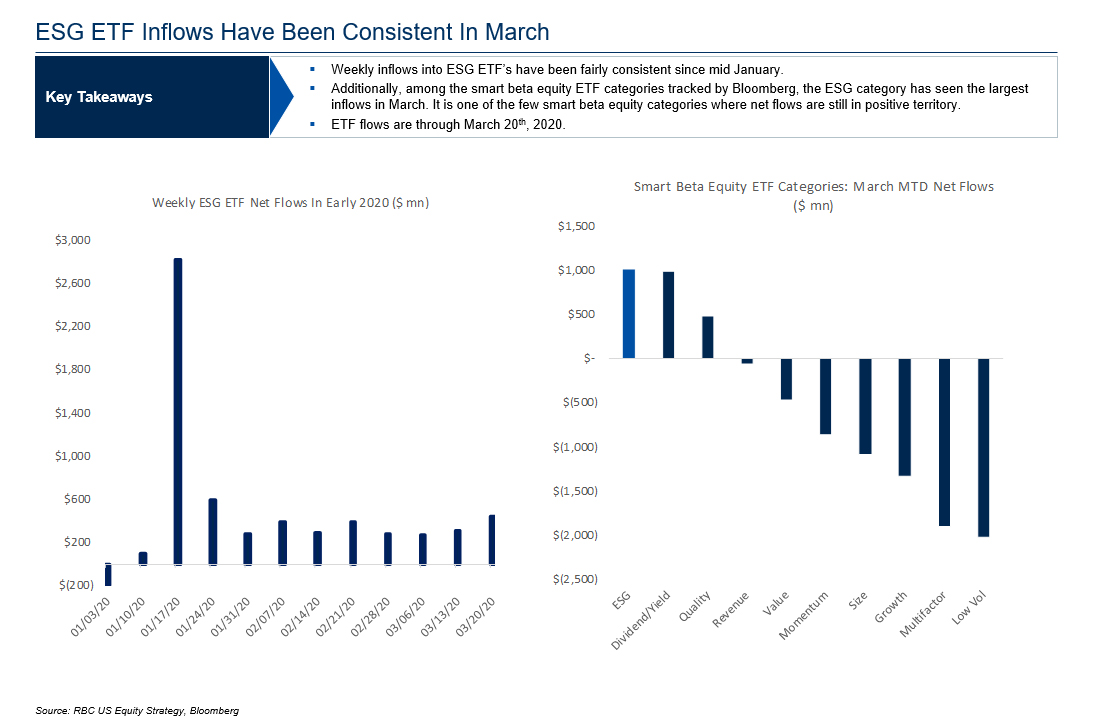

Through the beginning of 2020, it appears that investors still had an appetite for sustainable funds.

Our early flows analysis through February suggests that ESG-focused active and passive equity funds were on pace to hit new highs in 1Q20.

U.S.-listed ESG equity Exchange Traded Funds (ETFs) have persisted consistently through March, tracking a bit below January highs, but above their monthly average since 2019.

3. Actively Managed ESG funds Have Seen Strong Relative Fund Track Records In Early 2020

Active stock pickers in the sustainable fund universe turned in an impressive performance in March, with two thirds beating their benchmark through late March. Similar to last year, relative fund track records for these funds were stronger than traditional active managers’ performance.

We believe this solid performance can be attributed to the fact that these equity funds tend to have less exposure to energy and financials, more exposure to higher quality stocks, and resilience in the most popular S&P names in the fundamental/active sustainable equity sector during the stock market drawdown.

For Required Conflicts Disclosures, click here. These disclosures are also available by sending a written request to RBC Capital Markets Research Publishing, P.O. Box 50, 200 Bay Street, Royal Bank Plaza, 29th Floor, South Tower, Toronto, Ontario M5J 2W7 or sending an email to rbcinsight@rbccm.com.

Our Commitment to ESG

RBC Capital Markets’ ESG StratifyTM encompasses all of our ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.