Required Conflicts Disclosures

Over the past few months, we’ve explored how health and social issues sparked by the pandemic have elevated the importance of social ESG factors, like treatment of employees & other human capital initiatives.

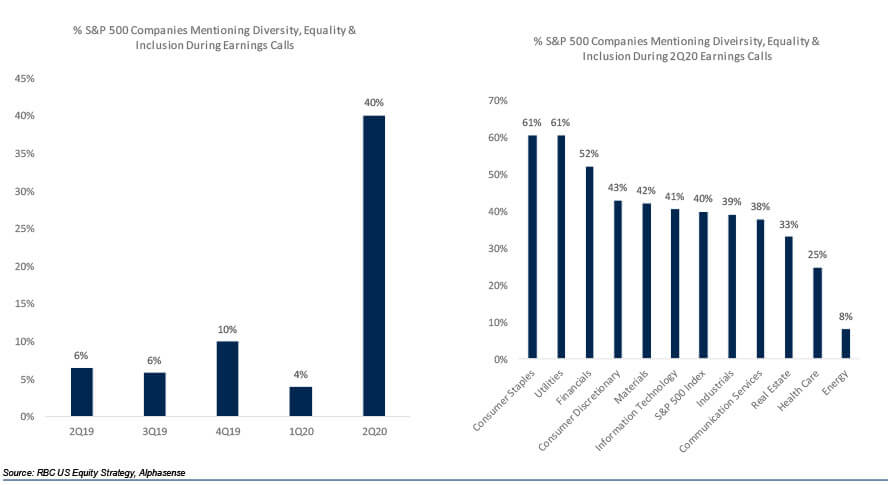

Now, nationwide racial inequality protests have prompted many to reassess Diversity, Equality, and Inclusion policies. Our latest research shows that 40% of S&P 500 companies discussed D&I policies during 2Q earnings calls, up from 4% in 1Q, and 6% during the same quarter a year ago.

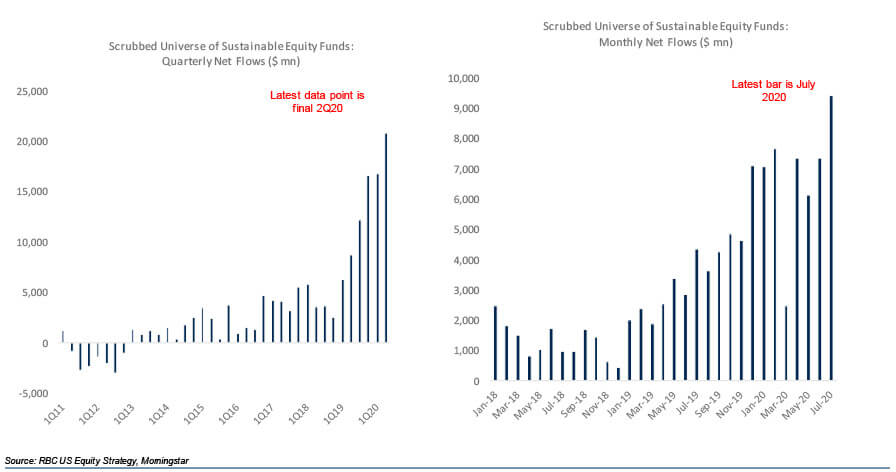

Investors reacted to this news by pouring record levels of capital into ESG funds. In 2Q, net inflows into our universe of dedicated ESG funds hit new highs, and 3Q inflows look to be off to a strong start so far in July.

To explore how S&P 500 sectors have approached D&I, we reviewed what companies have been saying on D&I in recent months, higher level sector trends on quantitative D&I data, and the performance of companies with stronger workforce ESG scores. It offers interesting insights on where D&I emphasis has increased the most, and how that focus matters from a performance perspective.

Here are the key takeaways from our report:

Companies advance D&I plans during 2Q reporting season

Through early August, 40% of S&P 500 companies had discussed diversity & inclusion during 2Q earnings calls, up meaningfully from prior reporting seasons, with companies highlighting their heightened, longer term focus on D&I and its importance to their corporate strategies.

We also found that since late May, 38% of S&P 500 companies announced new D&I initiatives such as internal programs (training, hiring & development, increased ERG investments) and external commitments (donations to racial justice groups, minority community investments, and diverse supplier spending). One thing we noticed is that we have started to see more companies publicly disclose quantitative targets on their own workforce representation with timeline commitments.

Overall, we found that diversity, equality & inclusion have been most in focus among Staples, Discretionary, Financials, Communication Services, and Utilities (either in earnings calls or in newly announced initiatives).

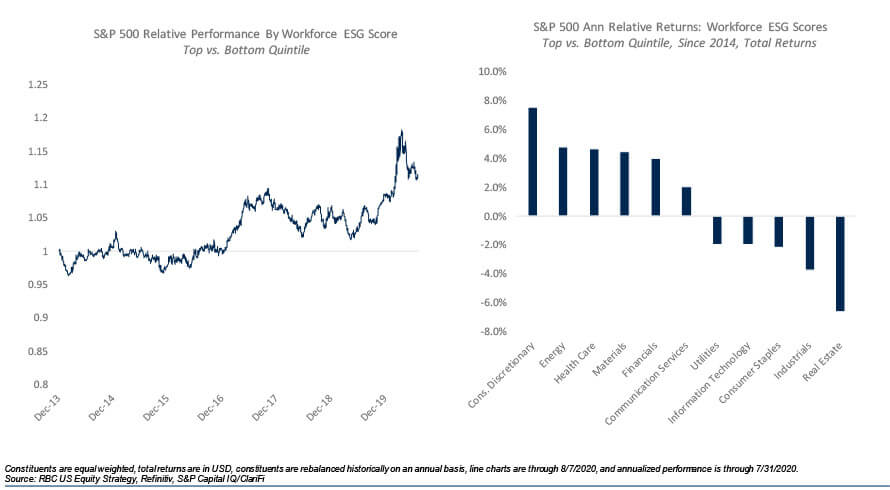

S&P 500 names with stronger ESG scores outperformed since 2014

Leveraging data from Refinitiv, we’ve found that companies with higher ESG workforce scores (where D&I policies and track records are contributing inputs) have outperformed those with lower scores within the U.S. over the past six years. Within sectors, this rang especially true for the Consumer Discretionary, Energy, Health Care, Materials, Financials, and Communication Services sectors.

In our view, we think this is particularly interesting for Consumer Discretionary, Financials, and Communication Services, since these are three sectors where D&I has been highly in focus recently and workforce ESG scores historically have mattered from a performance perspective.

Sustainable Fund Inflows Hit New Highs in 2Q & 3Q Inflows Are Off To A Strong Start

Inflows into our universe of dedicated ESG equity funds (Morningstar tracked US, global, and sector focused equity funds with meaningful assets invested in US equities, that have a clear heavy emphasis on ESG practices) rose to new highs in 2Q20. So far 3Q net flows look to be off to a strong start, with July inflows climbing to a new monthly record.

Our Commitment to ESG

RBC Capital Markets’ ESG StratifyTM encompasses all of our ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.