Required Conflicts Disclosures

The COVID-19 outbreak may prove to be a watershed moment for sustainable investing.

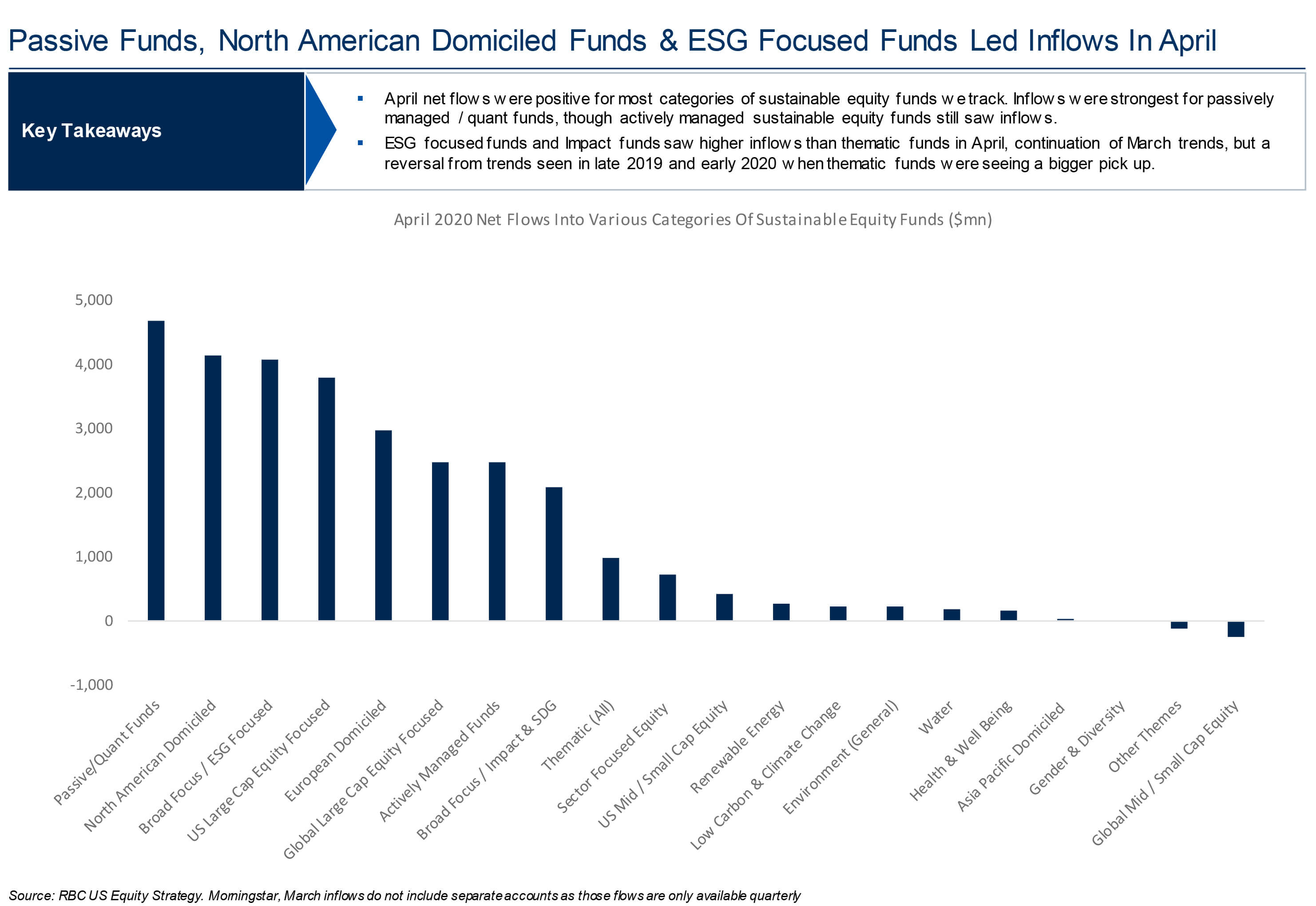

Since the start of the pandemic, sustainable equity funds (particularly passively managed and quant) attracted record inflows and better-than-average returns. And if the current pace of inflows persists, they are on track to reach even higher levels in 2Q20.

The strength of these funds suggests that ESG clearly matters to both investors and S&P 500 companies alike, particularly as the current crisis pulls back the curtain on health disparities and social and economic inequalities.

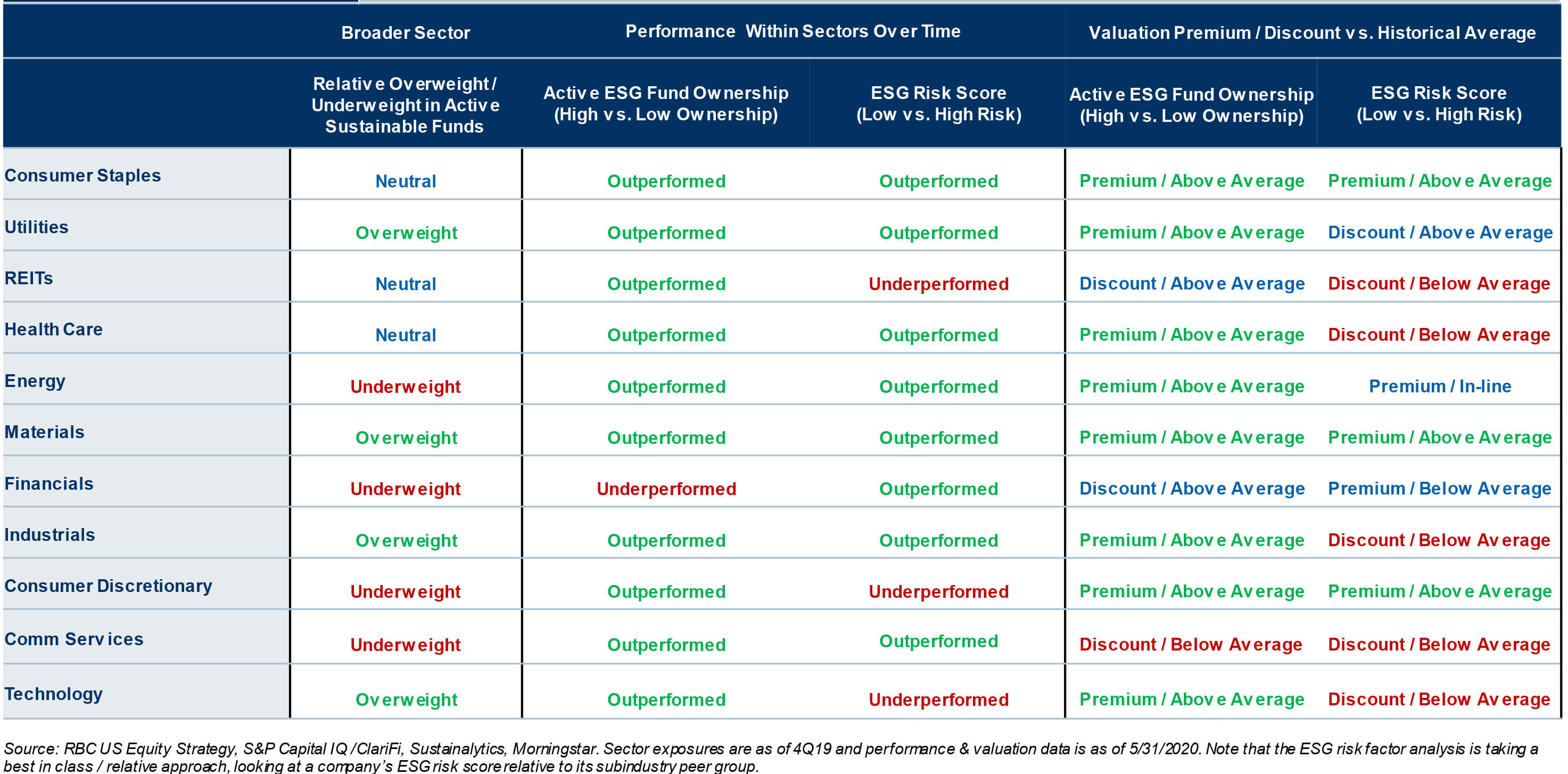

But in which S&P 500 sectors does ESG really matter the most, and how? Our heat sector map offers some surprising clues. It highlights the influence of ESG factors (specifically high active ESG fund ownership and ESG risk scores) on specific sectors, and may provide some insights on why ESG is outperforming many of its non-sustainable counterparts.

Here are the main findings from our report:

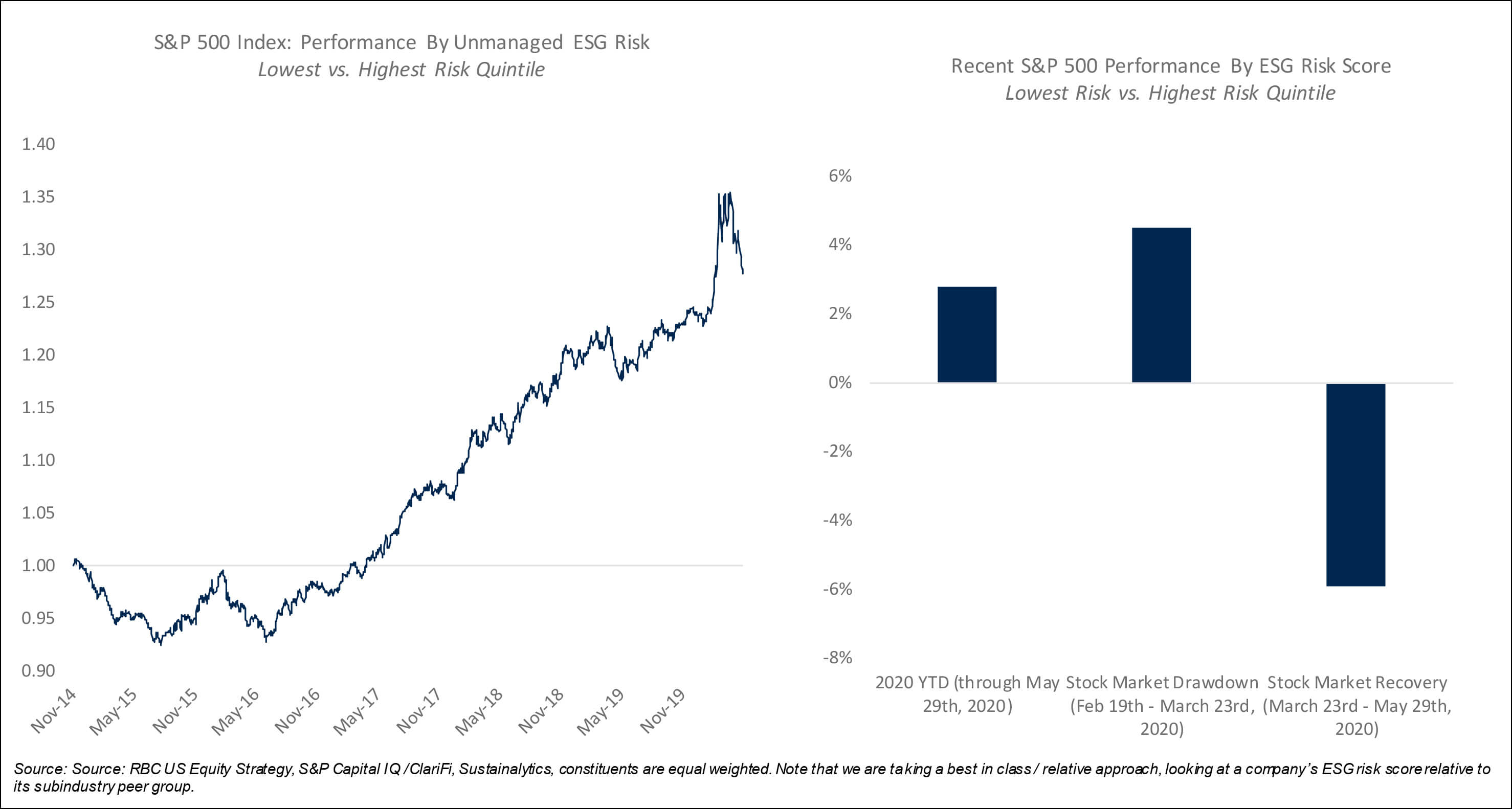

Five years running, low-risk ESG companies outperform those with higher scores

Sustainable investing has been around for decades, but well-credentialed ESG companies have really taken off over the past five years.

Since late 2014, large caps with lower ESG risk scores have outperformed those with poorer profiles in most sectors.

Since late 2014, large caps with lower ESG risk scores have outperformed those with poorer profiles in most sectors. Even during the coronavirus-fueled-drawdown, ESG funds outperformed, displaying weakness in the recovery off the March 23rd low.

Feeling the heat: ESG matters for most sectors

The heat map shows that ESG has some level of influence on all sectors. As far as performance, both active fund ownership and ESG risk scores explains outperformance in 7 of the 11 major sectors. In the other four sectors, one of the factors outperformed. As far as valuation premiums, active ownership, and probably strong inflows, explained above-average premiums in 8 of the 11 major sectors.

Passive and broad-focused funds led inflows in April

Most categories of sustainable equities posted strong net flows in April. Passively managed/quant funds saw the most impressive inflows, although active funds still saw inflows. Continuing March trends, ESG-focused and impact funds experienced higher inflows than thematic funds in April. This was a reversal from late 2019 and early 2020 when thematic funds (environmentally focused funds in particular) were seeing a bigger pick up.

More than a Phenomenon

Even against market volatility and economic instability, sustainable investing is showing that it’s much more than just a bull market phenomenon. Amid the pandemic, investors are rallying support behind ESG initiatives and S&P 500 companies are advancing their commitment to human and social capital initiatives. Our studies show that ESG clearly influences performance and valuation premiums in some way on all S&P 500 sectors, suggesting strong momentum for ESG for years to come.

Sara Mahaffy authored “The ESG Scoop: Introducing Our New ESG Sector Heat Map.” For more information about the full report, please contact your RBC representative.

Our Commitment to ESG

RBC Capital Markets’ ESG StratifyTM encompasses all of our ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.