After a record-breaking 2020, ESG investing already appears to be on a roll.

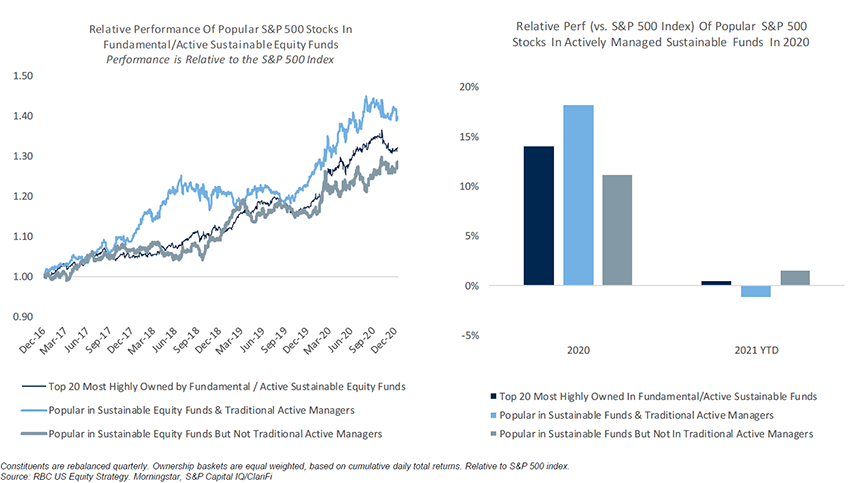

Net flows accelerated to new highs in 4Q20 and are still running at a healthy pace. The S&P 500 names that are popular in actively-managed sustainable equities (but less so in traditional funds) most impacted by these flows not only outperformed throughout last year, but are also outperforming so far in 2021. This year, we believe climate change legislation under the Biden Administration will help maintain the momentum. And, as the global pandemic rages on, we expect investors and stakeholders will demand higher standards on “S” and “G” initiatives such as social responsibility, employee safety and wellness, and race and gender diversity issues.

Here are the main takeaways from our report:

Environmentally-focused thematic funds lead surge in flows

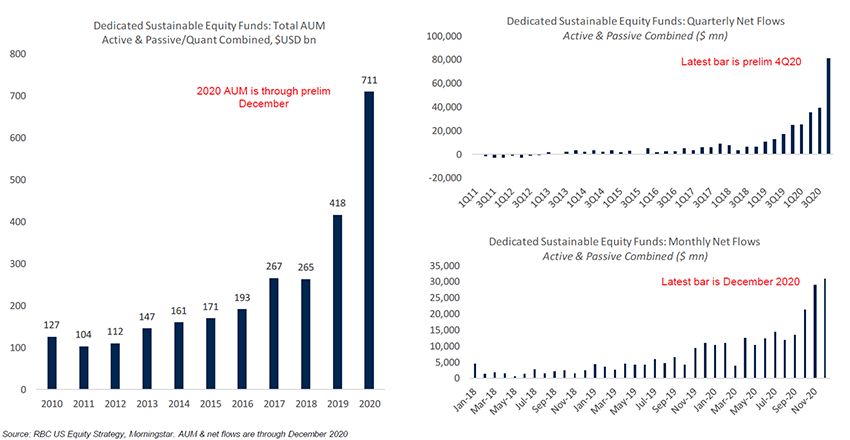

The number of funds that heavily emphasize sustainable investing has exploded over the past two years. In that vein, we decided to broaden our coverage universe to include all equities with a dedicated focus on sustainable investing. Through December, AUM totaled $711B globally, up 70% from the start of 2020. Although inflows have been strong across most of the categories that we track, environmentally-focused thematic funds demonstrated the largest spike in inflows and new fund launches recently. Impact funds, which invest across multiple sustainable development themes, also launched a number of new funds in 2020.

U.S. ESG ETF flows outpace all other categories

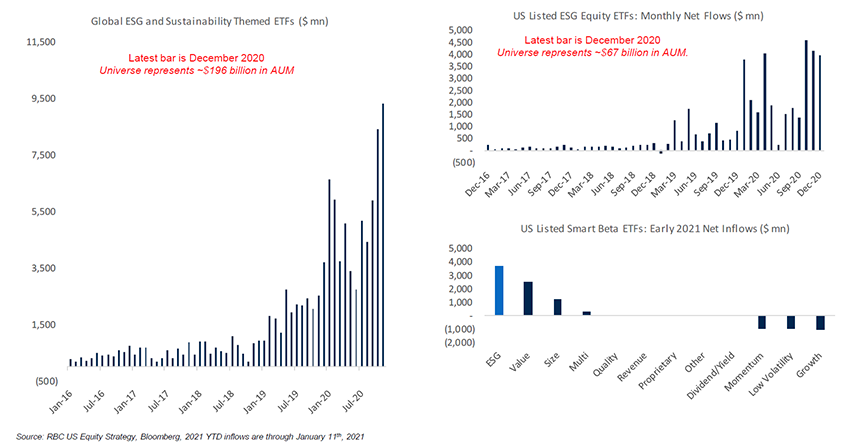

Beginning with a steady upward climb back to recent highs during the November election, U.S.-listed ESG ETF fund flows accelerated to new highs in 4Q20. So far this year, inflows have stayed strong (particularly after the Georgia Senate runoff election), outperforming every other smart beta ETF category, including Value. As President Biden implements climate change initiatives such as “green” infrastructure spending, increased environmental regulations, and mandated corporate climate disclosures, we expect ETF flows to remain strong.

The most popular S&P 500 names are outperforming in early 2021

S&P 500 names that are uniquely popular in actively-managed sustainable funds (popular in sustainable funds but less popular in traditional large cap long-only funds, and hedge funds) outperformed in 2020, and are outperforming in early 2021.

Reinvigorated “E” policies may give ESG a healthy boost

Based on early signs, we believe sustainable investing is gearing up for another solid year. Fund launches dedicated to sustainable investing have significantly increased over the past few years and the most popular S&P names in actively-managed equities are outpacing their non-sustainable counterparts. We expect several factors to help sustain this trend, including strong investor and stakeholder support for social equality and governance policies, and President Biden’s vow to make climate change a priority for his administration.

“Although inflows have been strong across most of the categories that we track, environmentally-focused thematic funds demonstrated the largest spike in inflows and new fund launches recently.”

Sara Mahaffy authored “Expecting 2021 To Be Another Strong Year for Sustainable Equity Fund Flows” published on January 13, 2021. For more information about the full report, please contact your RBC representative.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.