Among S&P 500 sectors, Financials have reported some of the weaker ESG scores over the past few years, which led global and U.S.-focused sustainable funds to tilt exposure away from it and into improving industries such as Healthcare and Industrials.

But recent research uncovered signs that may prompt U.S. and global-focused sustainable funds to reconsider these underweight positions. Our report explores these signs as well as other key performance indicators that may lead to a narrowing of Financials’ underweight in the near future.

Here are the main takeaways from our report:

Financials show improving ESG scores

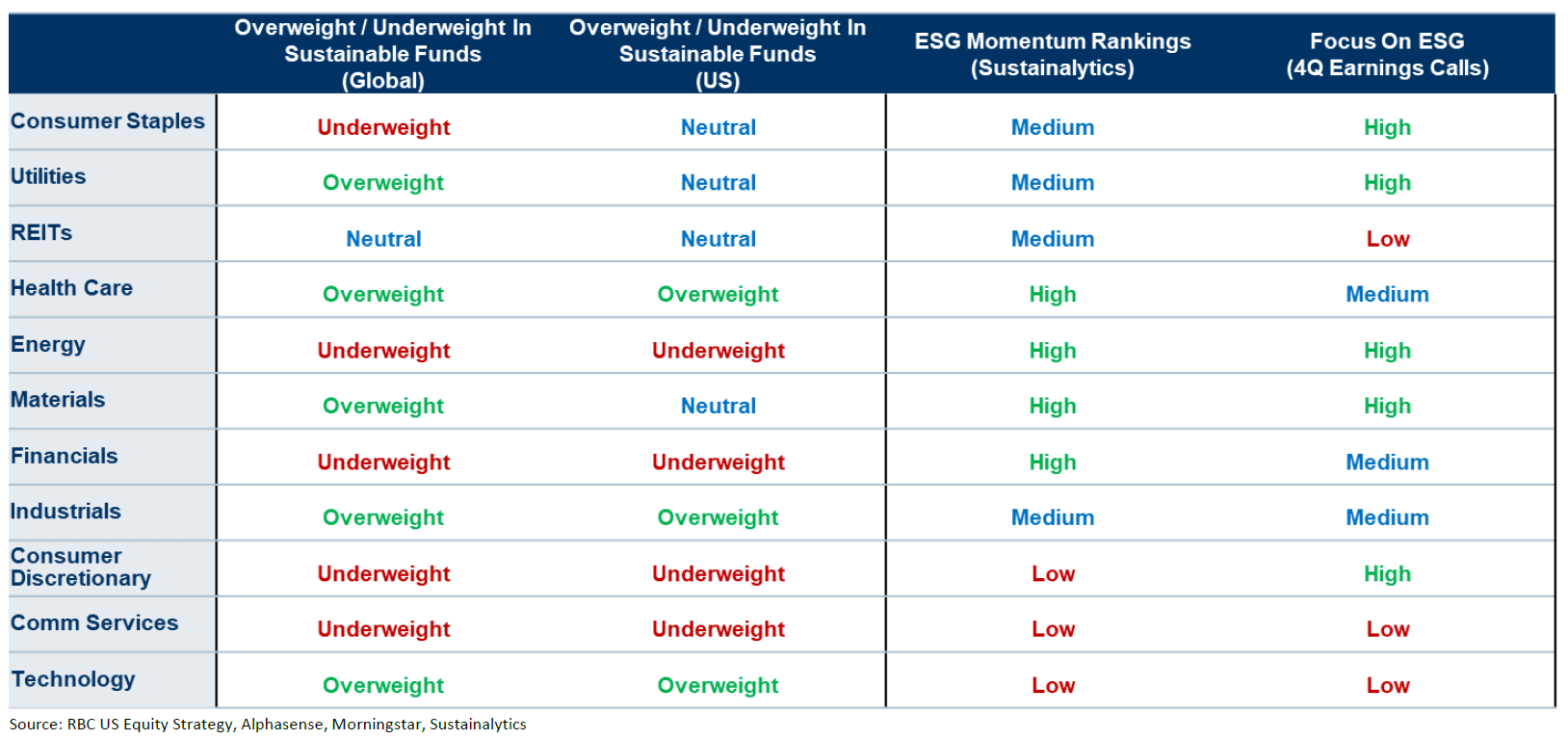

Our ESG Momentum Indicator analysis revealed trends that may remove some barriers for ESG-conscious investors. Both Energy and Financials—two sectors which previously reported weaker scores - demonstrated improving scores and a fairly high degree of focus on ESG topics during their corporate earnings calls. In contrast, Communications Services, another underweight in sustainable funds, revealed limited improvement in ESG scores and paid less focus to sustainable issues on its earnings calls.

S&P 500 ESG Sector Heat Map

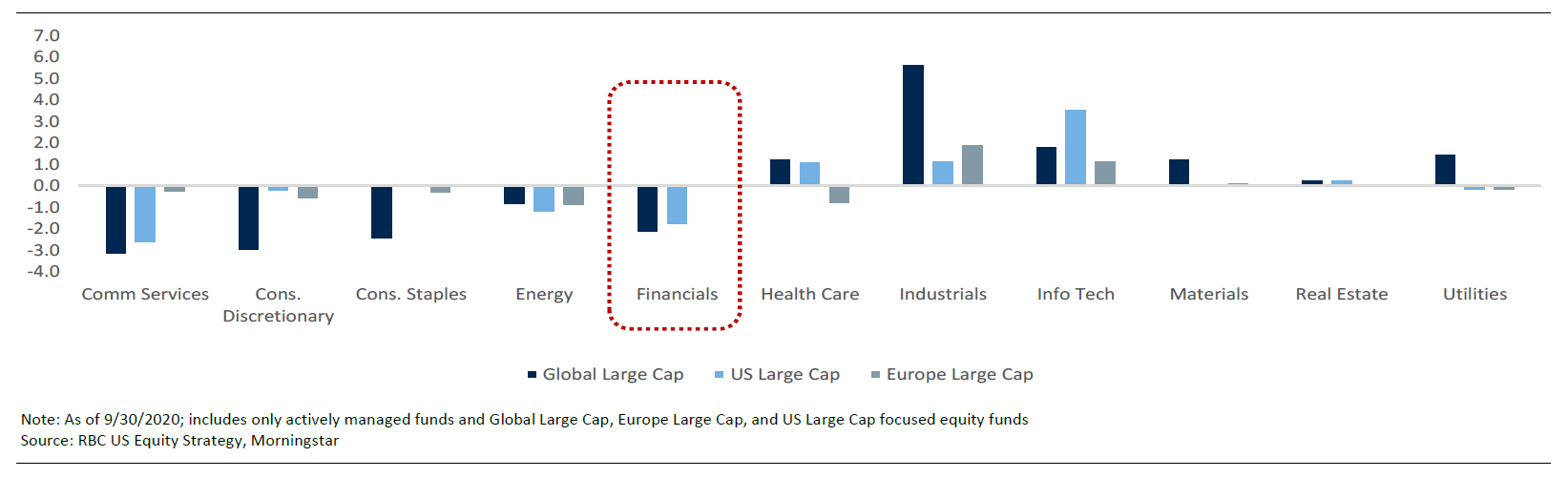

Tilting away from Financials in the U.S., but staying neutral in Europe

Since we started tracking this data early last year, sector allocations of both global and U.S.-focused sustainable funds tilted away from Financials. But there are signs that these positions may narrow: Financials’ risks scores are trending higher due to improving controversy assessments, and sector allocations are currently neutral in European-focused sustainable equities.

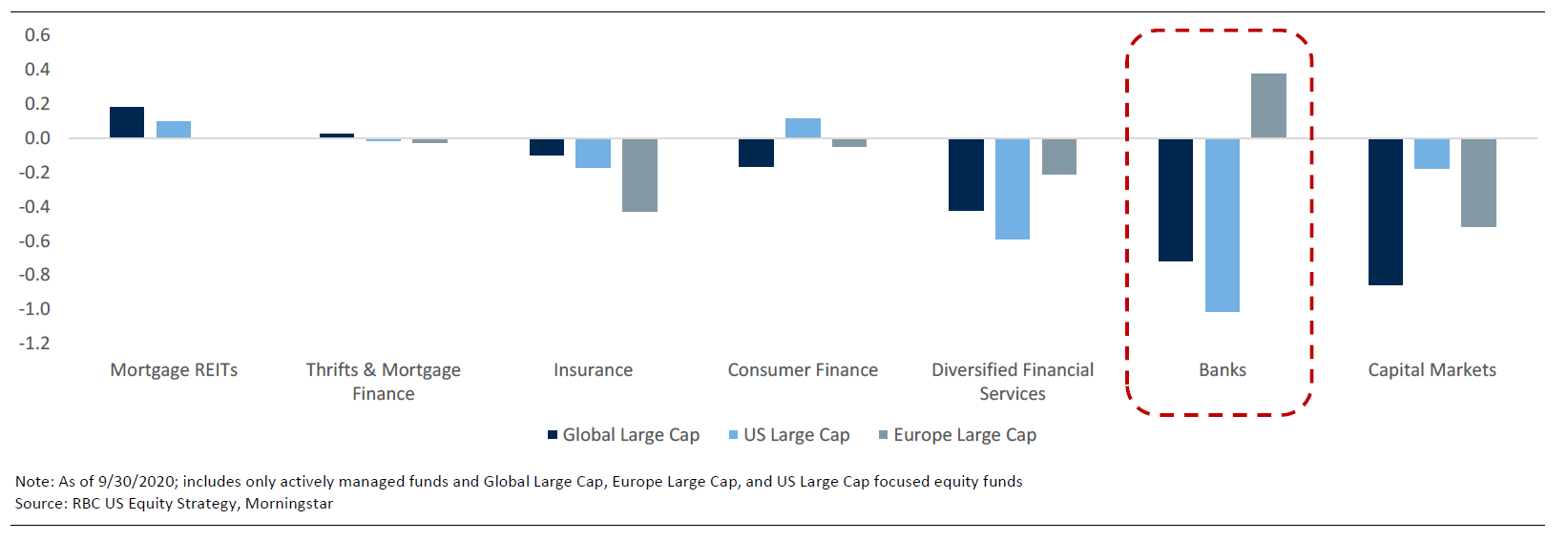

At the industry level, Capital Markets, Banks, and Diversified Financials have the lowest level of exposure in both global and U.S.-focused sustainable funds. Capital Markets and Diversified Financials are also slightly underweight in European-focused sustainable funds, while Banks have somewhat higher exposure.

Actively Managed Sustainable Funds vs. Traditional Funds: Relative Sector Overweights and Underweights

Actively Managed Sustainable Funds vs. Traditional Funds: Relative Industry Exposures (Financials)

Financials’ outperformance may be headwinds for sustainable equities

Over the past two years, actively-managed sustainable equities posted strong relative fund track records, particularly when compared to their traditional equity counterparts. While this outperformance was partly driven by relative underweights to Energy and Financials, we found that the top sustainable fund holdings—including popular names unique to these funds, rather than long-only or hedge funds—outperformed.

Through early February, relative fund track records for sustainable funds were either similar or weaker than traditional equities, and top sustainable fund holdings also declined as relative valuations soared to new highs. (We will continue to observe these patterns closely). We believe Energy and Financials’ outperformance have been headwinds for these funds.

Financials may be worth a second look

Actively-managed sustainable fund outperformance over the past few years was partly attributed to an underweight in Financials and Energy. Financials are now outperforming and its ESG profile is improving, relative to other S&P 500 sectors. With sustainable fund track records showing signs of weakness, we believe it may be time for U.S. and global-focused sustainable funds to take another look at this sector.

“Both Energy and Financials—two sectors which previously reported weaker scores—demonstrated improving scores and a fairly high degree of focus on ESG topics during their corporate earnings calls.”

Sara Mahaffy authored “ESG Sector Snapshot for Financials” published on March 5, 2021. For more information about the full report, please contact your RBC representative.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.