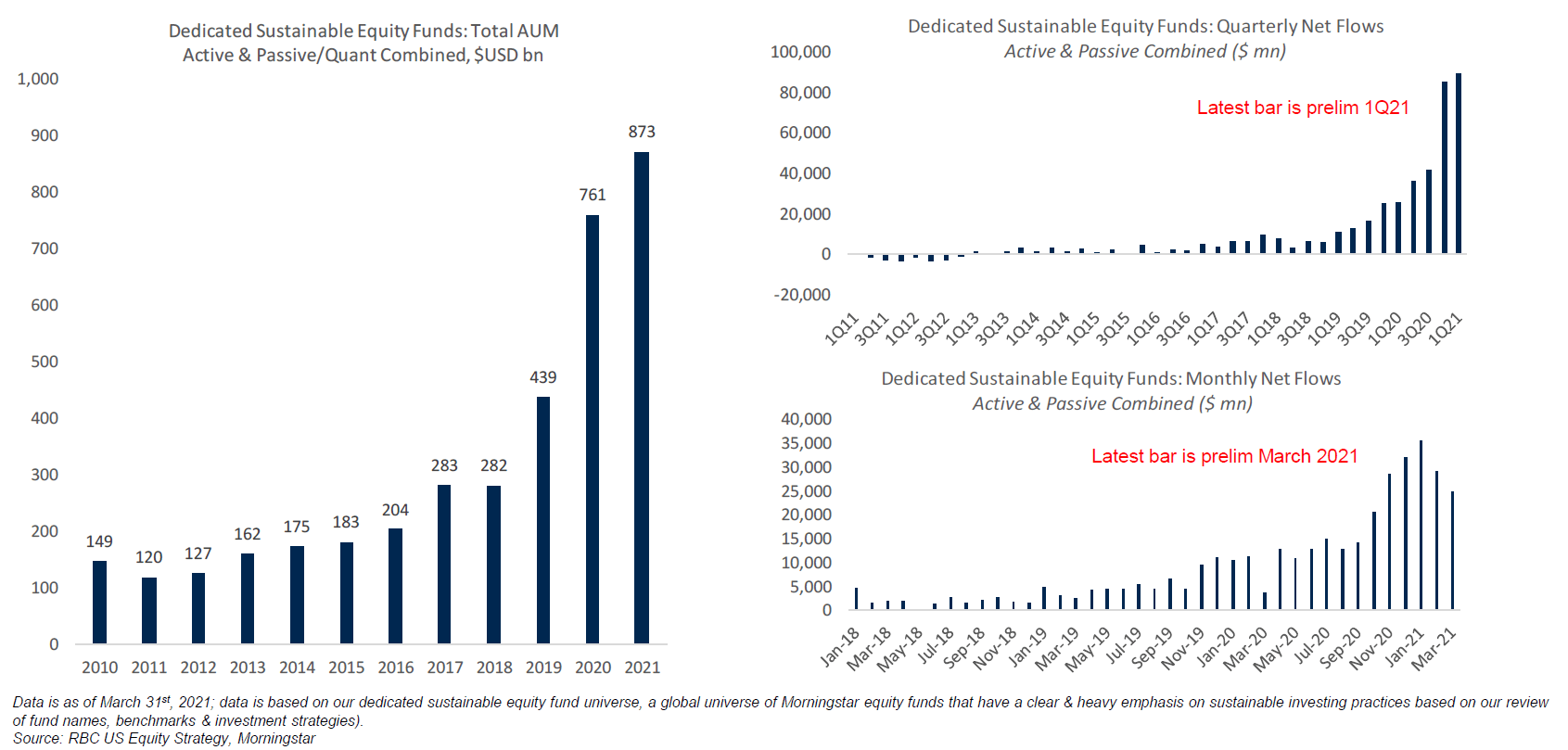

Over the past two years, actively-managed sustainable equity funds fared much better than their traditional counterparts, a trend that supported record-breaking flows and new fund launches. But weaker YTD performance track records and strong inflows into Value funds appears to have dampened sustainable fund flows recently. After hitting new highs in January, fund flows eased in February and March, but stayed positive.

Although we will continue to observe this trend, it doesn’t change our positive long-term view on sustainable investing, particularly as the U.S. and other countries announce updated emissions reduction targets leading up to the U.N. Climate Change conference (COP26) in November.

Here are the main takeaways from our report:

After soaring to record highs, fund flows drop back

After surging throughout 2020 and hitting record highs in 1Q21, the pace of new sustainable fund launches and inflows diminished a bit in February and March. Among categories, clean energy focused thematic funds suffered the largest decline, while low carbon, sustainable agriculture/food, aging population, and health and well-being funds experienced the biggest pick up in flows.

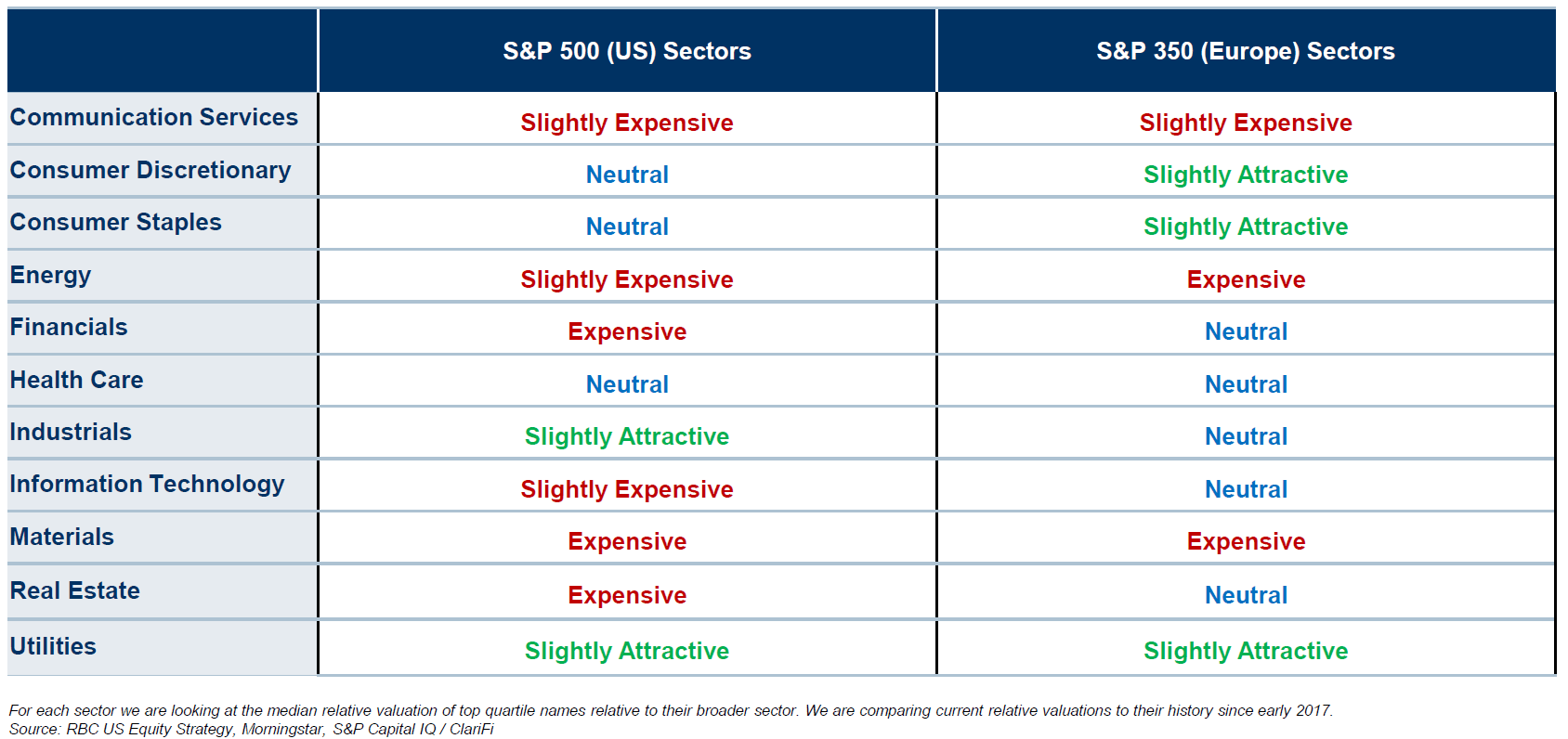

ESG leaders across sectors begin to look more reasonably valued

Our ESG valuation heat map focuses on valuations of sustainability leaders relative to recent history within the major S&P 500 and S&P Europe 350 GICS sectors. Although our rankings don’t reveal any compelling opportunities yet, sustainable leaders within U.S. & European Large Cap Utilities, Industrials, Health Care, Consumer Discretionary and Staples are starting to look more attractive compared to recent history.

U.S. Small- to Mid-Cap ESG leaders in Health Care, Financials, Staples, and Information Technology also appear to be more reasonably valued.

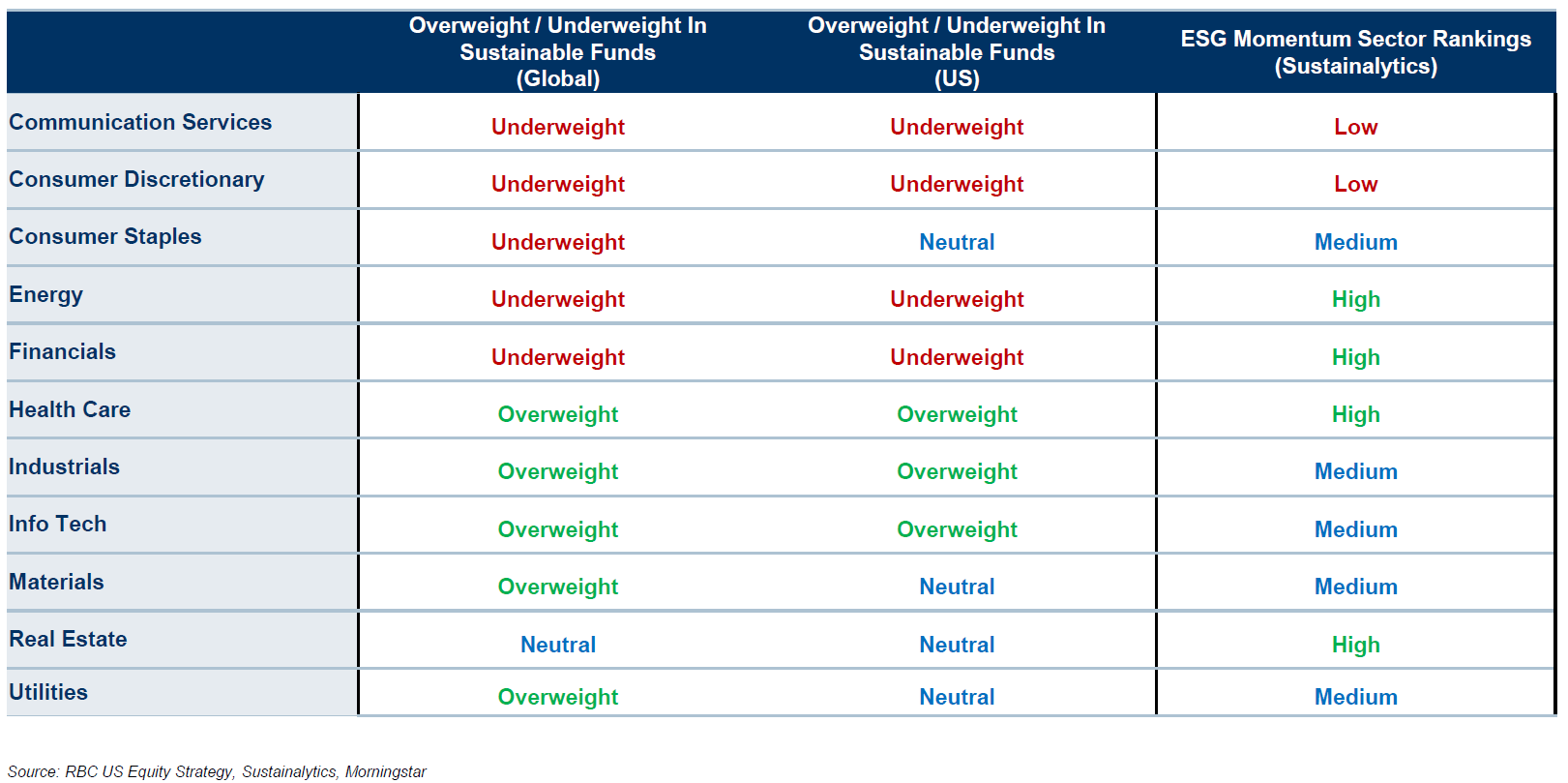

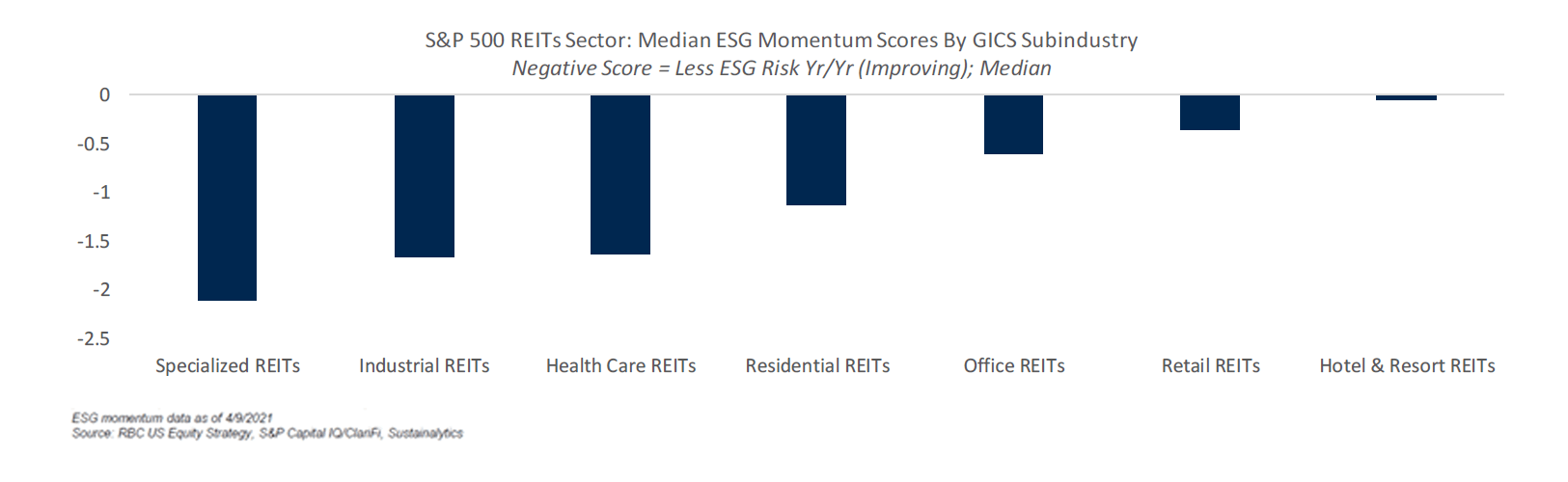

Specialized REITs drive major improvement in Real Estate ESG scores

Most REITs subindustries have improved their ESG scores recently. But the Specialized REITs subindustry (including data centers and towers) helped drive the Real Estate sector to the #2 position in our latest ESG momentum analysis. Among actively-managed sustainable equities, the Real Estate sector’s standing has been relatively neutral, but that position may change with improving ESG scores.

Watching for better valuation opportunities ahead

Rather than a turning point, we believe the recent pause in fund flows may be attributed to weaker sustainable fund performance and recent inflows into Value Funds. Most of the ESG leaders we track—based on either ownership data or 3rd party ESG ratings--have underperformed this year. This change will keep us on the lookout for better valuation opportunities in ESG leaders, many of which are starting to look more reasonably valued compared to recent history.

"Among actively-managed sustainable equities, the Real Estate sector’s standing has been relatively neutral, but that position may change with improving ESG scores."

Sara Mahaffy authored “ESG Stat Pack” published on April 20, 2021. For more information about the full report, please contact your RBC representative.

Our Commitment to ESG

ESG Stratify™ encompasses all of RBC Capital Markets’ ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.