Prior to the onset of the pandemic, Multi-Industry companies viewed ESG strategies as mainly a “nice to have.” But given the renewed focus on sustainable products and solutions, these companies now view them as a “need to have.”

As ESG assets continue to rise, we not only believe the post-COVID interest in sustainability will bring tailwinds to this sector, but also strong future momentum.

Our latest research explores the implications of these trends for ESG investors.

Sustainability offers ESG tailwinds to Multi-Industry companies

We believe many trends are bringing ESG tailwinds to the Multi-Industry sector. First, many of these companies have reprioritized sustainable strategies, particularly those focused on Indoor Air Quality (IAQ), advanced water and wastewater treatment, and energy transition.

Second, Multi-Industry companies are unique in helping customers achieve their ESG goals by providing them with sustainable products and solutions, as opposed to other sectors that seek to achieve their own sustainability targets internally.

As depicted in the word cloud below, the most important ESG factors for these companies include Energy Management, Product Design & Lifecycle Management, and Materials Sourcing & Efficiency.

These powerful ESG megatrends could add a significant boost to topline growth for many companies in our coverage and, given the expanding asset base of sustainable investing strategies, there appears to be room for growth.

Source: RBC Capital Markets, SASB, wordclouds.com

Ratings scores may not always depict actual ESG fund ownership

One way to gauge a company’s focus on ESG is by analyzing ESG scores from ratings firms. When we compared Sustainalytics ratings with actual ownership in actively managed sustainable funds, we found that the ratings agency agreed with our view that large caps tend to have a higher percentage of ESG fund ownership compared to their SMID-cap peers.

However, ratings may not always show the full picture of ESG ownership. Our conversations with company management revealed that, in some cases, data wasn’t always accurately captured by the rating agencies. For example, one large-cap company in our coverage area didn’t get full credit for the sustainability of its water sales because the agency said it sold through industrial distributors, not water customers. But that discrepancy has since been rectified.

Increased activity and sentiment drive ESG momentum

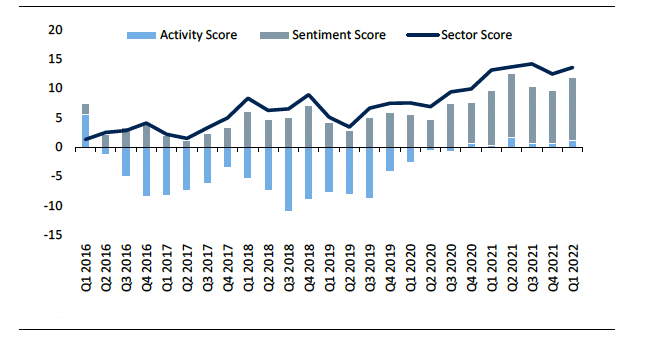

Despite the positive sentiment score of the Multi-Industry sector since inception, ESG activity was low from 2016-2019. We attribute this to U.S. investors’ lack of interest in ESG before COVID-19.

Companies’ renewed post-COVID interest on ESG and sustainability has helped improve ESG ratings. In fact, we’re not surprised that momentum has continued to improve in this sector as more companies build out their strategies, implement new ESG targets, and improve ESG disclosures and transparency.

Source: RBC Elements, FactSet, RBC Capital Markets

We’re proud to see Sara Mahaffy, our ESG equity strategist, make Business Insider’s annual 2022 Rising Stars of Equity Research list! Learn more about her story here.

Our Commitment to ESG

RBC Capital Markets’ ESG StratifyTM encompasses all of our ESG thought leadership and insights, including our monthly ESG Scoop series and industry-specific publications from our research analysts. RBC’s Equity Research Group delivers thorough, comprehensive assessments of companies spanning all major sectors, along with macro insights and stock-specific ideas to help guide portfolio management decisions.

Sara Mahaffy and Deane Dray authored “Multi-Industry & Electrical Equipment: Multi-Positioned for ESG Tailwinds,” published on June 27, 2022. For more information about the full report, please contact your RBC representative.