- Human capital – a dimension of sustainability that includes health and safety; diversity, inclusion, and engagement; and labor practices – is a widely recognized driver of value creation and business resilience

- Despite a growing body of research supporting the financial materiality of good human capital management, a gap persists between investor expectations and corporate disclosure

- As focus moves toward the tangible measurement of progress against human capital metrics, we see significant opportunity to further integrate these factors into the sustainable finance market

The Evolution of Human Capital Management

One month into the COVID-19 pandemic, we published an edition of Sustainability Matters that predicted “crises such as COVID-19 offer an opportunity for companies with good management and strong corporate cultures to differentiate themselves, particularly in terms of issues related to human capital.” Two and a half years later, that statement continues to ring true. After climate, human capital - a dimension of sustainability that is inclusive of employee health and safety; employee diversity, inclusion, and engagement; and labor practices – is the ESG-related topic that has garnered the most attention from corporates and investors alike since the onset of the pandemic. As evidence of its cross-industry financial relevance, human capital is second only to climate risk as the most common thematic issue across the Sustainability Accounting Standards Board (SASB) standards.1 Larry Fink’s 2022 Letter to CEOs noted that BlackRock research showed that companies who forged strong bonds with their employees saw lower levels of turnover and higher returns through the pandemic.2

In the years leading up to the pandemic, the landscape of human capital management underwent a period of rapid change as automation and artificial intelligence technologies, paired with new workforce models and growing income inequality, introduced new complexity to the employee-employer relationship. The pandemic accelerated this disruption, upending physical work environments and bringing to the forefront a focus on the role of employers in supporting the health and economic well-being of their employees. Pandemic-era work arrangements revealed that employees at all stages of life place a high value on human-centric workplace cultures that support flexibility and well-being. Topics such as racial equity, mental health, and equitable pay and benefits continue to remain top of mind for stakeholders, as evidenced by a rising share of shareholder activism campaigns focused on issues related to human capital.

The “Great Resignation” and ongoing debates regarding return-to-office mandates suggest that the work-life lessons that we take away from the pandemic are still in flux. What is clear, however, is that the past two and a half years have amplified a wider range of stakeholder voices and introduced greater scrutiny of human capital management practices overall. This edition of Sustainability Matters explores the emergence of human capital as an industry-agnostic sustainable finance opportunity in the wake of the COVID-19 pandemic and explores the ways in which corporates and investors are addressing new challenges and opportunities in the current environment.

The Gap between Investor Expectations and Corporate Disclosures

A growing body of research supports the financial materiality of good human capital management. State Street Global Investors recently published a discussion paper that highlighted the positive impacts of diverse groups on decision-making, risk oversight, and innovation, noting how management teams with a critical mass of racial, ethnic, and gender diversity are more likely to generate above-average profitability.3 A recent study in the Financial Analysts Journal found that an equal-weighted portfolio of companies that treat their employees the best, based on the “100 Best Companies to Work for in America” list, earned an excess return of 2.0-2.7% per year.4 The “Best Companies” list was selected as a proxy for high employee satisfaction as the assessment considers not only pay and benefits, but also credibility, respect, fairness, and pride/camaraderie. Using a sample spanning four decades, the study found that companies with the highest levels of employee satisfaction tended to outperform in most periods, with the largest excess returns coming from crisis periods, such as the dotcom crash and the financial crisis.5

Long-term investors with portfolios spanning the global capital markets have become increasingly vocal with regards to heightened expectations for corporate human capital disclosure. In August 2022, Norges Bank Investment Management (NBIM), which manages Norway’s $1.2tn Government Pension Fund, published an expectations paper setting out a framework for investee companies on the topic. Emphasizing the relationship between effective human capital management and financial performance from both a value creation and business resilience perspective, the CEO of NBIM noted that “people have become companies’ greatest resource”. Indeed, intangible factors – namely, intellectual capital – are a significant driver of corporate value creation. In 2020, 90% of the market cap of the S&P 500 was in intangible assets, compared to just 17% in 1975.6

Despite the research linking human capital management and financial performance, there remains a gap between the information that investors are seeking and what corporates are disclosing. Calls for improved disclosure are growing: in June 2022, the Working Group on Human Capital Accounting Disclosure, a small group of former SEC officials and academics, submitted a petition to the SEC to improve corporate transparency on the topic. One member of the group, former SEC commissioner Joseph Grundfest, observed to the press that “current accounting rules give us more information into the economic consequences of buying or leasing a drill press than of hiring or training a software engineer…How much sense does that make in today’s world?”7

Globally, the sustainability disclosure landscape is in the midst of an evolution: the International Sustainability Standards Board (ISSB), launched at COP26 in November 2021, has published exposure drafts that set out proposed requirements for an entity to disclose the material sustainability-related risks and opportunities to which it is exposed. The ISSB, which has indicated its intention to publish new sustainability disclosure standards by the end of the year, has also taken ownership of the SASB Human Capital Research Project, which aims to assess the scope and prevalence of cross-cutting human capital management themes – including workforce composition, workforce costs, and workplace turnover – across 77 industries. The research performed for this project will inform the ISSB’s consultations, and we anticipate that the forthcoming ISSB standards will help corporates align more closely with the financially material information related to human capital that investors are seeking.

The Sustainable Finance Opportunity

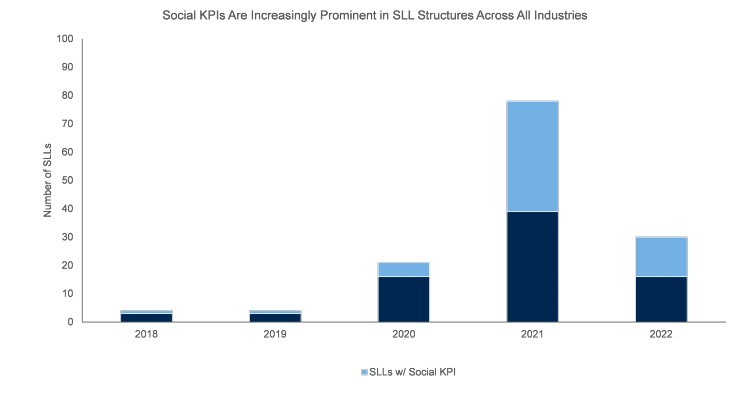

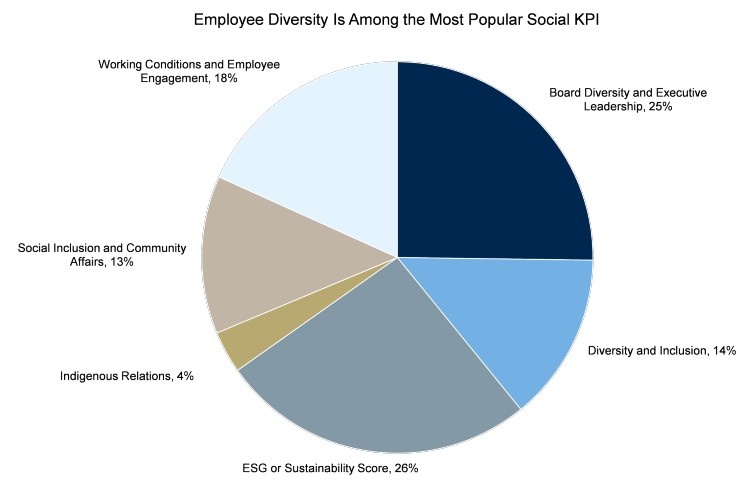

Recognizing that there is no one-size-fits-all approach to good human capital management – every company encounters a different set of risks and opportunities according to its sector, geography, and stakeholder base – we see the flexibility offered by sustainability-linked debt instruments in particular as a helpful tool for corporates to advance their human capital objectives. Sustainability-linked loans and bonds are bespoke products with interest rates tied to the achievement of sustainability performance targets (SPTs) and can be used as both a catalyst for positive change as well as a communication tool to inform investors of the company’s commitment to sustainability. Many companies that issue sustainability-linked debt instruments include an SPT related to a social key performance indicator; targets aimed at advancing employee gender and racial diversity have been among the most popular to date. Others have come to market with SPTs focused on driving improvements in health and safety and human capital development, including employee education, upskilling, and job training.

Source: RBC Capital Markets Internal Database. Data set includes 137 Sustainability-Linked Loans that RBCCM has tracked globally between March 2018 and August 2022.

Source: RBC Capital Markets Internal Database. Data set includes 137 Sustainability-Linked Loans that RBCCM has tracked globally between March 2018 and August 2022.

In September 2022, RBC Capital Markets acted as Joint Sustainability Coordinator, Joint Active Bookrunner, and Billing & Delivery Bank for Anglo American Capital’s €745m debut Sustainability-Linked Bond (“SLB”), which represented the first ESG coordinator role for RBC’s European DCM franchise. The SLB featured three Sustainability Performance Targets (SPTs), including an innovative, first-of-its-kind job creation target. As part of its efforts to support thriving communities and ensure residents in host communities have access to employment opportunities that will allow them to improve their standards of living, Anglo American aims to increase the ratio of off-site jobs to on-site jobs in relevant regions to at least 5:1 by 2030.8 The coupon rate for the SLB is linked to the achievement of this sustainability performance target, as well as two others focused on GHG emissions reduction and water use, respectively.

As investors, regulators, and stakeholders increasingly focus on other facets of human difference that drive diversity of thought and experience – including sexual orientation, disability, socioeconomic status, and neurodiversity – we see significant opportunities for continued innovation in the sustainable debt market. Given the emerging research supporting the link between employee satisfaction and financial performance, we anticipate that sustainability-linked instruments focused on corporate culture and employee well-being, as measured through metrics such as voluntary employee turnover or inclusion in Bloomberg’s Gender-Equality Index, will become increasingly popular.

In the current inflationary environment, private markets are also honing in on human capital management as a lever for value creation. Private equity firms are increasingly looking to generate cash flows by transforming businesses instead of acquiring new ones, and working with portfolio companies’ HR leaders on strategies for talent attraction and retention strategies is a growing area of focus.9 Further underscoring the important role of human capital management in value creation, four of the six disclosure areas laid out by the PE-led ESG Data Convergence Initiative are related to human capital, including work-related injuries, net new hires, employee engagement, and board diversity.

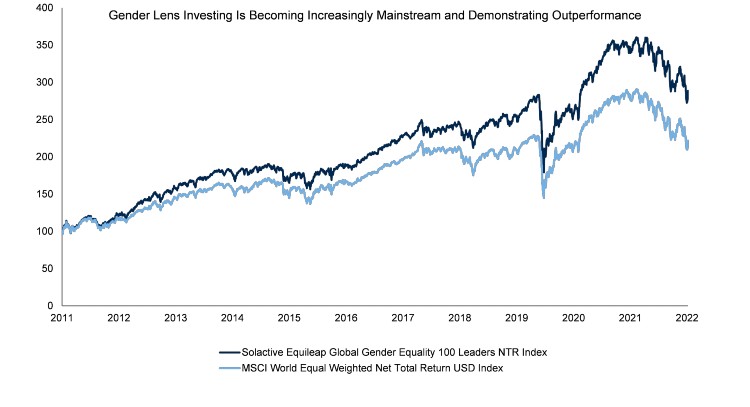

Recent data from Equileap show that gender lens investing is becoming increasingly mainstream, growing from US$645 million to a US$6bn industry in the last five years.10 In September 2022, one of the funds tracking the Equileap Global Gender Equality 100 Leaders Index, which ranks 100 global companies that score highly on gender equality in the workplace, announced that it had attracted assets in excess of US$1.6bn. Equileap evaluates companies on 19 gender equality criteria, including gender balance from the board to the workforce, gender pay gaps, and policies relating to parental leave, sexual harassment, and flexible work.10 The Leaders Index has demonstrated consistent outperformance over the MSCI World Equal Weighted Index, particularly in the aftermath of the recent market downturn.

Source: Bloomberg, October 2022.

Closing Thoughts

Beyond company-specific opportunities and risk mitigation benefits, we see strong human capital management as a driver of broader societal advancement by contributing to financial inclusion, health and well-being, and, ultimately, the realization of human potential. Looking ahead, we see ample opportunities for the sustainable finance market to continue to support our clients as they set and achieve ambitious human capital objectives. RBC Capital Markets works in partnership with our clients to help them navigate an evolving global environment and to provide a wide range of sustainable debt solutions and ESG advisory services.

2 Larry Fink's Annual 2022 Letter to CEOs | BlackRock

3 board oversight of racial and ethnic diversity, equity and inclusion (ssga.com)

4 Hamid Boustanifar & Young Dae Kang (2022) Employee Satisfaction and Long-Run Stock Returns, 1984–2020, Financial Analysts Journal, 78:3, 129-151. https://www.cfainstitute.org/en/research/financial-analysts-journal/2022/2074241

5 Hamid Boustanifar & Young Dae Kang (2022) Employee Satisfaction and Long-Run Stock Returns, 1984–2020, Financial Analysts Journal, 78:3, 129-151. https://www.cfainstitute.org/en/research/financial-analysts-journal/2022/2074241

6 Intangible Asset Market Value Study - Ocean Tomo

7 More Corporate Reporting on Workers Urged by Ex-SEC Members (1) (bloomberglaw.com)

8 Sustainability-linked financing framework (angloamerican.com)

9 For Private Equity Firms, Buying New Companies and Laying Off Employees Isn’t Cutting It Anymore | Institutional Investor; https://www.privateequityinternational.com/creating-value-in-the-mid-market/

10 Equileap_Global_Report_2022.pdf