Published June 2, 2021 | 2 min read

In the US, there’s light at the end of the pandemic tunnel as we come into the second half of 2021. Those sectors that felt the pinch during the shutdowns will be looking for signs of whether recovery can be swift and sustained.

The year that was

While the FinTech industry did more than survive, 2020 still saw venture funding drop somewhat to 2% year-on-year. However, already in Q1/21, venture-backed funding has increased 98% from the same quarter last year, reaching an all-time high, according to CB Insights.

We also saw corporate participation in VC deals, such as tech companies getting in on the action, increase to $21.5B from $20.2B in 2019. At the same time, the number of deals decreased to 630 from 687. This indicates a trend of larger, but fewer deals, as M&A remains a strong option for incumbent firms looking for scale.

Emerging from shutdown

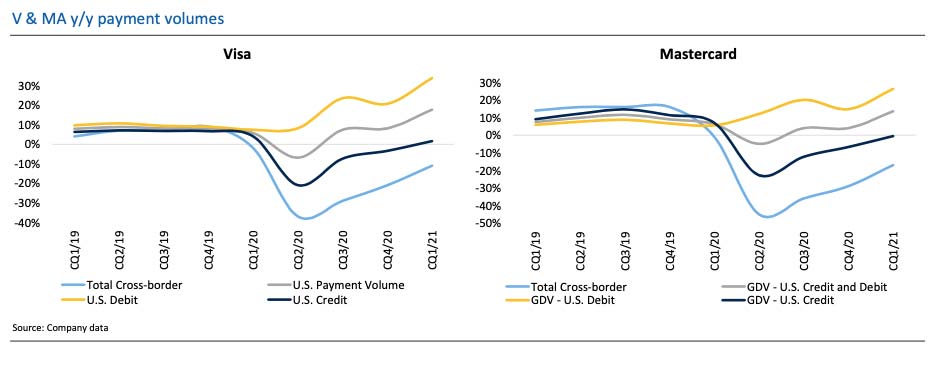

Promising signs are emerging already in the US payment/switched volumes for Visa and Mastercard. These volumes have continued to improve from early in 2021, meaningfully accelerating in April, and up around 60% year-on-year. Total US payment volumes for both companies have returned to growth now from their troughs in 2020, primarily led by US debit charges and the decline of cash usage.

There is a solid macro backdrop for these increased volumes. Hotel occupancy rates are back at pre-pandemic levels, according to data from STR, and dining data from OpenTable is also returning to pre-COVID, although so far showing near-flat growth. That optimism sweeps into the future as well, with US GDP forecast to climb at its fastest pace in nearly four decades, adding 6.25% in 2021.

No turning back for digitization

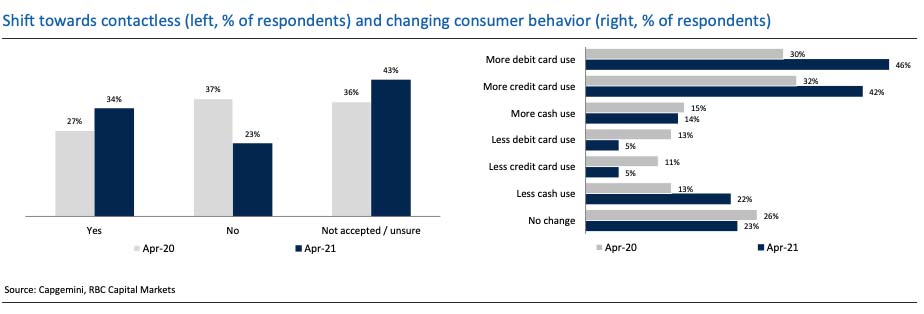

But at least some of these rising volumes can be attributed to the rapid and persistent digitization of payments. According to recent survey data from Capgemini, around 9% of respondents saw a decline in cash usage from April 2020 to April 2021, amid a 16% increase in debit card use and 10% for credit cards. Perhaps more importantly, around 43% of businesses now believe that digital payments are either somewhat or much more important now compared to before the pandemic.

We believe it is clear that COVID- 19 accelerated the digitization of payments while the continued strength in underlying trends suggests this is a true secular shift likely to persist well beyond the pandemic.

The rise of Buy Now, Pay Later (BNPL)

This embrace of digital payments has done no harm to the emerging BNPL sector, with a growing number of firms all offering more or less the same terms to users looking for short-term loans.

We analyzed data from the 2021 Global Payments Report by Worldpay from FIS and found that global BNPL growth is expected to accelerate on a CAGR basis. Global share of BNPL grew to 2.1% in 2020 (up from 1.6% in 2019) and is now expected to double its share to 4.2% by the end of 2024. As for which firms will get the largest slice of that growth, for the most part, the terms aren’t offering much in the way of differentiation to most users.

Users typically get 0% interest on purchases, as long as they make an initial payment and pay the rest in three installments every two weeks. All will charge late fees for missed payments and some will add high APR fees for repeatedly failing to pay. And there’s some range in the amount, with loans capped at as little as several hundred and other firms offering up to $17,500.That means the real differentiators for companies in the sector will be merchant integration and ease-of-use.

Join us at this year’s RBC FinTech Conference to see which firms think they can be the winners in the new BNPL space and how firms are forecasting their future post-pandemic.

The RBC Technology Research Team authored “Preview: 2021 RBC Capital Markets Financial Technology Conference” published on May 26, 2021. For more information about the full report, please contact your RBC representative.