Published March 2, 2023 | 3 min read

Key Points

- Growth opportunities exist for payments players, despite the cost-of-living crisis and downturn in consumer spending.

- Cash is king and payments, processing and IT services firms with excess funds may seek growth through M&A, or revamped product offerings.

- Concentrating on improving the customer experience and tapping under-served markets will also be critical for beating the recession.

- FinTech investment dynamics may change in 2023 as industry classifications shift under GICs.

- Focusing on quality compounders in H1/23 and high growth in H2/23 will be critical.

As the cost-of-living crisis bites and major global economies tip into recession, there are still growth opportunities for payments, processing and IT Services firms. Many have proven resilient in the past and have excellent cash flow fundamentals today. What’s more, new technologies, combined with seamless customer experiences, have the potential to help buoy consumer spending habits and fuel market growth alongside more traditional routes, such as M&A.

Not all doom and gloom

A great deal can change in the space of a year. Alongside the ongoing fallout from the Covid-19 pandemic, 2022 saw macroeconomic pressures increase – with rising inflation and interest rates, geopolitical tensions, war in Ukraine, and supply chain disruptions. As a result, consumers across the globe are now experiencing a pinch in their pockets as everyday items from electricity to food become more expensive.

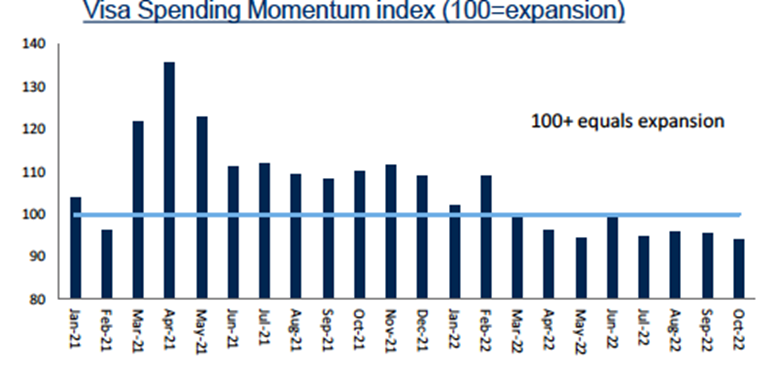

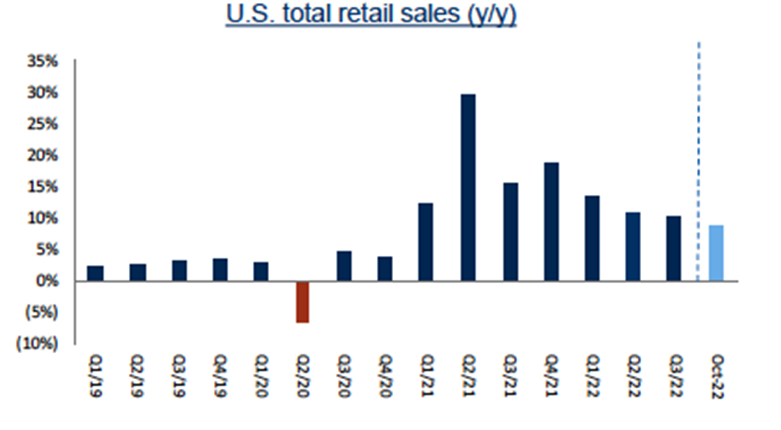

Inevitably, this translates into reduced consumer spending. But major indices report a mixed picture of how extreme the downturn is. According to the Visa Spending Momentum Index, for example, consumer spending continues to decline month-on-month as wallets are being stretched (see graph 1). Yet US retail sales towards the end of 2022 were relatively robust and show double-digit totals, up from single digits earlier in the year (see graph 2).

Meanwhile, in the UK, the Barclays Consumer Card UK spending index saw overall spending accelerate to 3.5% year-over-year in October 2022, up from 1.8% the prior month with essential spending +5.7% and non-essential spending +2.5%, versus +3.3% and +1% in September.

As such, silver linings are possible, despite the stormy outlook.

Source: Visa, Fiserv, Bloomberg, UK Office of National Statistics, RBC Capital Markets

Source: U.S. Census Bureau, Mastercard, RBC Capital Markets

Avoiding a hard landing

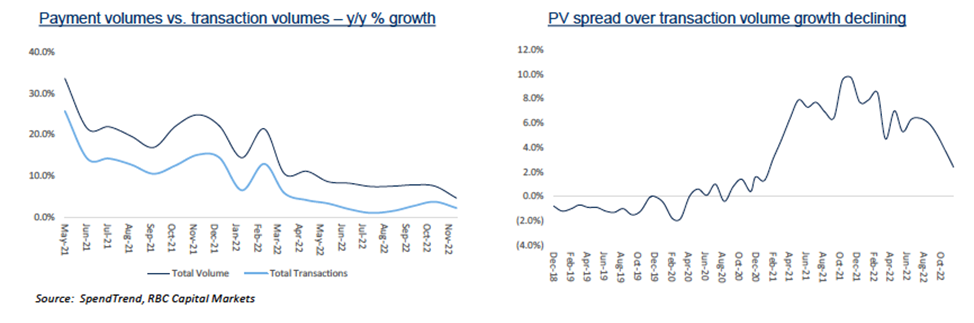

Record high inflation is also impacting reported payment volumes. In fact, we estimate that payment volumes have been over-inflated by low-to-mid single-digits on average over the past 18+ months.

But if the US Fed, and indeed other central banks, succeeds in breaking the back of inflation in 2023, the payments industry may be in for a soft landing. This would present in the form of consumer spending remaining healthy, unemployment remaining more-or-less stable, and transaction growth accelerating to compensate for lower average tickets.

If, however, consumer spending slows, unemployment rises, and payment volumes converge back to transaction growth, the landing may come with more of a bump – leading to tougher times in the second half of 2023.

Despite the uncertain outlook, there are opportunities for payments players and processors to continue to grow – but this will require a re-evaluation of current strategies and a plan to tackle the impact of the recession head on.

Recession-proofing tactics

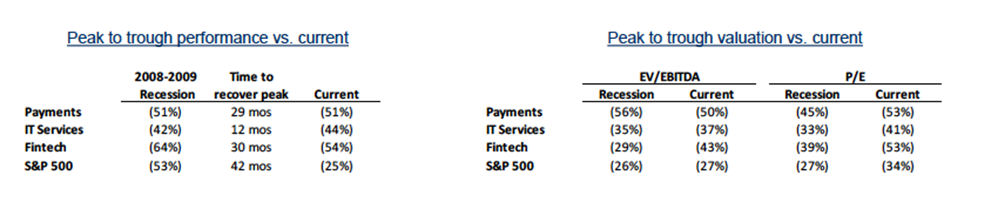

The good news is that while payments players have tended to be among the first to feel the impact of recession, they have also led the way out of it.

Source: FactSet, RBC Capital Markets

In addition, numerous payments and IT services firms currently have robust free cash flow metrics – an inevitable area of focus in times of economic downturn. Those with significant excess cash may also be able to take advantage of M&A opportunities during 2023, boosting inorganic growth.

Despite having sound balance sheets, firms must also continue to pivot with market trends and adapt their offerings and delivery channels to encourage revenue growth. These include customer-experience driven developments such as invisible or frictionless payments, as well as SaaS models, morphing into payments-as-a-service. Untapped market segments can also be explored further in 2023 – from B2B spend to travel-related payments and more.

Ringing the FinTech changes

Another important change happening in March 2023 is the shift in the Global Industry Classification Standard (GICS) from S&P Dow Jones Indices and MSCI Inc. This will see certain industry classifications eliminated and new ones created – for example ‘Data Processing & Outsourcing Services’ will become ‘Transaction & Payment Processing Services.’

As a result, some FinTechs may be moved away from the ‘tech’ class into financial services. Certain IT firms may also be reclassified as ‘industrials’. This represents no great threat operationally but may change investment dynamics – especially as the financial services sector could become more of a home for growth, rather than its traditional ‘value’ outlook.