Published August 10, 2021 | 4 min read

Despite the backdrop of a global pandemic, private companies have been extremely active in the capital markets. Across the IPO, SPAC and Private Placement landscape we have witnessed record deal volume and returns. Our panel discussion with the leaders of our Global ECM and Privates businesses highlighted important trends and opportunities for private companies.

Multiple paths to equity

At RBC’s Private Tech Conference 2021, the 35 companies presenting have recently raised close to $3 billion in aggregate. For future capital-raising, they’re also spoiled for choice. They can choose to access the vast amount of dry powder waiting in the private markets, or they can take multiple different paths to a public outcome.

“I think one of the major themes that we're seeing out there right now is this concept of choice,” says Chip Wadsworth, Head of TMT Equity Capital Markets at RBC Capital Markets.

“Private companies today clearly have a lot of flexibility to either finance themselves privately or go into the public markets. Approaching the public markets, there are multiple paths that a private company can take, including a traditional IPO, an auction IPO and a SPAC merger.”

Chip Wadsworth, Head of TMT Equity Capital Markets, RBC Capital Markets

A crowded SPAC market

Michael Ventura, Managing Director and Co-Head of SPAC Coverage at RBC Capital Markets believes that we’re in the midst of writing some of the most formative chapters in the history of the SPAC market.

“We have over 400 publicly traded SPACs that are searching for acquisitions,” he says, “and those SPACs have over $125 billion in trust.”

“There are over 250 SPACs publicly on file in the backlog. That number doesn’t even address the shadow backlog of SPAC IPOs that have yet to flip their filing public. Depending on what institutional investors you speak to, there's anywhere from 60 to 80 SPACs that are currently in the process of deSPACing, and looking at opportunities to raise incremental PIPE capital in conjunction with their M&A announcements.”

Headwinds for the SPAC market

As Ventura points out, the SPAC market is an echo chamber – when the health of the IPO market is weakened, the health of M&A tends to follow. There are quite a lot of concessions that SPACs are making right now to get IPOs executed, including decreasing size, shortening tenure, overfunding the trust, and changing warrant structure. The alpha generation is less around deal announcement and more around deal close. There have also been informal comments from the SEC around regulations for SPACs that may change how they operate today.

The SEC has talked about analyzing how forward projections are used as well as the relationship and conflict disclosure between banks, SPACs and target companies. The regulator is also assessing accounting treatments for warrants, which are a critical element of the SPAC structure. What the SEC hasn’t done is give a clear timeline on when it will be making formal comments on the market.

“That’s really doubling down in terms of creating friction and a negative feedback loop in certain parts of the SPAC lifecycle,” says Ventura.

A build-up of dry powder

However, that level of available choices means that if a SPAC or IPO doesn’t look attractive, private equity is waiting in the wings. In just the first six months of 2021, more than $150 billion worth of capital has been put to work within private companies, twice the amount raised in IPOs and already more than was invested throughout all of last year. Ricardo McKenzie, Head of Private Placements at RBC Capital Markets, points out that in addition to traditional late stage VCs and crossover institutions, there are other capital providers coming in and providing additional liquidity. This, and the amount of dry powder, is partially down to how constricted the public markets have been. The private market has been a big outflow generator for investors compared to the public market and there’s still a liquidity discount associated with privates relative to public valuations.

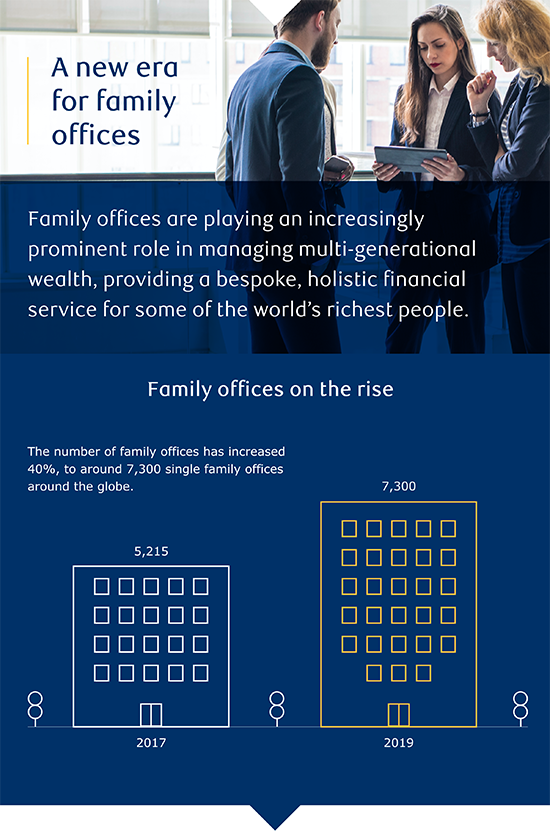

Some of those new capital providers are family offices, an area of growth that has accelerated dramatically around the world, according to Susan Baxter, Vice-Chair of the Enterprise Strategic Client Group at RBC Capital Markets.

“Between 2017 and 2019, the number of family offices increased 40%, to around 7,300 single family offices around the globe. And based on what has happened in the increase in wealth over the past 12 months, I think that number will probably have increased again,” she said.

“You've got families who’ve got a billion dollars, you've got families who have $100 billion – some of them have significant pools of money that they're putting to work.”

Susan Baxter, Vice-Chair of Enterprise Strategic Client Group, RBC Capital Markets

Elevated multiples and rising rates

While the outlook for private technology firms remains optimistic, there are always potential questions about the future. As Seth Ostrie, Technology Sector Strategist at RBC Capital Markets points out, 26 publicly traded technology companies today are valued north of 20 times calendar 2022 sales. One of the top questions from investors is whether these elevated multiples for secular growth sectors like internet, software, adtech, and fintech are justified.

“However, the majority of investors believe the multiple expansion witnessed by technology companies has primarily been the result of a general resizing of end-markets. This proverbial total addressable market (TAM) expansion has coincided with global enterprise and commercial companies maniacally focusing on securing new applications on their continued journey to the cloud. And these digital transformation initiatives have been further cemented by a strong run of very compelling IPOs over the past six years that have enriched both private and public technology investors,” he says.

Even in a higher rate environment, which is anticipated by many in the next 24 months or so, investors are responding strategically. Baxter says that family offices are locking in rates on credit facilities for as long as they can get and then put the proceeds to work in private and public markets. Rising rates will also cut both ways in the SPAC market. Ventura points out that cash and trust are somewhat tied to interest rates, so the return that institutional investors can expect at a base level will probably increase along with rates.

“But the bigger question is, if we’re entering into a higher interest rate environment or an inflationary environment, how much growth are institutional investors willing to underwrite in the SPAC or pipe market?”

Mike Ventura, Co-Head of SPAC Coverage, RBC Capital Markets

For private investors, strategic and discerning investments will be the order of the day in a rising rate environment, looking for companies and sectors that will be firmly on the ramp to recovery in the coming months. However, McKenzie believes that, overall, funds will continue to flow into the private market.