Published August 3, 2021 | 4 min read

The tech sector is in a unique position. The pandemic has vastly accelerated the pace of digital transformation to the extent that technology today is table stakes. Companies must put technology at the center of their business, and their IT infrastructure has to be secure. For software and cloud providers, the solutions they’re producing have to appeal to developers, and they must help companies harness the power of data.

These trends have changed the game for private tech companies, as participants at RBC Capital Markets’ Private Tech Conference 2021 discovered over two virtual days of presentations from 35 companies.

“You cannot exist as a business today without being technology-enabled and technology-forward and, to a certain extent, even close to technology native,” says Rishi Jaluria, Software Analyst at RBC Capital Markets.

“You cannot exist as a business today without being technology-enabled and technology-forward and, to a certain extent, even close to technology native.”

Rishi Jaluria, Software Analyst, RBC Capital Markets

“Five years ago, you could be any sort of company and pretend to be a technology company. You could sell mattresses online and say, ‘Well, we’re a tech company because we have an app and a website. But that’s not the case anymore.”

Security first

In this world of accelerating digital transformation, security has become an enabling feature of business processes. Where once companies talked about technology enabling their business transactions and process, now it’s security that enables the tech that drives operations.

“This means leveraging cloud-based technology, like zero-trust architecture, to really shrink the attack surface, cloud workload protection, network segmentation, insider threat management, and advanced identity solutions,” says RBC Capital Markets Software Analyst Matt Hedberg.

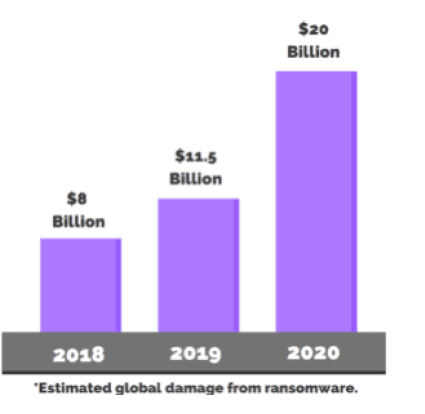

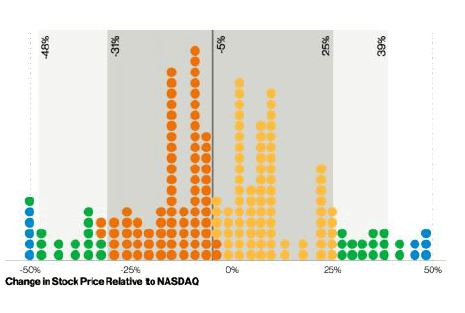

Security transformation is a prerequisite for digital transformation, making it a source of competitive differentiation for companies. According to simulations done in Verizon’s 2021 Data Breach Investigation Report1, the median cost of a breach is $21,659, with 95% falling between $826 and $654,000. But this is a drop in the bucket compared to the 5% average stock decline vs. the Nasdaq following a breach.

The power of data is mostly untapped

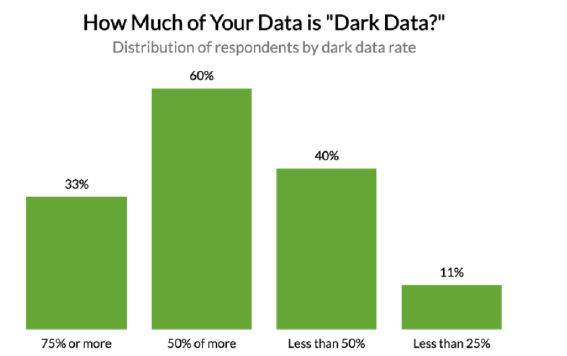

Simply put, organizations that do more with their data win. So it’s surprising then that companies are consistently under-utilizing the data they hold. Dark data, or data that goes unused, comprises more than half of the data collected by companies. Given that some estimates indicate that 7.5 septillion (7,700,000,000,000,000,000,000) gigabytes of data are generated every single day, the unused majority represents a considerable opportunity.

Source: Splunk, IDC, Gartner's "Market Opportunity Map: Data and Analytics, Worldwide" pubished on May 6, 2021 by Alys Woodward, Hai, Swinehart, et al.

“Leveraging AI, leveraging cloud-based business analytics, and other technology that wasn't available a decade ago, we think that is really interesting,” says Hedberg. “And part of that is getting better predictive analytic capabilities. “Ultimately, in a post-COVID world, as we digitally transform, doing more with data is paramount.”

“Ultimately, in a post-COVID world, as we digitally transform, doing more with data is paramount.”

Matthew Hedberg, Managing Director – Software Research, RBC Capital Markets, LLC

Addressing the skills gap

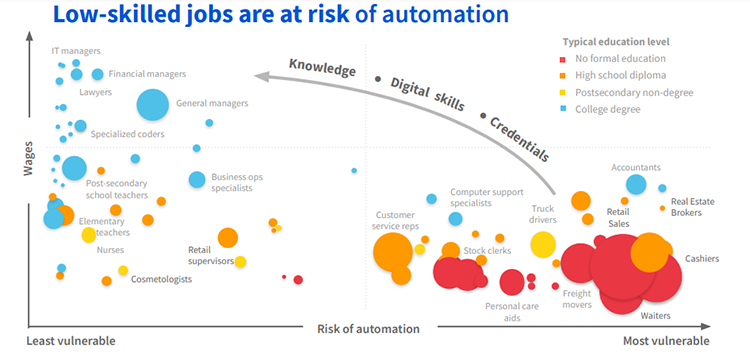

Companies are striving to transform digitally, but often they are hindered by the skills gap, as firms chase a dwindling supply of developers and technologists. For many, particularly if hybrid working becomes the norm, online platforms may be the answer. A hybrid work future should drive both demand and relevancy for online learning, both for individuals looking to upskill and for enterprises, to educate their own employees or seek a source of skilled workers outside of traditional learning institutions.

Technology is disrupting the workforce, as low-skilled jobs are at risk of automation, while the need for a digitally skilled workforce is exploding. The World Economic Forum estimates that 85 million jobs will be displaced by technology, while 97 million new technology-based jobs will be added by 2025.

Source: Coursera presentation, McKinsey, Bloomberg, BLS, Oxford University

Source: Coursera presentation, McKinsey, Bloomberg, BLS, Oxford University

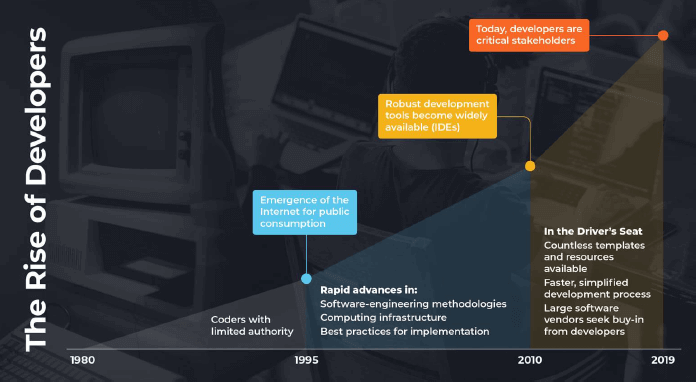

Developers are the new customers

As technology becomes more embedded in the fabric of businesses, it has become increasingly important for tech providers to build software solutions that are appealing to developers.

“This isn’t the old days, where a CIO would decide on a software solution and then deploy it. Three-fourths of developers are either considered the primary buyer or the influencer in the IT-purchase decision.”

Rishi Jaluria, Software Analyst, RBC Capital Markets

“Developers are increasingly part of the IT-buying decision. This isn’t the old days, where a CIO would decide on a software solution and then deploy it. Three-fourths of developers are either considered the primary buyer or the influencer in the IT-purchase decision. So if you don’t appeal to developers, you really just don’t have a future as a software solution,” says Rishi Jaluria, Software Analyst at RBC Capital Markets.

Source: Cloudinary

Source: Cloudinary

Marketplaces everywhere

Ecommerce was a clear winner during the pandemic, as online shopping became a necessity during lockdowns. But it’s not just groceries and consumer goods that have benefitted. Internet marketplaces are going far beyond traditional categories into less intuitive areas where there is significant equity value creation.

“What we're finding in talking with some privates, and certainly some of the smaller publics, is that marketplaces are finding their way into all verticals and subcategories,” says Brad Erickson, Internet Analyst at RBC Capital Markets.

“Examples of this at the conference are definitely things around the food supply and distribution chain. The farming vertical is also seeing a lot of evolution and technology. And then we've also had things like new takes on insurance, short-term and long-term rentals, and ticket brokerage.”

Granular trends for restaurants and adtech

Within the private tech sphere, two categories stand out as particularly interesting. The pandemic has drastically changed the restaurant industry; restaurants, ghost kitchens, convenience stores, and any fast-moving consumer good (FMCG) will need to leverage cloud-based technology to better align with changing customer preferences. This means leveraging technology such as online ordering, syndicating menus across demand side platforms (DSPs), delivery, AI and machine learning for things like queue analysis, and improved POS experiences.

In the adtech world, investors have been trying to determine the impact of cookie-loss on “open-internet” players. Since Google announced its plan to phase out third-party cookies from Chrome, the ad-tech comp group is down 26%, including 10% since Google announced the delay of its phase-out until 2023. But there is potential for universal IDs to be an attractive alternative to cookie-based identification.

“I think this is creating a really complicated environment for advertisers, who are adapting to changing consumer habits, trying to shift budgets towards digital, while maintaining visibility and ROI that now has changing datasets on how it's being calculated,” says Matt Swanson, Software Analyst at RBC Capital Markets.

1 https://www.verizon.com/business/resources/reports/dbir/

All statements in this report attributable to Gartner represent RBC Capital Markets' interpretation of data, research opinion, or viewpoints published as part of a syndicated subscription service by Gartner, Inc. and have not been reviewed by Gartner. Each Gartner publication speaks as of its original publication date (and not as of the date of this report). The opinions expressed in Gartner publications are not representations of fact and are subject to change without notice.

The RBC Technology, Media & Telecom Equity Research Team authored “Focus Themes of the 2021 RBC Technology Private Company Conference (July 13–14)” published on July 11, 2021. For more information about the full report, please contact your RBC representative.