Published March 26, 2021 | 3 min watch

Key Points

- Valuations across the tech sector are up. COVID has boosted Fintech valuations in particular.

- Fintech provides the ultimate combination of stable, recurring growth and minimal downside.

- As the quality of SPACs sponsors has increased, so has the ability of SPACs to price growth-potential in the tech and Fintech sectors.

- B2B transactions have been more resistant to change and are ripe for tech and Fintech growth.

- Financial services are now digitally consumed. There is a strong basis for growth to accelerate.

Fintech valuations are increasing. What’s driving that, and where might we see valuations go next?

Valuations across the entirety of the tech sector are up. Financial technology has benefited disproportionately because COVID has proved to be the ultimate use case of several financial technology applications. That has created an accelerant to these businesses. Their financial performance has justified a recalibration of the valuation paradigm.

“I think we are seeing a permanent recalibration of valuations, it speaks to a fundamental shift in the importance of technology in financial services.”

Jason Gurandiano, Global Head of Financial Technology, Investment Banking, RBC Capital Markets

What are the key qualities that attract investors to the Fintech sector?

Fintech provides the ultimate combination from an investor perspective in that it delivers growth, and it's stable and recurring. And there are not many downsides.

Can you point to some recent significant deals in the sector that involved RBC?

We saw the Affirm IPO, which was a market leader in the buy-now-pay-later space. We saw the IPO of Rocket Mortgage, and we were extremely pleased and fortunate to be a book runner on the IPO Shift4, which was the relaunch of the IPO sector.

We’ve seen a significant number of Fintech SPACs and IPOs recently. What determines whether a SPAC or an IPO is the better vehicle for going public?

People want to create a demarcation line between SPACs and IPOs, but at the end of the day, they are both capital markets transactions whereby the goal is to properly fund an enterprise in the public market and assess the right clearing price for the company both from a value perspective and also for investors to generate alpha.

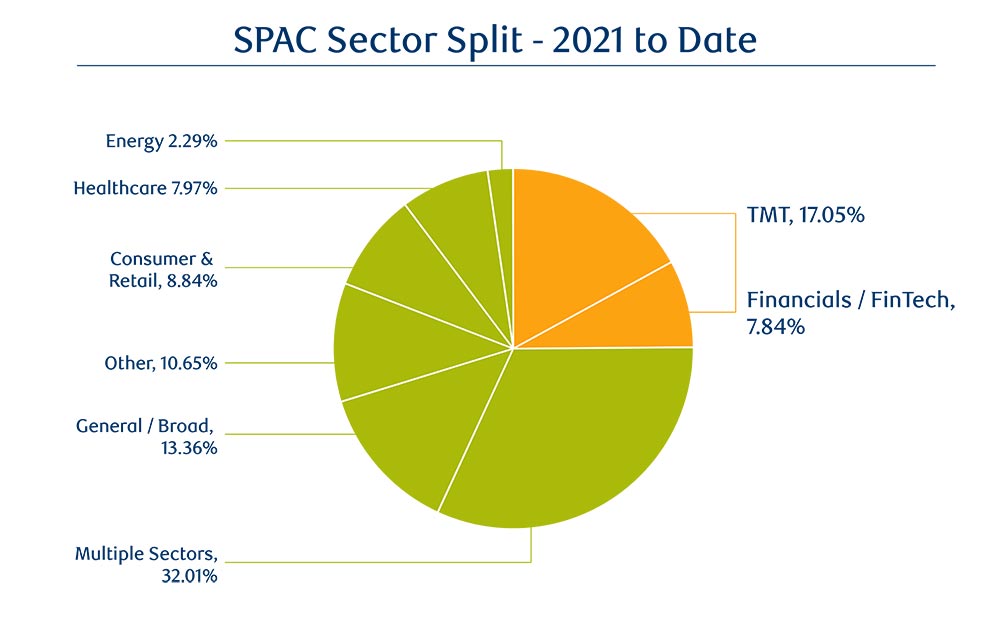

A company that evaluates an IPO by definition should be considering a SPAC transaction, and if you look at the universe of SPACs, a large proportion of them have either a tech or a specific Fintech bent to them.

What are some of the factors driving the sustained growth of SPACs in particular?

First, the quality of the SPACs sponsors has increased exponentially. Then the ability of the market to price growth through a SPAC vehicle has developed materially. The third piece is investors looking at the SPACs as a more efficient way to establish a meaningful shareholding in a company that they like, as opposed to a traditional IPO where even the biggest allocation usually leaves a shareholder wanting more.

“The ability of the market to price growth through a SPAC vehicle has developed materially.”

Jason Gurandiano, Global Head of Financial Technology, Investment Banking, RBC Capital Markets

What is driving how RBC innovates using Fintech?

If you look across the board, RBC is seizing leadership from a technology point of view. One because it's imperative to support our growth, but also, I think it ties very well into our ESG initiatives, whereby technology is the ultimate way to democratize financial services across the board.

I believe that there is more work to be done in leveraging technology to create a more inclusive environment for the underbanked or unbanked. There is a social and economic imperative and ensuring that we foster technology that provides full inclusion to people for financial services.

What will be driving growth in Fintech and payments moving forward?

The B2B sector is the sector that has been the most resistant to change. The means of transacting between enterprises are surprisingly archaic. As problems are solved, there'll be new opportunities uncovered that will create further and faster innovation. Payments will continue to be an area ripe for consolidation and extensive M&A activity. This is especially the case as we see new companies moving into the public markets, and we see larger companies that now need to acquire technology to offset the speed of development of some of their more nimble competitors.

“Payments will continue to be an area ripe for consolidation and extensive M&A activity.”

Jason Gurandiano, Global Head of Financial Technology, Investment Banking, RBC Capital Markets

The pandemic drove growth in Fintech and payments. Should we expect the pace of change to slow as the influence of the pandemic lifts?

I think there's no turning back. Financial services is now a digitally consumed and digitally delivered product. The best question to ask is whether we will see an even greater acceleration in the adoption of financial technology in the short and medium-term instead of any setback. My assumption and strong view are that we will see that acceleration.