Key Points

- Biopharma capital is in the crosshairs of COVID-19.

- Capital formation trends in the biotechnology sector are shifting.

- The definition of companies considered “well-capitalized” is being redefined.

- Investors will become even more focused on strong capital positions and balance sheets.

From its earliest days, the biotechnology industry has relied on a steady supply of capital to survive, let alone thrive. While clinical failures and commercial challenges are constant concerns for individual companies, closing the financing spigot also looms as an existential threat and a crippling scenario for the sector.

Over the past six years we have seen short periods of heightened volatility due to external events that have sharply limited access to the equity capital markets and increased the sector’s cost of capital. This was exemplified in March and early April due to the COVID-19 pandemic. With the Nasdaq Biotech Index (NBI) experiencing an approximate 40% increase from the March 16 lows to re-establish an all-time high, the resiliency of the sector has been extraordinary.

Along with this resilience, we are witnessing a reassessment of financing strategies impacting capital formation in the industry. COVID-19 has reminded management teams that the best laid plans for capital can be derailed by unforeseen events. A large segment of the biopharma industry is experiencing delays in clinical programs or commercial launches. While we are beginning to see a resumption of activity on both fronts, the impact on operational timelines remains one of the most significant disruptions confronting companies and investors alike. As a result, the mantra “raise capital when you can and not when you have to” has never been more relevant.

Capital in the Crosshairs

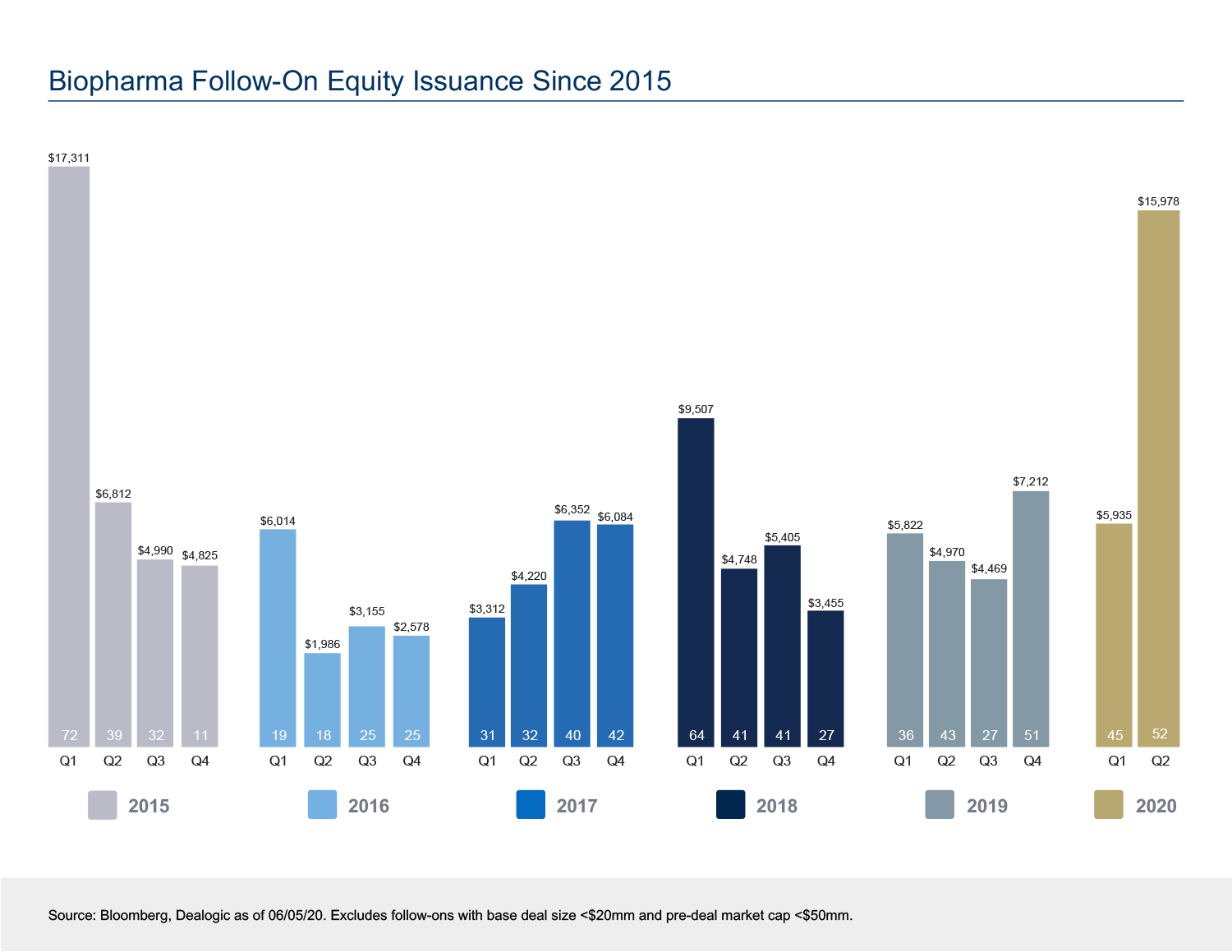

Biopharma is a uniquely capital-intensive sector. Thankfully, from a capital raising perspective, COVID-19 is different to prior market dislocations. During the financial crisis of 2009, we saw a sudden and dramatic decline in equity financing activity across sectors, including biopharma, that persisted for multiple years. This time, after a brief hiatus at the onset of the crisis, we’re seeing far greater resiliency in the capital markets with record amounts of capital raised in 2020 so far.

What is remarkable about this latest wave of equity financing activity is its breadth – large deals, small deals, catalyst-related financing, opportunistic financing, IPOs. A rich scope of biotech equity capital markets activity is on full display.

While execution strategies have primarily focused on minimizing market risk – accelerated roadshows, ‘wall cross’ and overnight offerings – order books have been robust and after-market performance has been solid. Investor engagement remains high. In May, we saw a record number of participants – over 700 investors, a 2x increase from 2019 – gather remotely at this year’s #RBCHealthcare2020 conference, held virtually under the shadow of the COVID-19 pandemic.

“The mantra ‘raise capital when you can and not when you have to’ has never been more relevant.”

- Vince Lozada

The Definition of ‘Well-Capitalized’ Is Changing

Biotech boards of directors and management teams spend a significant amount of time thinking about ‘cash runways’. It’s a discussion that involves trying to satisfy multiple objectives. From our vantage point, we’ve seen an evolution of what is deemed a strong balance sheet. Looking at pro forma balance sheets post the recent wave of equity financing activity, we see signs that this definition continues to evolve.

For US-listed biotech companies that completed IPOs since April 1, the median quarters of cash were approximately 12 (or three years). For biotech secondary offerings, that number is about eight, or two years. Many of us can remember when 12 months of cash was the objective. Although those days are long since behind us, we are struck by the aspiration to fortify balance sheets out two or three years.

The unpredictable disruption caused by COVID-19 is a catalyst for these longer cash runways, but there are other reasons as well. We are seeing fewer single-product stories, so budgets are now increasingly designed to deliver multiple milestones across product candidates, in addition to platform development and pipeline expansion. Having longer runways means the failure of the lead program, while still painful, won’t necessarily sink a company.

Investors also consistently recognize and value ‘fortress balance sheets’. As this bar continues to be raised, there are implications for capital formation strategies across the sector. Recent biotech equity financing activity highlights the depth and the capital raising efficiency of the public equity capital markets, which can serve to accelerate IPO timelines and reinforce the strategy of being ‘ready to go’ when markets allow.

“Investors also consistently recognize and value ‘fortress balance sheets’. As this bar continues to be raised, there are implications for capital formation strategies across the sector.”

- Tim Papp

Lastly, periods like this can remind biotechnology firms of the importance of capital that isn’t dependent on the equity capital markets. Other sources have a role to play. Regular partnering and collaboration activity continues to be relevant to capital formation strategies. Classic tensions will remain. Being unencumbered can preserve valuable future strategic optionality – as a result, partnering activities should be well-defined for both strategic and corporate finance reasons.

Similar to this

Focusing on Fundamentals

Private and public biotech investors continue to be optimistic for the future. The pandemic has thrown a spotlight on the importance of an innovative biotechnology industry and the underlying fundamentals for the biopharma industry remain exceptionally strong.

Looking ahead, companies will continue to scrutinize their financial health in a proactive manner. Expect multiple years of cash on the balance sheet to continue to become the norm and the rate of new company formation and the resultant demand for capital to continue. Biotech will continue to prove that if a company has a meaningful impact on patients, it will have a meaningful impact on investors.