Key Points

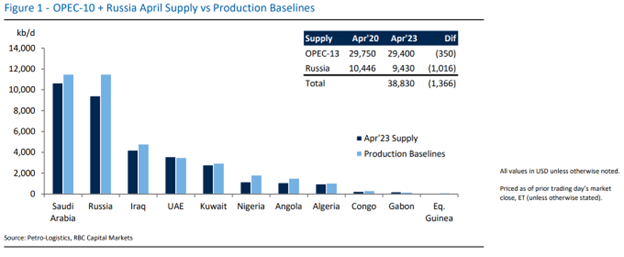

- If Brent prices remain in their current range or move a leg lower, we think OPEC would be prepared to take additional action.

- Policymakers in key producing countries remain extremely focused on ensuring that they have sufficient funds to deliver on their ambitious development plans.

- Iran remains an underappreciated geopolitical risk in the oil market.

With macro worries sending oil into another tailspin, and Brent flirting with $70/bbl, the efficacy of OPEC action has come into question once again.

While not wanting to put words in the mouth of the producer group leadership, we think they would pose the counterfactual question: where would oil be now if they failed to act and instead, signaled they would remain on the sidelines for the remainder of the year? Moreover, we think the 2015 period of pacificity is viewed as a cautionary tale. Once the producer group decided to course correct in November 2016 and return to active market management, they found the task of digging out from the deep hole and draining the subsequent inventory glut an arduous one.

With the recent report that OPEC is indeed meeting in person in Vienna this June, we believe the OPEC leadership is signaling that they are prepared to midwife the recovery in oil prices until both demand and macro worries subside.

Hence, if Brent prices remain in their current range or move a leg lower, we think OPEC would be prepared to take additional action to put in a price floor and scare off the shorts until fundamental factors become clear and in focus and more market participants vacate their spectator seats. We think that while this may entail a suboptimal volume/price revenue return in the short term, it would be viewed as a price worth paying if it serves as a bridge to a better year-end – especially if the Powell panic recedes.

We also think that policymakers in key producing countries remain extremely focused on ensuring that they have sufficient funds to deliver on their ambitious development plans and while they’re not entirely averse to borrowing, they would like to avoid that outcome.

One advantage that OPEC has this time around is they are not facing a substantial inventory glut like they did in 2016 when the Declaration of Cooperation was inked in Vienna and OECD inventories had already increased 200 mb above seasonally normal levels. We also think that the most recent OPEC cut, which is expected to drop supply levels 700 kb/d lower than what we have seen from the producer group since October, will have a material effect on balances. On top of the official OPEC cuts are the unplanned outages in Nigeria and Iraq that have taken a combined 800 kb/d off the market in recent weeks. As we noted in a previous report, the ITP pipeline closure in Iraq shows no sign of imminent resolution and could prove to be a prolonged disruption, while workers returned late last week in Nigeria.

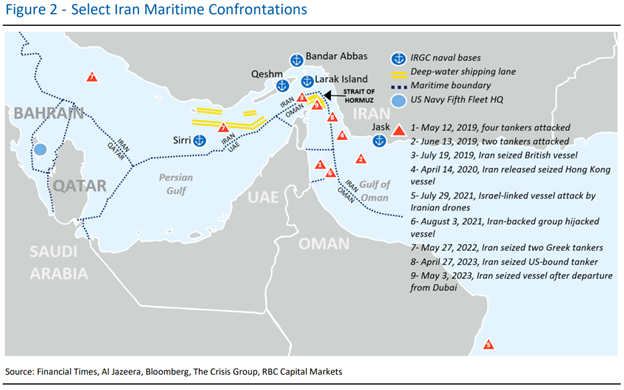

Finally, we continue to contend that Iran remains an underappreciated geopolitical risk in the oil market.

These past couple of weeks has seen a return to maritime confrontations, with Iran seizing another oil tanker in the Strait of Hormuz overnight. In addition, nuclear negotiations remain frozen and Iran reportedly slow walked the promise to reinstall cameras at their enrichment facilities. While Iranian oil exports have remained above the 1 mb/d in recent months, a level not maintained since the 2018 return of US sanctions, we think the Biden Administration will come under increasing pressure from Congress and the Israeli government to tighten sanctions and reduce Iranian revenue. Not only could more rigorous sanction enforcement reduce Iranian exports from current levels, it could also produce more high seas skirmishes. Of course, the even bigger risk is that the Israel Prime Minister Netanyahu will back words with actions and take more overt military steps to prevent Iran from joining Pakistan and North Korea in the nuclear club. For now, the oil market remains mired in a wall of recessionary worry, but we think OEPC remains fully committed to trying to midwife a recovery and that geopolitical factors could become more salient into the back half of the year.