Key Points

- As expected, OPEC+ opted to stay the course with the 2 mb/d cut agreed on in October as it waits to see the impact of the EU sanctions and G7 price cap plan on Russian crude exports.

- While much attention has been focused on Russia’s shadow fleets as a means of sanctions avoidance, we think insufficient attention has been paid to the potential difficulties in accessing alternative insurance arrangements.

- Given that many unknowns still remain, we revert to “show me the data” before making a call on how much Russian supply is displaced versus permanently deleted from global balances.

- Given the unprecedented uncertainties, the OPEC+ watch and wait strategy appears very sound.

As expected, OPEC+ opted to stay the course with the 2 mb/d cut agreed on in October as it waits to see the impact of the EU sanctions and G7 price cap plan on Russian crude exports.

While Washington succeeded in getting Poland, Estonia, and Lithuania to agree to the $60/bbl cap, it remains uncertain whether the plan will ensure the smooth flow of Russian barrels to Asian markets or if there will be a material disruption because of deliberate supply action from Moscow or risk aversion by international compliance departments.

Leading Russian energy officials, including Deputy Prime Minister Alexander Novak, continue to maintain that they will withhold supply from any customer that participates in the cap plan.

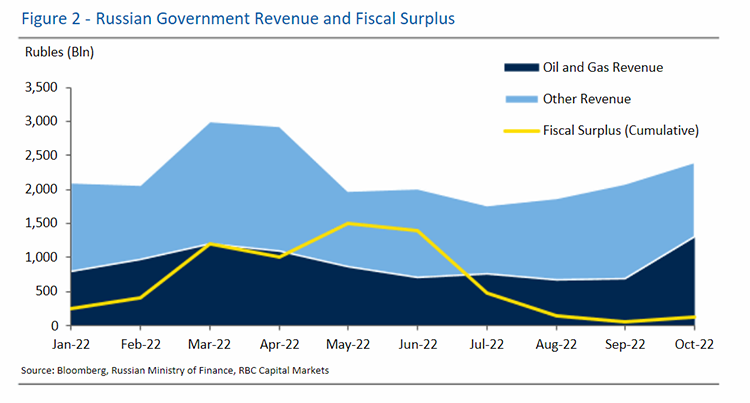

Biden administration officials dismiss such threats as bluster, insisting that Russia essentially has no choice but sell at the cap given oil’s outsized importance to the Treasury.

Part of the reason that Washington pushed so hard for a higher cap was to try to financially incentivize Moscow to maintain current crude supplies; even at the risk of allowing Putin to access enough hydrocarbon revenue to fund his war machine. And yet, Moscow may not be in the mood to let the West take such a win and avert a politically perilous spike in energy prices. To date, the Kremlin has made good on many of its disruptive threats; for example, cutting off gas importers that refused to pay in Rubles. Any clear indication that Russia is prepared to cut off oil exports could cause prices to spike in the coming days.

Compliance departments in trading houses, shipping firms, and insurance brokerages may also lead with “no” until they have more time to parse the G7 guidance.

We would remind our readers of the initial buyer’s strike that occurred after the war commenced and the West sanctioned key Russian financial institutions.

While the White House made it clear that they were deliberating carving out energy transactions to keep Russian barrels on the market, it took several weeks for legal departments to become comfortable about continuing to participate in the Russian energy trade. The US Treasury Department has been engaged in extensive dialogue with key stakeholders for months, but legal departments may still be hesitant to immediately sign off due to the extensive delays in announcing the actual price and providing operating guidelines. Light touch enforcement signals may not be sufficient to overcome initial unease given the millions of dollars in fines that have been assessed for violating sanctions, including on Iranian oil exports.

While much attention has been focused on Russia’s shadow fleets as a means of sanctions avoidance, we think insufficient attention has been paid to the potential difficulties in accessing alternative insurance arrangements.

In our conversations with energy officials in key Asian consuming countries, the EU’s insurance ban was cited as especially challenging. Around 95% of the world’s tanker shipments are insured through the London-based International Group of P&I Clubs, which has said it is subject to the EU’s sanctions package given the member clubs’ heavy reliance on European reinsurance. Alternatives to Western insurance are limited, and Russia’s domestic alternatives are likely unable to provide comparable coverage and claim payment due to Russian bank sanctions, adding to the calculus of countries like China and India in accepting vessels in ports, as well as littoral states of key waterways in accepting ships insured by non- standard means – a key factor in the curtailment of Iranian shipments in 2012.

Additionally, insurers often include sanctions exclusion clauses in policies that void coverage if the cargo violates sanctions, which may limit their compliance burdens, but concern has been expressed from insurers on the potential disruptions caused by the lack of harmonization on the attestation process and ships being stranded without insurance or bank support mid-voyage.

Given that many unknowns still remain, we revert to “show me the data” before making a call on how much Russian supply is displaced versus permanently deleted from global balances.

The true level of Russian logistical constraints and the subsequent disruption that would occur if Russia does make good on its promise to not deliver to anyone trying to enforce the price cap is a futile exercise.

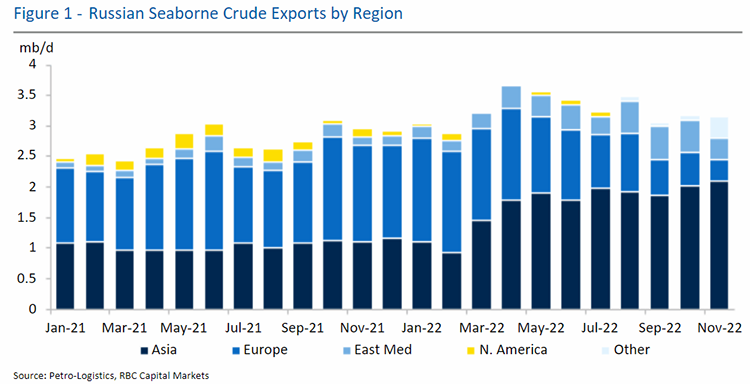

While the majority of traditional G7 cargoes have already been rerouted to Asia, Russia’s ability to organically support departures after tomorrow devoid of Western services is still up in the air. We know that Russia has been amassing a “shadow fleet” and that Russian tankers have been using Russia’s National Reinsurance Company. What we don’t know, aside from logistical capacity, is the level of consumer appetite, which has been reportedly mixed given uncertainty on price cap implementation and outstanding intergovernmental agreements on Russian insurance programs. Given the unprecedented uncertainties, the OPEC+ watch and wait strategy appears very sound.

Helima Croft authored “OPEC+ and G7 Price Caps: Watch and Wait,” published on December 5, 2022. For more information on this commentary or to access global commodities research, please contact your RBC representative.